NFT Nedir?

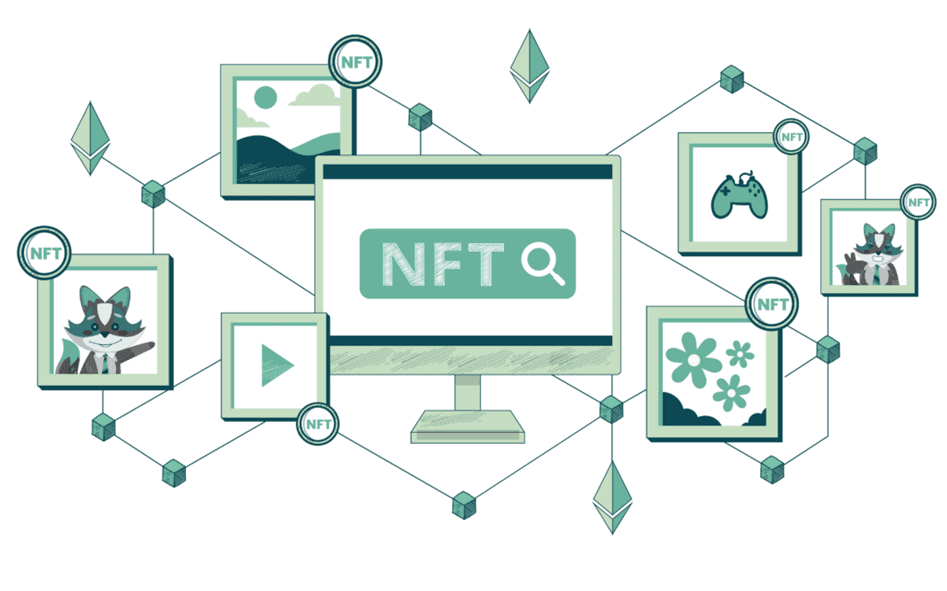

NFT, “Non-Fungible Token” kelimelerinin kısaltmasıdır. Bir dijital varlığın benzersizliğini ve sahipliğini belirlemek için blockchain teknolojisi kullanılarak oluşturulan bir dijital varlık türüdür. “Fungible” olan bir şey, bir başka benzer öğeyle değiştirilebilir demektir, örneğin, Bitcoin bir fungible varlık olarak kabul edilir çünkü bir Bitcoin’in değeri başka bir Bitcoin ile değiştirilebilir.

Ancak, NFT’ler benzersizdir ve her biri tek ve özel bir kimlik taşır. Örneğin, bir sanat eserinin NFT’si, o sanat eserinin dijital bir kopyasını temsil eder ve o eserin sahipliğini belgeler. Bir NFT’nin sahibi, o varlığı başka biriyle takas edebilir veya satabilir, ancak NFT’nin kendisi benzersiz olduğu için dijital olarak takas edilen şey de benzersizdir.

NFT’ler genellikle sanat eserleri, dijital koleksiyon ürünleri, sanal gayrimenkuller ve diğer dijital varlıklar gibi çeşitli alanlarda kullanılır. NFT pazarı, son zamanlarda popülerlik kazanmış ve birçok sanatçı, yaratıcılar ve koleksiyoncular için yeni bir gelir kaynağı ve ticaret platformu haline gelmiştir.

NFT’nin Açılımı Nedir?

NFT, “Non-Fungible Token” ifadesinin kısaltmasıdır. Türkçe karşılığı “Değiştirilemez Belirteç” olarak çevrilebilir. Bu terim, bir dijital varlığın benzersizliğini ve sahipliğini belirlemek için kullanılan bir blockchain tabanlı belirteç türünü ifade eder.

NFT’ler Nasıl Üretiliyor?

- Platform Seçimi: İlk adım, NFT’leri oluşturabileceğiniz bir platform seçmektir. Ethereum gibi birçok blokzincir platformu, NFT oluşturmayı destekler. Öne çıkan NFT platformları arasında OpenSea, Rarible ve Foundation gibi pazar yerleri bulunur.

- Varlık Seçimi: NFT oluşturmadan önce, bir dijital varlık veya eser seçmeniz gerekir. Bu bir sanat eseri, dijital koleksiyon öğesi, müzik parçası veya başka bir dijital varlık olabilir.

