Çığır açan bir oracle(1*) çözümü olan Pyth Network, merkezi olmayan bir konsensüs mekanizması aracılığıyla son derece güvenilir ve kurcalamaya karşı korumalı fiyat beslemeleri sağlayarak DeFi ortamını dönüştürüyor. Geleneksel oracle’ların aksine Pyth, birden fazla saygın kaynaktan gelen verileri bir araya getirerek verilerin doğruluğunu ve bütünlüğünü sağlar. Bu yenilikçi yaklaşım, Merkeziyetsiz finans (DeFi) ekosisteminin güvenliğini ve güvenilirliğini artırmayı vaat ediyor.

PYTH Network

Merkeziyetsiz finans (DeFi) alanında, piyasa verilerinin dağıtımını ve kullanımını tamamen dönüştürme potansiyeline sahip yeni bir katılımcı ortaya çıktı. Kripto dünyası, geniş bir varlık yelpazesi için son derece güvenilir ve aşılmaz fiyat akışları sağlamayı vaat ettiği için, yeni bir uzlaşı yöntemi kullanan bir oracle çözümü olan Pyth Network’ü fark etti. Pyth’in merkezi olmayan yaklaşımı, tek bir veri kaynağına dayanan geleneksel oracle’ların aksine, güvenilir piyasa katılımcılarından oluşan bir konsorsiyumdan birçok veri noktasını bir araya getirerek sunduğu fiyat akışlarının doğruluğunu ve bütünlüğünü sağlar. Mevcut oracle sistemlerinin dezavantajları bu yaratıcı strateji ile giderilebilir ve daha güvenilir bir DeFi ekosistemine kapı açabilir.

PYTH Network Nedir?

Finansal hizmetlerin dağıtımı, hızla genişleyen merkeziyetsiz finans alanında devrim yaratıyor. Güvenilir fiyat akışlarına sahip olmak, DeFi’nin en büyük sorunlarından biridir. Geleneksel oracle’lar, DeFi uygulamalarına veri sağlayan merkezi; manipülasyona, saldırılara ve kesintilere açık sistemlerdir.

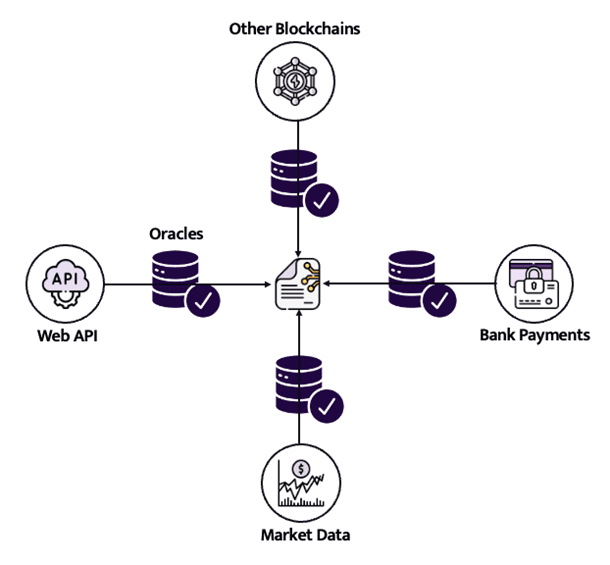

Bu sorunların üstesinden gelmek için Pyth Network adı verilen merkeziyetsiz bir oracle oluşturuldu. Pyth, özel bir fikir birliği tekniği kullanarak diğer kaynakların yanı sıra borsalardan, piyasa yapıcılardan ve veri sağlayıcılardan gelen verileri toplar. Bu yöntemle, Pyth’in sunduğu fiyatlandırma akışlarının tek bir veri kaynağı arızası durumunda bile doğru ve güvenilir olması garanti edilir.

Güvenilir olmasının yanı sıra, Pyth aynı zamanda güvenlikli olacak şekilde tasarlanmıştır. Pyth, verilerini kurcalanmaya karşı korumak için kriptografik tekniklerin bir kombinasyonunu kullanır. Bu, tek bir varlığın ağı kontrol edememesini sağlamak için eşik kriptografisinin kullanılmasını ve hassas bilgileri açığa çıkarmadan verilerin doğruluğunu doğrulamak için “Sıfır bilgi ispatı”(2*) kullanılmasını içerir.

