Blockchain endüstrisinin dinamik ortamında Seedify.fund, erken aşama blockchain projelerini beslemek ve güçlendirmek için öncü bir merkez olarak duruyor. Çok yönlü yaklaşımı, DAO odaklı bir başlangıç aşaması fonu, merkeziyetsiz bir inkübatör ve hepsi de gelecek vaat eden projeleri başarıya doğru ilerletmek için titizlikle tasarlanmış bir launchpad’i kapsamaktadır. Projenin kapsayıcı vizyonu, inovasyon ve büyümenin birleştiği, merkeziyetsiz teknolojilerin ilerlemesini sağlayan gelişen bir ekosistemi teşvik etmektir.

SFUND Nedir?

Seedify.fund’un yerel token’ı olan SFUND, platformun can damarı olarak hizmet ederek çok yönlü işlevlerini harekete geçirir ve topluluğuna güç verir. Seedify ekosisteminin çeşitli yönlerine sorunsuz bir şekilde entegre olarak fayda ve yönetim sağlar.

Launchpad Katılımı: SFUND sahipleri, Seedify’da barındırılan ilk DEX tekliflerine (IDO’lar) katılmak için imrenilen bir erişim elde ederek, yeni ortaya çıkan aşamalarında gelecek vaat eden blok zinciri projelerine yatırım yapmak için en önemli fırsatları güvence altına alır.

Topluluk Yönetimi: SFUND sahipleri, Seedify’ın geleceğini şekillendirmeye aktif olarak katılmak için tokenlarının gücünü kullanırlar. Oylama mekanizmaları aracılığıyla, proje seçimi, tokenomik ve platform geliştirme ile ilgili önemli kararları etkilerler.

Staking Ödülleri: SFUND tokenlarını stake etmek, pasif gelir akışının kilidini açar ve sahiplerini platforma olan sadakatleri için ödüllendirir. Ayrıca, stake etme ağ güvenliğine katkıda bulunarak Seedify ekosisteminin genel dayanıklılığını artırır.

Ekosistem Ücretleri: SFUND, proje listeleme ücretleri, listeleme başvuru ücretleri ve topluluk oylama ücretleri dahil olmak üzere çeşitli platform ücretlerinin kolaylaştırılmasında önemli bir rol oynar. Bu, Seedify’ın sorunsuz çalışmasını ve sürdürülebilir büyümesini sağlar.

Ekip Teşvikleri: SFUND, Seedify ekibi için finansmanın temel taşı olarak hareket eder ve platformun bütünlüğünü korumak, işlevselliğini geliştirmek ve toplulukla aktif bir şekilde etkileşim kurmak için gerekli kaynakları sağlar.

SFUND Coin

SFUND bir ERC-20 tokenidir ve çalışmasını desteklemek için sağlam Ethereum blok zincirinden yararlanır. Bu, ölçeklenebilirlik, güvenlik ve birlikte çalışabilirliğin doğal faydalarını sağlayarak çeşitli blok zinciri ekosistemleriyle sorunsuz entegrasyona olanak tanır. Özellikle, SFUND tamamen merkeziyetsiz bir token olup, gelecekte tahsis edilmek üzere ayrılmış ön maden veya takım tokenları bulunmamaktadır. Dağıtım mekanizması, topluluk arasında adil bir dağıtım sağlayarak sahiplenme ve katılım duygusunu teşvik eder.

SFUND Tokenomics

Seedify tokenomikleri, uzun vadeli SFUND tutmayı teşvik etmek ve token sahiplerinin çıkarlarını platformun başarısıyla uyumlu hale getirmek için özenle hazırlanmıştır. Bu uyum, Seedify’ın ve desteklediği projelerin kolektif büyümesine kendini adamış bireylerden oluşan bir topluluğu teşvik eder.

Topluluk: Toplam SFUND arzının önemli bir %50’si topluluğa tahsis edilerek token sahiplerinin platformun başarısını paylaşması ve yönetişimine katkıda bulunması sağlanır.

Ekosistem Geliştirme: Seedify ekosistemini beslemeye ve sürdürmeye adanan SFUND’un %30’u platform bakımı, pazarlama ve stratejik ortaklıklara yönlendirilir. Bu, platformun sürekli büyümesini ve ilerlemesini sağlar.

Ekip: Seedify ekibinin paha biçilmez katkısını kabul ederek, SFUND’un %10’u onların sürekli motivasyonu ve projenin başarısına olan bağlılıkları için ayrılmıştır. Bu, onların hedeflerini platformun uzun vadeli büyümesiyle uyumlu hale getirir.

Pazarlama ve Ortaklıklar: Seedify’ın erişimini artırmak ve yeni projeler ve kullanıcılar çekmek için SFUND’un %10’u pazarlama ve ortaklıklar için ayrılmıştır. Bu, daha geniş çapta benimsenmeyi teşvik eder ve platformun blok zinciri ekosistemindeki önemini artırır.

