Aerodrome, Coinbase’in Layer 2 blockchain platformu Base üzerine inşa edilmiş merkeziyetsiz bir borsadır. Optimism ağındaki en büyük TVL’nin sahibi Velodrome Finance’in Coinbase üzerindeki projesidir. Base blockchaini, hızlı ve düşük maliyetli işlemler sağlayarak dikkat çekerken, Aerodrome bu altyapıyı kullanarak merkezi olmayan bir borsa deneyimi sunmayı amaçlıyor. Bu platform, güçlü likidite teşvik motoru, oy-kilitleme yönetim modeli ve kullanıcı dostu deneyimi bir araya getirerek Base’in likidite merkezi olmayı hedefliyor.

Aerodrome’un Teknik Özellikleri

- Likidite Teşvik Motoru: Aerodrome, likidite sağlayıcılarını platforma çekmek için likidite teşvik motoru kullanıyor. Bu motor, likidite sağlayıcılarına AERO token’ları ile ödüller verir. Bu ödüller, platformun yönetimine katılmak veya staking ödülleri kazanmak için kullanılabilir.

- Oy-Kilitleme Yönetim Modeli: Aerodrome, oy-kilitleme yönetim modeli kullanır. Bu da kullanıcıların yönetim oylamalarına katılabilmek için AERO token’larını belirli bir süre boyunca kitlemeleri gerektiği anlamına gelir. Bu yaklaşım, yönetim kararlarının platformun en iyi çıkarları doğrultusunda alınmasına yardımcı olur.

- Kullanıcı Dostu Arayüz: Aerodrome, kullanıcıların ve likidite sağlayıcılarının platformu rahatlıkla kullanabilecekleri kullanıcı dostu bir arayüze sahiptir. Bu da yeni kullanıcıların bile kolayca platformu kullanmaya başlamalarını sağlar.

Aerodrome’un DeFi Alanındaki Rolü

Aerodrome, merkezi olmayan finans alanında önemli bir rol oynamaya aday bir DEX’dir. Bu yazının yazıldığı sırada 180 Milyon $ TVL ile Base üzerindeki lider protokol olarak yerini almış vaziyette. Geçtiğimiz ay içerisinde Base, günlük işlem miktarı alanında Arbitrum ve Optimism’i geçerek Etherum Layer 2 platformları arasında konumunu güçlendirmişti. Aerodrome da lansmanı ile birlikte Base ağının merkeziyetsiz likidite kaynağı olmayı hedefliyor.