Pyth henüz geliştirilme aşamasındadır, ancak DeFi’de fiyat akışlarının sağlanmasında devrim yaratma potansiyeline sahiptir. Pyth, güvenilir ve güvenli fiyat akışları sağlayarak DeFi uygulamalarını daha sağlam ve güvenilir hale getirmeye yardımcı olabilir.

Pyth Nasıl Çalışır?

Pyth’in uzlaşma sürecinin temeli “likidite madenciliği” fikridir. Pyth ağına veri katkısında bulunan katılımcılar likidite madencileri olarak bilinir. Likidite madencileri, verileri karşılığında Pyth tokenları ile ödüllendirilir.

Bir likidite madencisi, daha fazla veri karşılığında daha fazla Pyth jetonu alır. Bu nedenle likidite madencileri doğru ve güvenilir veriler sağlamaya teşvik edilir.

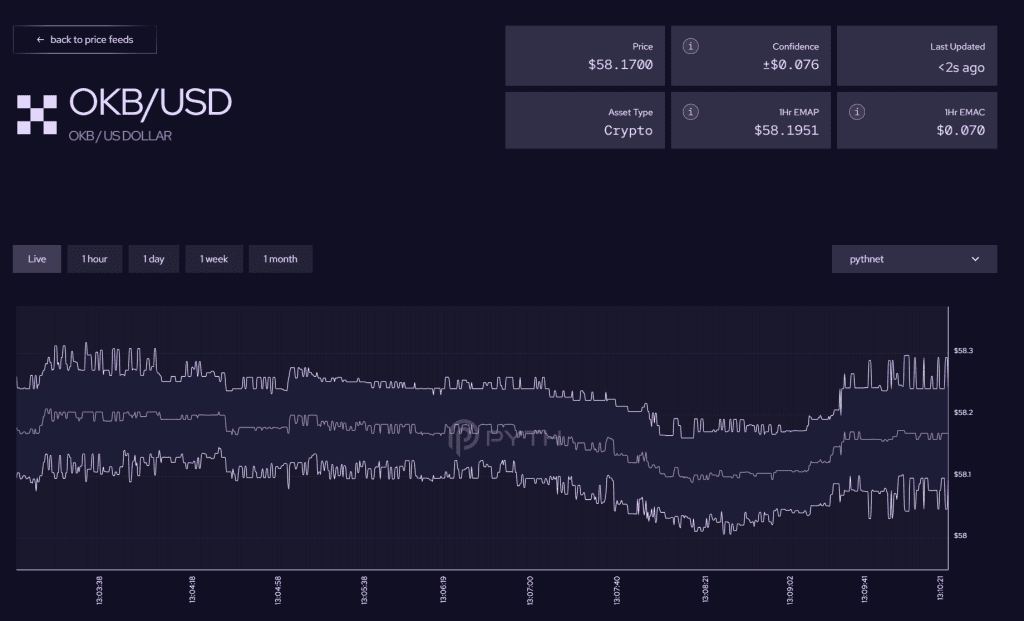

Pyth’in mutabakat yöntemi aşağıdaki gibi çalışır:

-Veriler, likidite madencileri tarafından Pyth ağına yüklenir.

-Her likidite madencisinden gelen veriler Pyth ağı tarafından birleştirilir.

-Pyth ağı, kriptografik bir yöntem kullanarak varlığın nihai fiyatını belirler.

-DeFi uygulamaları Pyth ağından nihai ücreti alır.

PYTH’nin Avantajları

Pyth, geleneksel oracle’lardan aşağıdaki gibi çeşitli şekillerde üstündür:

– Güvenilirlik: Pyth’in merkeziyetsiz yöntem teknolojisi, tek bir veri kaynağının arızalanması durumunda bile kesin ve güvenilir fiyat akışlarını garanti eder.

– Güvenlik: Veri manipülasyonunu önlemek için Pyth çeşitli kriptografik mekanizmalar kullanır.

– Şeffaflık: Pyth, verilerini kamuya açık hale getirerek kullanıcıların doğruluğunu teyit etmesini sağlar.