Seedify Etkisi

Seedify, blok zinciri ekosisteminde önemli bir sütun olarak durmakta, erken aşamadaki projeleri güçlendirmekte ve yeniliğin geliştiği işbirlikçi bir ortamı teşvik etmektedir. Merkezi olmayan yaklaşımı ve topluluk odaklı yönetimi, gelecek vaat eden projelerin gelişmesi ve blok zinciri endüstrisinin genel büyümesine katkıda bulunması için verimli bir zemin oluşturmaktadır.

Seedify Temel Özellikler

DAO güdümlü başlangıç aşaması fonu: Seedify’ın DAO güdümlü başlangıç aşaması fonu, seçim sürecinde devrim yaratarak topluluğu olağanüstü potansiyele sahip projeleri toplu olarak değerlendirme ve seçme konusunda güçlendirir.

Merkezi Olmayan İnkübatör: Seedify’ın merkezi olmayan inkübatörü, seçilen projelere uygulamalı destek sağlayarak yalnızca finansmanın ötesine geçer. Fikirlerini geliştirmeleri, ürünlerini geliştirmeleri ve toplulukla anlamlı bağlantılar kurmaları için onlara rehberlik eder.

Kaliteli Projeler için launchpad: Seedify’ın launchpad’i, yüksek kaliteli blok zinciri projelerinin IDO’larını gerçekleştirmeleri için özel bir platform sağlar. Bu, erken aşama yatırımcıların gelecek vaat eden fırsatlara erişimini sağlarken, projelerin gerekli teşhir ve desteği almasını sağlar.

Garantili Geri Ödeme Mekanizması: Seedify’ın IDO’ları, proje başarısızlığı veya tatmin edici olmayan performans durumunda token sahiplerine koruma sağlayan yeni bir garantili geri ödeme mekanizmasını kapsamaktadır. Bu güvence yatırımcılara güven aşılar ve platforma olan güveni artırır.

Seedify Launchpad Ne Kadar Kazandırdı?

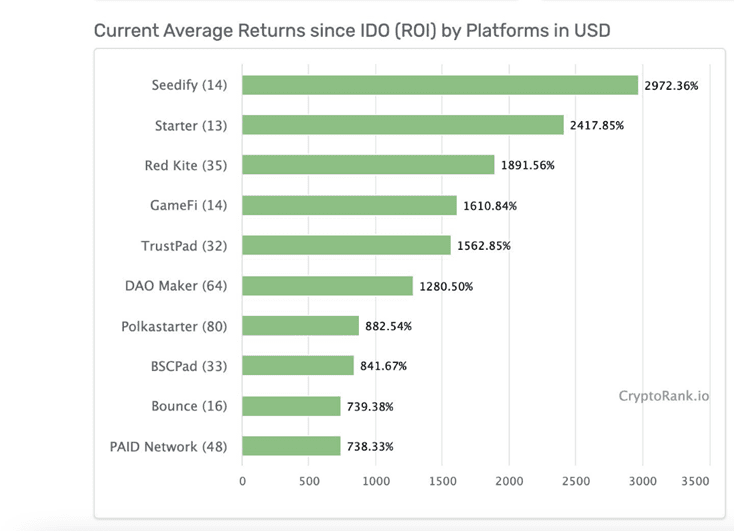

Seedify, aynı zamanda rakip launchpad platformlarına göre daha önde bir performans sergiliyor. En bilinen LaunchPad platformları ise sırası ile Seedify, Starter, Red Kite, TrustPad, Dao Maker, Polkastarter ve BSCPad.

Seedify platformunda ön satış ile arz olan tokenlar, ortalama olarak iyi bir performans gösteriyor. Bu performansın arkasında kullanıcılarına çok uygun fiyat ile satılmaları bulunuyor. Bu yöntemin adı ön satış olmakla birlikte, kullanıcılara “garanti kazanç” vaad etmiyor. Bir çok proje birkaç kat yükseliş yaşasa da, bazı projeler daha kötü veya daha iyi performans gösterebiliyor.

Seedify’ın $SFUND stake eden kullanıcılarına ön satış ile sunduğu bazı projeler ise tarihi performans göstermiş bulunuyor. Geçmiş verilere bakıldığında, Bloktopia en yüksek değerindeyken ön satıştan alan birisine yaklaşık 680 kat para kazandırdığı görülüyor. Bir başka popüler proje olan Cryptomeda’nın gerçekleştirdiği 185 katlık bir yükseliş bulunuyor. Daha yakın bir tarihte ön satış ile $SFUND holderlarına sunulan bir diğer proje ise ChainGPT. Ortalama olarak ön satış evresinden satın alınan projeler katılımcılara güzel potansiyel karlar ettirebiliyor, bu katılım tier sistemlerine ve token arz sayısına göre değişebiliyor.

Seedify Tier Sistemi Nedir?

Seedify platformundaki launchpad’de duyurulan kripto para ön satışlarına, kullanıcıların $SFUND tokenlerini stake etmeleri şartı ile katılım sağlanabiliyor. Farklı Tier sistemlerine farklı alım hakları tanımlayan Seedify, kullanıcılarına projelerin ön satışlarına katılarak uygun bir fiyattan almalarını sağlıyor.