- Token Oluşturma: Seçtiğiniz platformda, NFT’yi oluşturmak için bir token oluşturma süreci başlatılır. Bu adımda, varlığınızın tanımını ve özelliklerini belirlemeniz gerekir. Örneğin, bir sanat eseri için başlık, açıklama, sanatçı bilgileri ve benzersiz bir token kimliği (ID) oluşturulur.

- Minting (Yaratma): Token oluşturulduktan sonra, blokzincir üzerinde NFT’nin mint (yaratma) işlemi gerçekleştirilir. Bu, NFT’nin benzersiz bir dijital imza almasını sağlar ve blokzincirde kaydedilir.

- Yayınlama ve Satış: Oluşturulan NFT, platformda yayınlanır ve diğer kullanıcılar tarafından görülebilir hale gelir. Sahip olduğunuz NFT’yi diğer kullanıcılara satmak veya takas etmek için platformun sağladığı araçları kullanabilirsiniz.

- Takip ve Transfer: NFT’niz bir kez oluşturulduktan sonra, blokzincirdeki kaydı NFT’nin sahipliğini belgeler. NFT’nin takibini yapabilir ve istediğiniz zaman diğer kullanıcılara transfer edebilirsiniz.

NFT’ler Ne İşe Yarar?

NFT’ler, dijital varlıkların benzersizliğini ve sahipliğini blokzincir üzerinde belgeleyerek dijital dünyada benzersiz bir değer sağlarlar. Bir sanat eserinin NFT’si, o eserin dijital bir kopyasını temsil eder ve o eserin tek sahibini belirler.

Sanatçılar ve diğer yaratıcılar için NFT’ler, dijital eserlerini sergilemek, satmak ve takas etmek için yeni bir pazar sağlar. Geleneksel sanat piyasasında görülemeyen yeni bir gelir ve etkileşim biçimi sunarlar.

NFT’ler, dijital varlıkların telif haklarını ve lisanslarını izlemek ve yönetmek için bir mekanizma sunar. Bir NFT, sahibinin belirli bir dijital varlığı sahiplendiğini belgelediği için, sanatçılar ve diğer yaratıcılar eserlerinin kullanımını kontrol etme yetkisine sahip olabilirler.

Koleksiyoncular, NFT’leri dijital koleksiyonlarını oluşturmak ve genişletmek için kullanabilirler. Benzersiz NFT’lerin nadirlikleri ve talepleri, bir yatırım aracı olarakta görülebilir.

NFT’ler, oyunlar ve sanal dünyalar gibi dijital ortamlarda kullanılan varlıkların benzersiz temsili için de kullanılabilir. Bir oyunda bir karakter, eşya veya arazi parçası gibi dijital varlıkların sahipliğini belirlemek için NFT’ler kullanılabilir.

Neler NFT Olabilir?

Sanat Eserleri: Dijital resimler, illüstrasyonlar, 3B modeller ve diğer sanat eserleri NFT olarak temsil edilebilir. Örneğin, bir sanatçının dijital bir tablosunun NFT’si, o tablonun benzersiz bir dijital kopyasını temsil edebilir.

Müzik ve Ses Kayıtları: Şarkılar, albümler, ses efektleri ve diğer ses kayıtları da NFT olarak oluşturulabilir. Bir müzik eserinin NFT’si, o eserin dijital bir kopyasını veya lisansını temsil edebilir.

Dijital Koleksiyon Eşyaları: Dijital kartlar, koleksiyon figürleri, sanal giyim ve aksesuarlar gibi dijital koleksiyon eşyaları NFT olarak temsil edilebilir. Bir oyun karakterinin özel bir kostümü veya bir spor kartının NFT’si, o öğenin benzersiz bir dijital kopyasını temsil edebilir.

Sanal Gayrimenkul ve Toprak Parçaları: Sanal dünyalarda, oyunlarda ve diğer dijital ortamlarda var olan gayrimenkul ve toprak parçaları da NFT olarak temsil edilebilir. Bir sanal evin veya arazinin NFT’si, o evin veya arazinin sahipliğini temsil edebilir.

Sosyal Medya İçeriği: Özel tweet’ler, dijital koleksiyon kartları gibi sosyal medya içeriği NFT olarak temsil edilebilir. Bir tweet’in NFT’si, o tweet’in benzersiz bir dijital kopyasını temsil edebilir.

