Hisse bölünmesi, bir şirketin mevcut hisse senedi sayısını artırarak veya azaltarak gerçekleştirdiği bir finansal işlemdir. Şirketler, hisse senetlerini bölme işlemine genellikle hisse başına fiyatı daha uygun hale getirmek, daha fazla yatırımcı çekmek veya hisselerin daha likit hale gelmesini sağlamak gibi nedenlerle başvururlar.

İleriye Yönelik Hisse Bölünmesi (Forward Stock Split):

- İleriye yönelik hisse bölünmesi, şirketin mevcut hisse senedi sayısını artırarak gerçekleştirilen bir işlemdir.

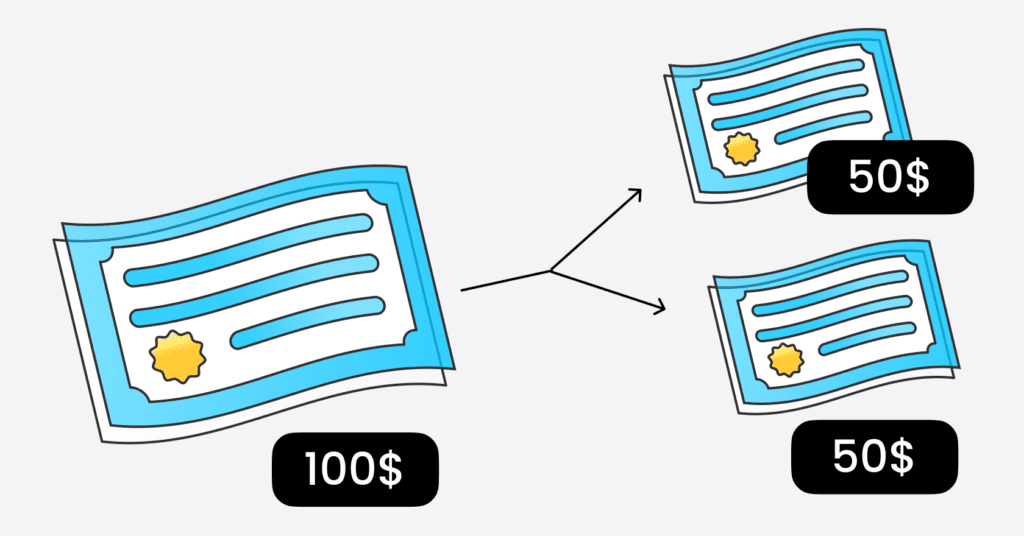

- Örneğin, 2:1 ileriye yönelik hisse bölünmesi, herhangi bir yatırımcının her bir eski hissesini iki yeni hisse ile değiştireceği anlamına gelir.

- Bu tür bölünmeler, hisse başına fiyatı düşürerek hisse senetlerini daha erişilebilir hale getirmeyi amaçlar.

Geriye Yönelik Hisse Bölünmesi (Reverse Stock Split):

- Geriye yönelik hisse bölünmesi, şirketin mevcut hisse senedi sayısını azaltarak gerçekleştirilen bir işlemdir.

- Örneğin, 1:5 geriye yönelik hisse bölünmesi, her beş eski hissenin bir yeni hisse ile değiştirileceği anlamına gelir.

- Bu tür bölünmeler, hisse başına fiyatı yükselterek hisse senetlerini daha cazip hale getirmeyi veya belirli borsalarda listeleme gereksinimlerini karşılamayı amaçlar.

Hisse Bölünmesi Nasıl Çalışır?

Hisse bölünmesi işlemi, genellikle şirketin yönetim kurulunun kararıyla gerçekleşir ve hissedarların onayına tabi olabilir. İleriye veya geriye yönelik olarak gerçekleşen bölünmeler, hisse senedi sayısının değişmesine ve hisse başına fiyatın artmasına veya azalmasına neden olur.

Örneğin, 2:1 ileriye yönelik bir hisse bölünmesi, mevcut her hisse başına iki yeni hisse çıkarılacağı anlamına gelir. Bu, hissedarların ellerindeki hisse senedi sayısının artmasına ve hisse başına fiyatın yarı yarıya düşmesine yol açar. Geriye yönelik bir hisse bölünmesi ise tam tersini yapar, yani hisse senedi sayısını azaltır ve hisse başına fiyatı artırır.

Hisse bölünmeleri, genellikle yatırımcıları çekmek veya mevcut hisse senetlerini daha likit hale getirmek için kullanılan bir strateji olarak değerlendirilir. Ancak, hisse bölünmeleri, şirketin temel değerini veya finansal sağlığını değiştirmez, sadece hisse senedi yapısını değiştirir.

Hisse Sahipleri Üzerinde Hisse Bölünmesinin Etkileri

- Sahip Olunan Hisselerin Sayısı:

Hisse bölünmesi sonucunda sahip olunan hisse sayısı artar. Örneğin, 2:1 hisse bölünmesi yapıldığında, her hisse sahibi mevcut hisse başına 2 yeni hisseye sahip olur. Bu, hisse sahiplerinin ellerinde daha fazla hisse senedi bulundurmasına neden olur.

- Hisse Başına Fiyat:

Hisse bölünmesi sonucunda hisse başına fiyat düşer. Örneğin, 2:1 hisse bölünmesi yapıldığında, her bir hisse senedinin fiyatı yarı yarıya azalır. Bu, daha düşük bir hisse fiyatıyla ticaret yapmayı tercih eden yatırımcılar için cazip olabilir.