Tier sistemi kullanıcıların özel satışlara ve ilk arzlara katılmak için ihtiyaç duydukları miktarda SFUND token’ı belirlemeye yardımcı olur.

Tier sistemi düzenli olarak güncellenmektedir. Bu sebeple zaman içinde bu sayılarda değişim görmek oldukça mümkündür.

Tier sistemleri şu şekilde çalışır:

Tier 1: 500 SFUND

Tier 2: 1000 SFUND

Tier 3: 2500 SFUND

Tier 4: 5.000 SFUND

Tier 5: 7.500 SFUND

Tier 6: 10.000 SFUND

Tier 7: 25.000 SFUND

Tier 8: 50.000 SFUND

Tier 9: 100.000 SFUND

Tier 1’deki katılımcı, projenin toplam özel satışının %1’ini satın alma hakkına sahiptir.

Tier 9’daki katılımcı, projenin toplam özel satışının %10’unu satın alma hakkına sahiptir.

Özetle, tier sistemleri, kullanıcıların özel satışlara ve ilk arzlara katılmak için ihtiyaç duydukları miktarda SFUND token’ı belirlemeye yardımcı olur. Her tier, kullanıcılara özel satışta veya ilk arzında daha fazla token alma hakkı verir. Bu, Seedify launchpad’de adil bir dağıtım sağlamak ve her kullanıcının projeye yatırım yapma fırsatına sahip olmasını sağlamak için tasarlanmıştır.

Sonuç Olarak Seedify

Sürekli gelişen blok zinciri teknolojisi ortamında Seedify.fund, erken aşamadaki projeleri güçlendiren ve çığır açan fikirlerin gelişebileceği gelişen bir ekosistemi teşvik eden bir yenilik feneri olarak duruyor. DAO odaklı yönetim, merkeziyetsiz inkübatör ve launchpad’in benzersiz karışımı, gelecek vaat eden projelerin finansman, mentorluk ve küresel bir yatırımcı topluluğuna erişim sağlaması için destekleyici bir ortam sunmaktadır.

Blok zinciri endüstrisi genişlemeye devam ederken, Seedify geleceğini şekillendirmede önemli bir rol oynamaya hazırlanıyor. İnovasyonu beslemeye ve işbirlikçi bir ortamı teşvik etmeye olan bağlılığı, şüphesiz gelecek vaat eden projeleri çekecek ve onları merkezsiz ekosisteme önemli katkılarda bulunmaları için güçlendirecektir.

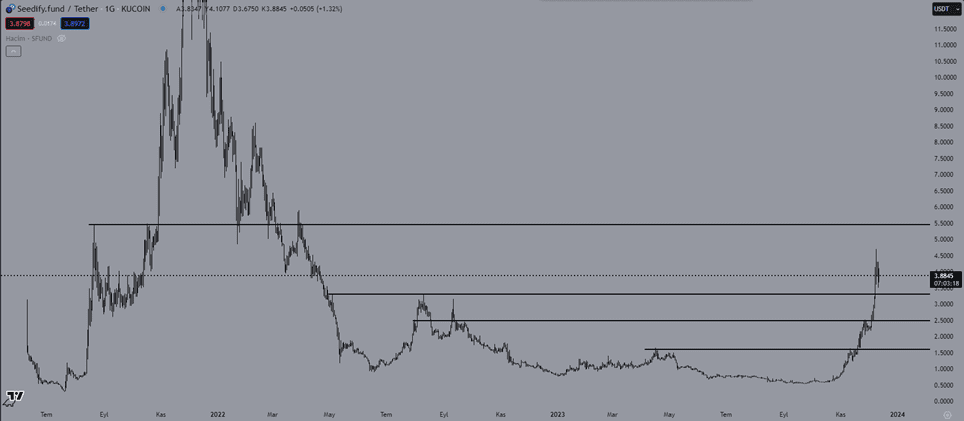

SFUND Coin Yorum

SFUND Coin için belirlenen destek ve direnç seviyeleri doğrultusunda, en yakın destek seviyesi 3.32 dolar olarak belirlenmiştir. Bu seviyenin altında, bir alt destek olarak 2.50 dolar seviyesi takip edilmekte olup, daha sonra 1.60 dolar seviyesi ise bir diğer destek noktası olarak belirlenmiştir. Öte yandan, fiyatın yukarı yönlü hareketinde takip edilen direnç seviyesi ise 5.47 dolar olarak gözlemlenmektedir. Bu destek ve direnç seviyeleri, varlığın fiyat hareketlerini izlemek ve olası ticaret stratejileri oluşturmak adına önemli referans noktaları olarak dikkate alınabilir.

SFUND Coin Nereden Alınır?

SFUND Token merkezi borsalar üzerinden veya merkeziyetsiz borsalar üzerinden alınabiliyor. SFUND Coin almak için Bybit borsasında %40 komisyon indirimli üyelik gerçekleştirerek alabilirsiniz.