PYTH Coin Nedir?

Pyth coin nedir sorusunun cevabı, merkezi olmayan finans (DeFi) alanında borç verme protokolleri ve borsalar için gerçek zamanlı veri hizmetleri sunmaktadır. Ayrıca proje, blok zinciri üzerine inşa edilmiş NFT’ler ve oyunlar için veri hizmetleri sunmaktadır. Pyth Network’ün yerel token’ı PYTH olarak adlandırılmaktadır. Ağın yönetiminin geleceğine ilişkin oylama, token tarafından mümkün kılınmaktadır. Ağın düzgün ve güvenli işleyişini garanti altına almak için, PYTH sahipleri de stake işlemlerine katılabilir.

Ağ ve veri platformunu kullanan daha fazla insanla birlikte, PYTH Coin muhtemelen artacaktır. Yapılan açıklamalarda, madeni paranın ekosistemin ve ağın genişlemesini desteklemek için de kullanılacağı iddia ediliyor.

PYTH Coin Tokenomics

| Token detayları: | Detaylar |

| Kısaltma: | PYTH |

| Max arz: | 10,000,000,000 PYTH |

| İlk Dolaşım Arzı: | 1,500,000,000 PYTH (15%) |

| Kilit açımı: | PYTH tokenlerinin %85’i başlangıçta kilitlidir ve ilk token lansmanından 6, 18, 30 ve 42 ay sonra kilidi açılacaktır. |

PYTH Network Coin Hizmetleri

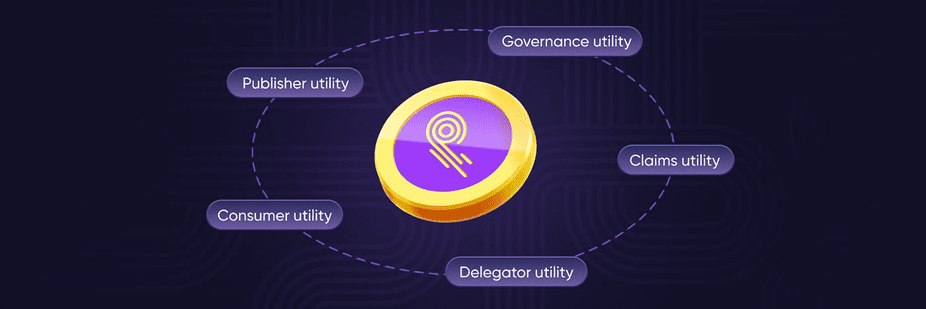

– İdare: PYTH token sahipleri, ağ kurallarında yapılacak değişiklikleri sunarak ve oylayarak Pyth Network’ün yönetiminde yer alabilirler.

– Staking: PYTH token sahipleri, teşvik almak ve ağ güvenliğini desteklemek için tokenlerini stake etme seçeneğine sahiptir.

– Ekosistem Teşvikleri: Örneğin, geliştiricileri ve veri tedarikçilerini ödüllendirerek, PYTH tokenleri Pyth Network ekosistemine katılım için bir teşvik olarak kullanılabilir.

PYTH Yorum

Ninja News analiz ekibi tarafından yayınlanan analizimizde PYTH Coin hakkındaki analize yer verilmektedir. Alanında uzman ekibimiz tarafınca hazırlanan bu analiz için tıklayınız.

PYTH Nereden Satın Alınır?

PYTH Coin’i merkezi borsalar üzerinden veya merkeziyetsiz borsalar üzerinden alınabiliyor. PYTH Coin almak için OKX borsasında %40 komisyon indirimli üyelik gerçekleştirerek alabilirsiniz.

(1*)Oracle çözümleri, merkezi olmayan uygulamalara gerçek dünyadan verileri sağlayan sistemlerdir. Bu veriler, fiyat bilgileri, hava durumu verileri, trafik verileri veya herhangi bir başka tür veri olabilir.

(2*)Sıfır bilgi ispatı, bilgisayar bilimlerinde veri güvenliği alanında kullanılan algoritmanın temel prensibi bildiğiniz bilgiyi bir başkasına, bilgiyi ona vermeden ispat etmektir.