- Toplam Yatırım Değeri:

Hisse bölünmesi, toplam yatırım değerini değiştirmez. Yatırımcının elindeki toplam değer, sahip olduğu hisse sayısı ile hisse başına fiyatın çarpımıyla hesaplanır. Dolayısıyla, hisse bölünmesi sonucunda hisse başına fiyat düşerken, sahip olunan hisse sayısı arttığı için toplam yatırım değeri aynı kalır.

Hisse Bölünmesinin Şirket Üzerindeki Etkileri

- Piyasa Değeri (Market Capitalization):

Hisse bölünmesi, şirketin piyasa değerini etkilemez. Piyasa değeri, hisse başına fiyatın hisse sayısı ile çarpılmasıyla hesaplanır ve hisse bölünmesi sonucunda bu iki faktör ters orantılı olarak değişir.

Örneğin, hisse başına fiyat düşerse, hisse sayısı artar ve piyasa değeri aynı kalır. Buna karşın, hisse başına fiyat yükselirse, hisse sayısı azalır ve piyasa değeri yine aynı kalır.

- Hisse Fiyatı:

Hisse bölünmesi sonucunda hisse fiyatı düşer. Daha düşük hisse fiyatları, hisse senetlerinin daha erişilebilir hale gelmesini sağlar.

Özellikle küçük yatırımcılar için daha düşük hisse fiyatları, hisse senetlerine yatırım yapmayı daha kolay hale getirebilir.

- Likidite:

Hisse bölünmesi, hisselerin daha likit hale gelmesine katkıda bulunabilir. Daha düşük hisse fiyatları, yatırımcıların hisse senetlerini daha kolay alıp satabilmelerine olanak tanır.

Likidite, hisse senetlerinin piyasada daha sık alınıp satılabilir olma durumunu ifade eder ve yatırımcılar için önemli bir faktördür.

Hisse bölünmesi, genellikle şirketin hisse senetlerini daha çekici ve erişilebilir hale getirmek amacıyla yapılır. Bu işlem, hisse senedi piyasasında daha fazla işlem yapılmasını teşvik edebilir ve yeni yatırımcıların ilgisini çekebilir. Ancak piyasa değeri ve hisse fiyatındaki değişiklikler, şirketin temel değerini etkilemez, yalnızca hisse senedi yapısını değiştirir. Şirketler, hisse bölünmesi kararı alırken dikkatli bir şekilde değerlendirme yapmalıdır.

Hisse Bölünmelerinin Avantajları ve Dezavantajları

Avantajlar:

- Daha Erişilebilir Hisse Senetleri: Hisse bölünmesi, hisse başına fiyatı düşürerek hisse senetlerini daha erişilebilir hale getirir. Bu, küçük yatırımcıların ve perakende yatırımcıların daha kolay hisse senedi almasına olanak sağlar.

- Likidite Artışı: Hisse bölünmesi, hisselerin daha likit hale gelmesini teşvik edebilir. Daha düşük hisse fiyatları, yatırımcıların hisse senetlerini daha sık alıp satmasına olanak tanır.

- Yatırımcı Çekme: Daha düşük hisse fiyatları, şirketin hisse senetlerine yatırım yapmayı düşünen yatırımcıların ilgisini çekebilir. Bu, şirketin hisse senetlerine olan talebi artırabilir.

Dezavantajlar:

- Yanlış Algılamalar: Hisse bölünmesi sonucunda hisse fiyatı düşse de, şirketin temel değeri değişmez. Buna rağmen, bazı yatırımcılar hisse fiyatının düşmesini olumsuz bir işaret olarak yanlış algılayabilirler.

- Maliyetler: Hisse bölünmesi işlemleri, şirketlere maliyet getirebilir. Özellikle büyük şirketler için bu işlem, hukuki ve finansal süreçlerle birlikte ekstra harcamalar gerektirebilir.

- Yatırım Kararlarında Karışıklık: Hisse bölünmeleri, yatırımcıların yatırım kararlarını etkileyebilir. Yatırımcılar, hisse bölünmesinin ardından şirketin finansal sağlığı ve performansını dikkatle incelemelidir.

Hisse bölünmesi, hisse senetlerini daha erişilebilir hale getirirken, bazı yanlış algılamalara neden olabilir ve şirketlere ek maliyetler getirebilir. Her bir hisse bölünmesi durumu, şirketin özel koşullarına ve yatırımcıların hedeflerine bağlı olarak farklılık gösterebilir.

Önemli Noktalar:

- Hisse bölünmesi, bir şirketin mevcut hisse senetlerini artırarak veya azaltarak gerçekleştirdiği bir finansal işlemdir.

- Şirketler hisse bölünmesini hisse başına fiyatı daha uygun hale getirmek, daha fazla yatırımcı çekmek veya hisselerin daha likit hale gelmesini sağlamak amacıyla yapabilir.

- Hisse bölünmesi, hisse sahiplerinin ellerindeki hisse sayısını artırırken hisse başına fiyatı düşürür.

- Toplam yatırım değeri hisse bölünmesi sonucunda değişmez, ancak hisse sahiplerinin portföylerinde daha fazla hisse senedi bulunur.

- Şirketin piyasa değeri hisse bölünmesi sonucunda değişmez, ancak hisse başına fiyat düşer.

- Hisse bölünmesi, hisselerin daha erişilebilir hale gelmesini ve likiditeyi artırmasını sağlayabilir.