Aerodrome Tokenomics

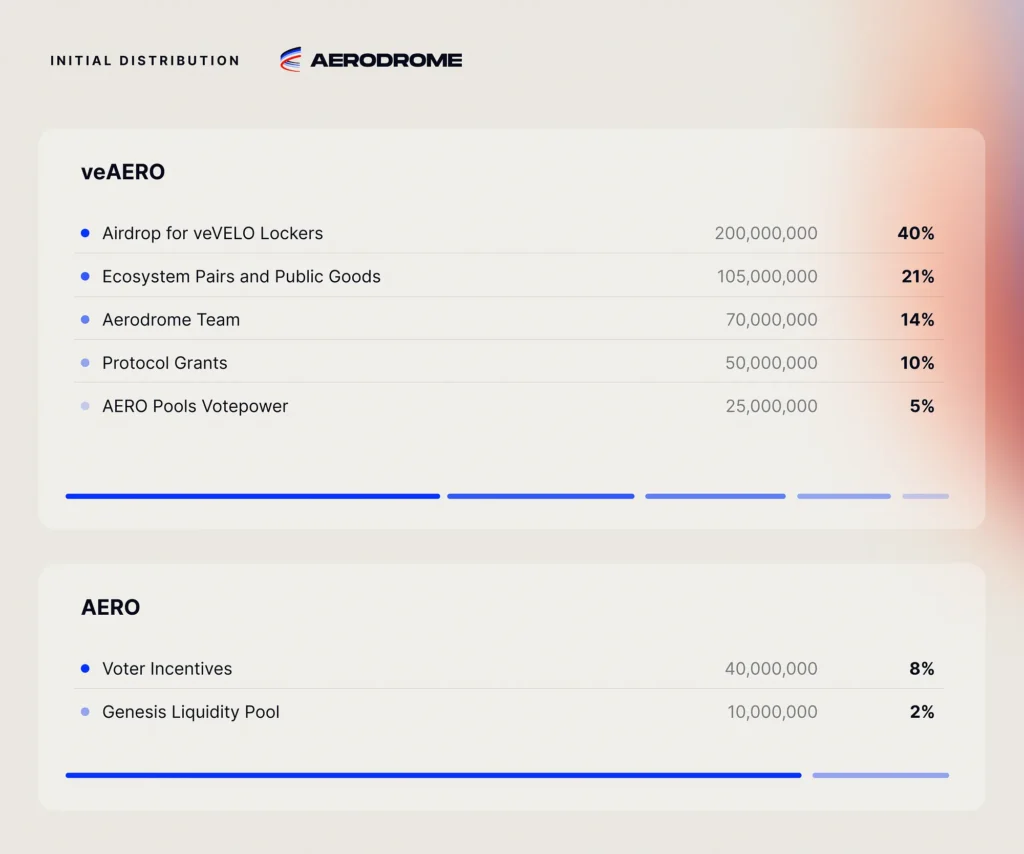

AERO token projesinin toplam başlangıç arzı 500 milyon coin olarak belirlenmiştir. Bu arzın %90’ı, yani 450 milyon coin, uzun vadeli katılımı teşvik etmek amacıyla “veAERO” olarak adlandırılan bir kilitleme mekanizması ile kilitlenmiştir.

Uzun vadeli projeye katılım, başarının temel taşlarından biridir. Bu nedenle, AERO projesi ekibi, toplam coin arzının büyük bir kısmını kilitli tutma stratejisini benimsemiştir. Bu kapsamda, 450 milyon coin olan veAERO’nun uzun vadeli katılımı teşvik etmek için kilitlendiğini görmekteyiz.

AERO projesi ekibi, toplam başlangıç arzının %40’ını oluşturan 200 milyon coini veVELO sahiplerine dağıtmayı planlamaktadır. Bu airdrop, mevcut veAERO sahiplerini ödüllendirmenin yanı sıra, daha geniş bir kullanıcı kitlesine de ulaşmayı amaçlamaktadır.

Airdrop Şartları ve Dağıtım Kriterleri

Airdrop’tan yararlanmak isteyen veVELO sahiplerinin belli başlı şartları yerine getirmesi gerekmektedir. En önemli şartlardan biri, en az 1000 adet veVELO’ya sahip olmaktır. Ancak Velodrome’un başlatılmasıyla birlikte belirli veVELO bakiyeleri, dağıtımın dışında bırakılacaktır.

Mevcut durumda, 500 milyon veVELO’ya sahip 3500 cüzdanda airdrop’tan yararlanma hakkı bulunmaktadır. Ancak, belirli kriterlere göre %20’lik bir kesim, airdrop’tan dışlanabilir. Bu ayrımın başlıca nedenleri, Velodrome ekibi ve ilk ortaklar için ayrılan veVELO bakiyeleri ile kullanıcı mevduatı kabul eden toplama protokolleri olacaktır.

veAERO Nasıl Çalışır?

Aerodrome platformunda, kullanıcılar ve protokoller arasındaki işbirliğini desteklemek için özel bir teşvik sistemi bulunmaktadır. Bu sistemde protokoller, veAERO token’larını kilitleyerek veAERO sahiplerine ödüller sunar. Karşılığında, veAERO sahipleri tercih ettikleri likidite havuzlarından elde edilen işlem ücretlerinin %100’ünü ve teşvikleri alırlar.

- Protokoller ve veAERO: Protokoller, belirli likidite havuzlarını hedeflerken veAERO token’larını kilitleyebilir ve bu havuzlara teşvikler yatırabilirler. Bu teşvikler, kullanıcıları belirli havuzlara likidite sağlamaya yönlendirmek için kullanılır.

- Kullanıcılar ve Likidite Havuzları: Kullanıcılar, protokollerin kilitlemiş olduğu veAERO token’ları ile tercih ettikleri likidite havuzlarına katılabilirler. Bu sayede hem işlem ücretlerinden hem de havuz teşviklerinden yararlanabilirler.

Bu sistem, likidite çekmeye çalışan protokoller ile getiri maksimizasyonu arayan kullanıcılar arasında karşılıklı bir ilişki yaratır. Protokoller, likidite sağlayıcılarını teşvik etmek için ödüller sunar ve bu da kullanıcıların getirilerini artırır.