NFT Nasıl Popüler Oldu?

NFT’nin popülerliği, öncelikle sanat ve eğlence endüstrilerinde yeni ve ilgi çekici kullanımlar bulmasıyla arttı. Sanatçılar, müzisyenler ve diğer yaratıcılar NFT’leri, eserlerini sergilemek, satmak ve takas etmek için yeni bir platform olarak gördüler. Özellikle sanat dünyasında NFT’ler, dijital sanat eserlerinin benzersizliğini ve sahipliğini belgeleyerek sanat ticaretinde devrim yarattı.

NFT’lerin yatırımcılar ve koleksiyoncular arasında dikkat çekmesi de popülerliklerini artırdı. Birçok kişi, NFT’leri dijital koleksiyonlar oluşturmak ve yatırım yapmak için kullanmaya başladı. Nadir NFT’lerin değeri arttıkça, daha fazla kişi bu alana ilgi duymaya başladı.

NFT’lerin popülerliği, blokzincir teknolojisi sayesinde benzersizliklerini ve sahipliklerini güvenilir bir şekilde belgeleyebilmesiyle de arttı. Bu, dijital varlıkların telif haklarını korumak, sahiplik geçmişini izlemek ve dolandırıcılığı önlemek için önemli bir özellik sağlar.

Sosyal medyanın etkisi de NFT’lerin popülerleşmesinde önemli bir rol oynadı. Ünlülerin ve etkileyicilerin NFT’leri satın alması ve tanıtması, bu alanın daha geniş kitlelere ulaşmasını sağladı. Ayrıca, NFT’ler hakkında artan tartışmalar ve haberler, insanların bu alana ilgi duymasını sağladı.

Son olarak, COVID-19 pandemisinin etkisi de NFT’lerin popülerleşmesine katkıda bulundu. Pandemi sırasında, fiziksel mekanların kapatılmasıyla birlikte dijital ortamların ve sanal etkinliklerin popülaritesi arttı. Sanatçılar ve diğer yaratıcılar, dijital ortamlara yönelerek NFT’lerin popülerliğini artırdılar.

En değerli NFT Projeleri Nelerdir?

Dünyanın en pahalı NFT’si şu anda Pak tarafından oluşturulan “The Merge” dir. Aralık 2021’de 91,8 milyon dolara satıldı ve bu da onu yaşayan bir sanatçı tarafından satılan en pahalı sanat eseri haline getirdi.

Ancak, “The Merge” nin tek bir alıcıya satılmadığını belirtmek önemlidir. Bunun yerine, 30.000’den fazla kişi, NFT’nin parçalarını satın aldı. Bu nedenle, bazı insanlar “The First 5000 Days” adlı eserin, 2021’de 69,3 milyon dolara Vignesh Sundaresan’a satıldığı için hala en pahalı NFT olduğunu savunuyor.

Proje açısından bakacak olursan en değerli NFT projelerini belirlemek, piyasa değerine, işlem hacmine, proje nadirliğine ve topluluk katılımına göre değişen karmaşık bir süreçtir. Ancak, öne çıkan bazı projeler vardır.

