Son zamanlarda kripto para dünyasında son derece popüler hale gelen DeFi’nin kelime anlamında “De” merkeziyetsiz anlamına gelirken “Fi” finansal anlamına geliyor. DeFi kendi içinde bir çok uygulamayı içeriyor. Bu uygulamalar, merkezi bir otoriteye ve üçüncü kişiye ihtiyaç duymadan finansal işlemlerin doğrudan iki kullanıcı arasında gerçekleştirilmesine izin veriyor.

DeFi’nin Amaçları

DeFi, finansal işlemlerde merkezi otoritelerin kontrolüne karşı alternatif bir sistem sunuyor. DeFi’nin temel amacı, finansal işlemleri daha hızlı, daha ucuz ve daha özgür bir şekilde gerçekleştirmek için yeni bir sistem oluşturmaktır. Ayrıca DeFi, finansal sistemlere erişimi olmayan veya geleneksel finansal sistemlerde yüksek ücretler ödemek zorunda kalan insanlara daha demokratik bir sistem sunmayı amaçlıyor.

DeFi’nin Kullanım Alanları

DeFi uygulamaları, borç alma ve borç verme, sigorta, yatırım ve türevler gibi finansal araçların işlem gördüğü bir platformdur. DeFi, finansal işlemlerin kurumlara göre daha hızlı, daha ucuz ve daha erişilebilir olmasını sağlamak amacıyla ortaya çıkmıştır.

DeFi’nin Avantajları

DeFi, merkezi bir otoriteye ihtiyaç duymadan çalışır. Bu da kullanıcıların, devletlerin ve kurumların sert yaptırımlarına ve kurallarına takılmadan finansal işlemlerini daha özerk, daha hızlı ve daha düşük komisyon ücretleriyle gerçekleştirmesini sağlar.

DeFi Protokolleri

DeFi projelerinin çoğu, genellikle Ethereum üzerinde çalışan yazılım protokolleridir. borç alma ve borç verme protokolleri, para transferi, tokenlaştırma, sigorta, yatırım gibi farklı alanlarda faaliyet gösterir. Örneğin Kripto para borç vermek isteyen biri, protokol tarafından kontrol edilen bir adrese tokenleri göndererek tutarına bağlı olarak faiz kazanabilir. Borç alanlar ise kripto para biçiminde teminat göndererek borç alma izni alabilir.

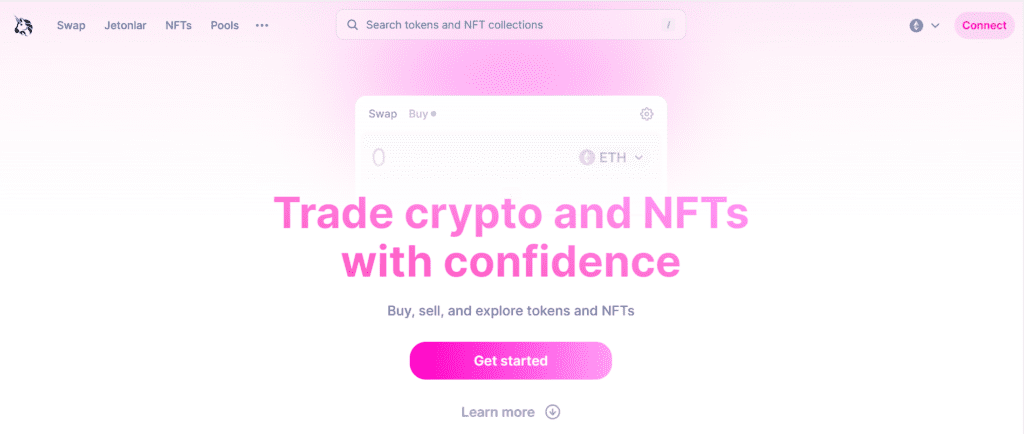

Popüler DeFi protokollerine Örnek olarak, Uniswap merkezi olmayan bir borsadır. kripto para birimlerinin takas edilmesini ve likidite sağlanmasını sağlar.

Aave ise, kripto para birimleriyle borç verme ve borç alma işlemlerini kolaylaştıran protokollerden biridir.

MakerDAO, DAI stabilcoininin oluşturulmasına izin verirken, Curve ve Synthetix yüksek likidite sağlayan merkezi olmayan borsa protokolleri olarak hizmet veriyor. Yearn Finance, otomatik yatırım stratejileri sunan bir yatırım platformu olarak kullanıcılara hizmet verirken, Lido Ethereum 2.0 staking için bir aracıdır ve kullanıcıların staking ödülleri elde etmelerine yardımcı olur.

Sonuç olarak, DeFi uygulamaları, finansal işlemlerde merkezi otoriteler yerine özerk bir sistem sunarak, kullanıcıların daha hızlı ve daha ucuz işlem yapmalarını sağlıyor. DeFi’nin merkezi otoritelerin kontrolüne alternatif bir sistem sunması ve finansal işlemlerde güvenlik, şeffaflık ve özerklik sağlamayı hedeflemesi, geleneksel finansal sistemlerdeki eksiklikleri gidermek için önemli bir adım olarak görülüyor.