Emisyon Süreci ve Artış Oranları

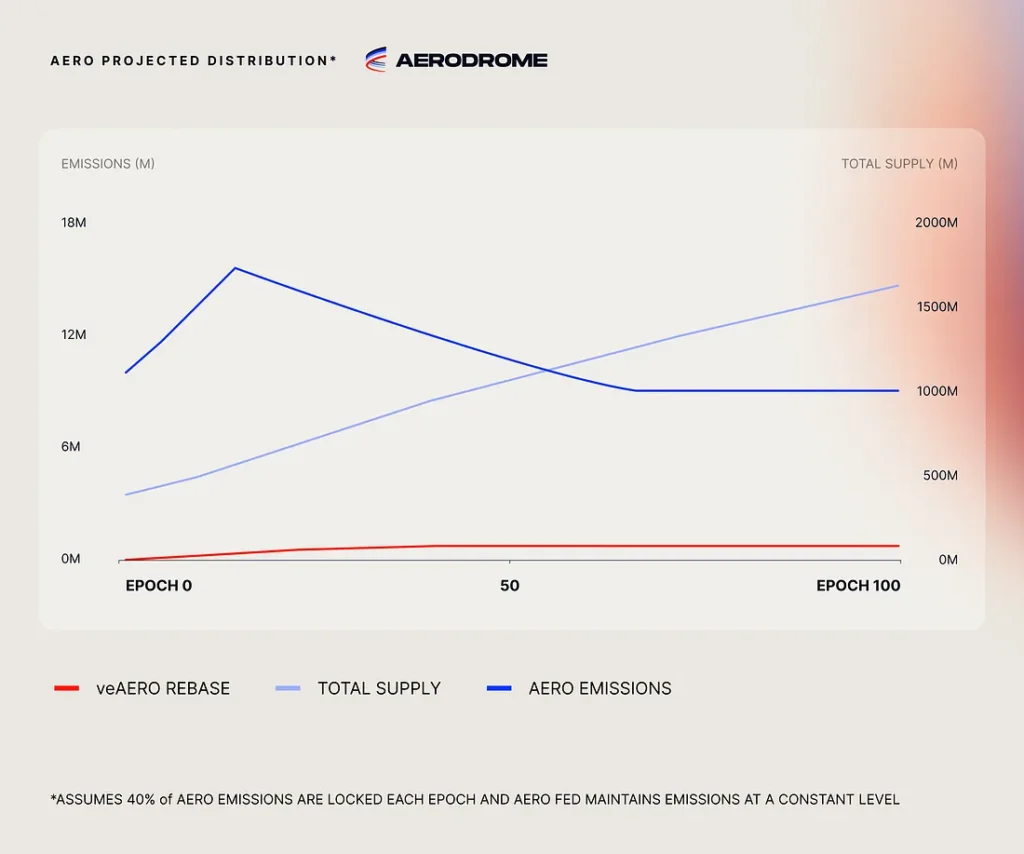

Aerodrome Emisyon süreci olarak Epoch (Dönem) adı verilen bir sistem izlemektedir. İlk Epoch’ta haftalık 10 milyon AERO piyasaya sürülecek ve takip eden 14 Epoch’ta bu %3 artacak. Haftalık 15 Milyon AERO seviyesinde peak yapıp sonrasında her Epoch’da %1 azacak. Bu düşüş Protokol olgunlaştıktan sonra arzın azaltılmasıyla AERO’nun değer kaybı yaşamasının önüne geçmek amacıyla yapılmaktadır.

Emisyonlar 9 Milyon AERO’nun altına indiği zaman, 67. Epoch’ta gerçekleşeceği öngörülüyor, veAERO aracılığıyla oy sahibi olan kullanıcılar Aerodrome’un Aero Fed sistemiyle para politikasında söz hakkına sahip olacaklar. Bu noktada kullanıcılar her bir Epoch için oylamayla aşağıdaki üç seçenekten birinde karar kılacaklar:

- Emisyonların toplam arzın %0.01 oranında arttırılması

- Emisyonların toplam arzın %0.01 oranında azaltılması

- Emisyonların o anki seyrinde değişiklik olmadan devam etmesi

Sonuç

Aerodrome merkezi olmayan finans dünyasında önemli bir oyuncu olarak ortaya çıkıyor. Coinbase’in Layer 2 blockchain platformu Base üzerine inşa edilmiş olan bu merkeziyetsiz borsa, hızlı ve düşük maliyetli işlemler sağlayan Base blockchain altyapısını kullanarak kullanıcı dostu bir deneyim sunmayı amaçlıyor. Likidite teşvik motoru, oy-kilitleme yönetim modeli ve veAERO token’larıyla desteklenen Aerodrome, hem likidite sağlayıcılarını çekmeye yönelik bir sistem sunuyor hem de kullanıcıların platform yönetimine katılımını teşvik ediyor.