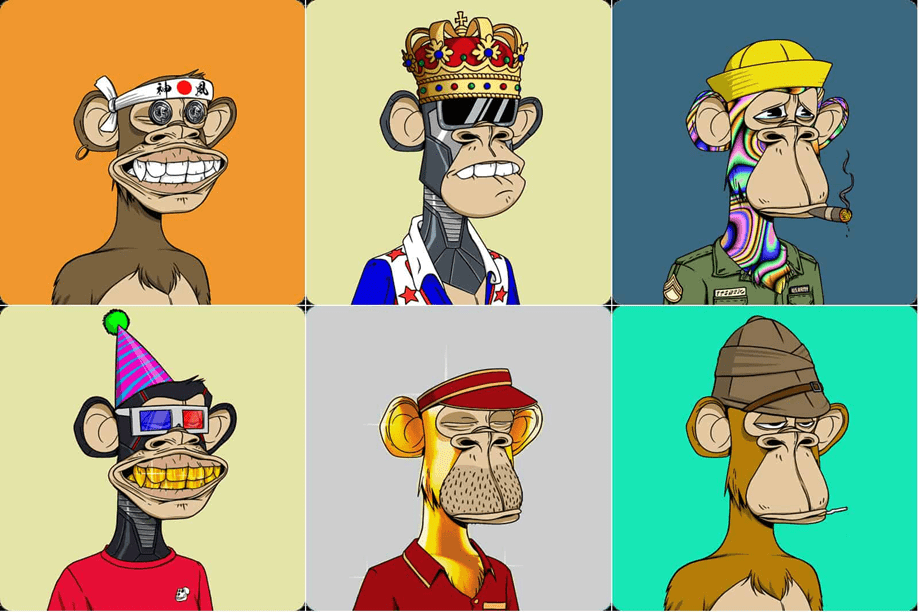

Bored Ape Yacht Club (BAYC): 10.000 maymun profil resminden oluşan bu koleksiyon, NFT alanındaki en tanınmış ve aranan koleksiyonlardan biridir. Bir BAYC sahibi olmak, üyelere özel bir kulübe erişim ve diğer avantajlar sağlar.

CryptoPunks: 2017’de piyasaya sürülen bu piksel avatar koleksiyonu, en eski ve en saygın NFT projelerinden biridir. Her CryptoPunk benzersizdir ve nadirlik derecelerine göre değişen fiyatlarla satılır.

Art Blocks: Dijital sanat eserleri için bir pazar yeri olan Art Blocks, benzersiz ve jeneratif sanat eserleriyle tanınır. Platform, Beeple’ın “EVERYDAYS: THE FIRST 5000 DAYS” adlı eseri de dahil olmak üzere, şimdiye kadar satılan en pahalı NFT’lerden bazılarını üretmiştir.

Ninja Squad NFT Nedir?

Ninja Squad NFT, Türkiye’den çıkan ve Crypto Kemal ve ekibi tarafından oluşturulan bir NFT koleksiyonudur. Toplam 8888 adet NFT içerir ve her biri benzersiz özelliklere sahip bir ninja karakterini temsil eder.

Ninja Squad NFT’ler, sahiplerine Ninja Squad topluluğuna erişim sağlayan bir anahtar niteliği taşır. Bu topluluk, bir trader topluluğudur ve üyeler arasında paylaşım yaparak kar elde etmeyi hedefler. Ayrıca, ekip tarafından geliştirilen trader yazılım programları sayesinde yatırımcılar, başka yerlerde bulamayacakları verileri tek bir platform üzerinden takip edebilirler.

Ninja sahiplerine, NST (Ninja Squad Token) adı verilen bir utility token dağıtılmıştır. NST token, geçtiğimiz günlerde Arbitrum ağına geçiş yapmasıyla birlikte fee ücretlerinde azalma yaşayarak hızlı bir yükseliş göstermiştir.

NFT nasıl satılır ve alınır?

Bir cüzdan oluşturun: NFT’leri saklamak ve işlemleri gerçekleştirmek için bir kripto para cüzdanına ihtiyacınız olacak. MetaMask, Trust Wallet ve Coinbase Wallet gibi birçok popüler cüzdan seçeneği mevcuttur.

Kripto para satın alın: Çoğu NFT, Ethereum (ETH) gibi bir kripto para birimi kullanılarak satın alınır. Cüzdanınıza ETH eklemek için bir kripto para borsası kullanabilirsiniz.

Bir NFT pazar yeri seçin: OpenSea, Rarible ve SuperRare gibi birçok farklı NFT pazar yeri bulunmaktadır. Her pazar yerinin kendine özgü ücretleri ve kullanıcı tabanı vardır, bu nedenle araştırmanızı yapmak ve sizin için en uygun olanı seçmek önemlidir.

Satın almak veya satmak istediğiniz bir NFT bulun: Pazar yerini kullanarak, ilgi alanlarınıza ve bütçenize uygun NFT’leri arayabilirsiniz.

Bir teklif verin veya satın alın: NFT’yi satın almak istiyorsanız, bir teklif vermeniz veya doğrudan satın almanız gerekir. Teklif vermek, NFT’yi belirli bir fiyata satın alma arzunuzu gösterir. Doğrudan satın almak ise anında tam fiyatı ödersiniz.

İşlemi tamamlayın: Teklifleriniz kabul edilirse veya doğrudan satın alma işlemini gerçekleştirirseniz, NFT cüzdanınıza aktarılır.