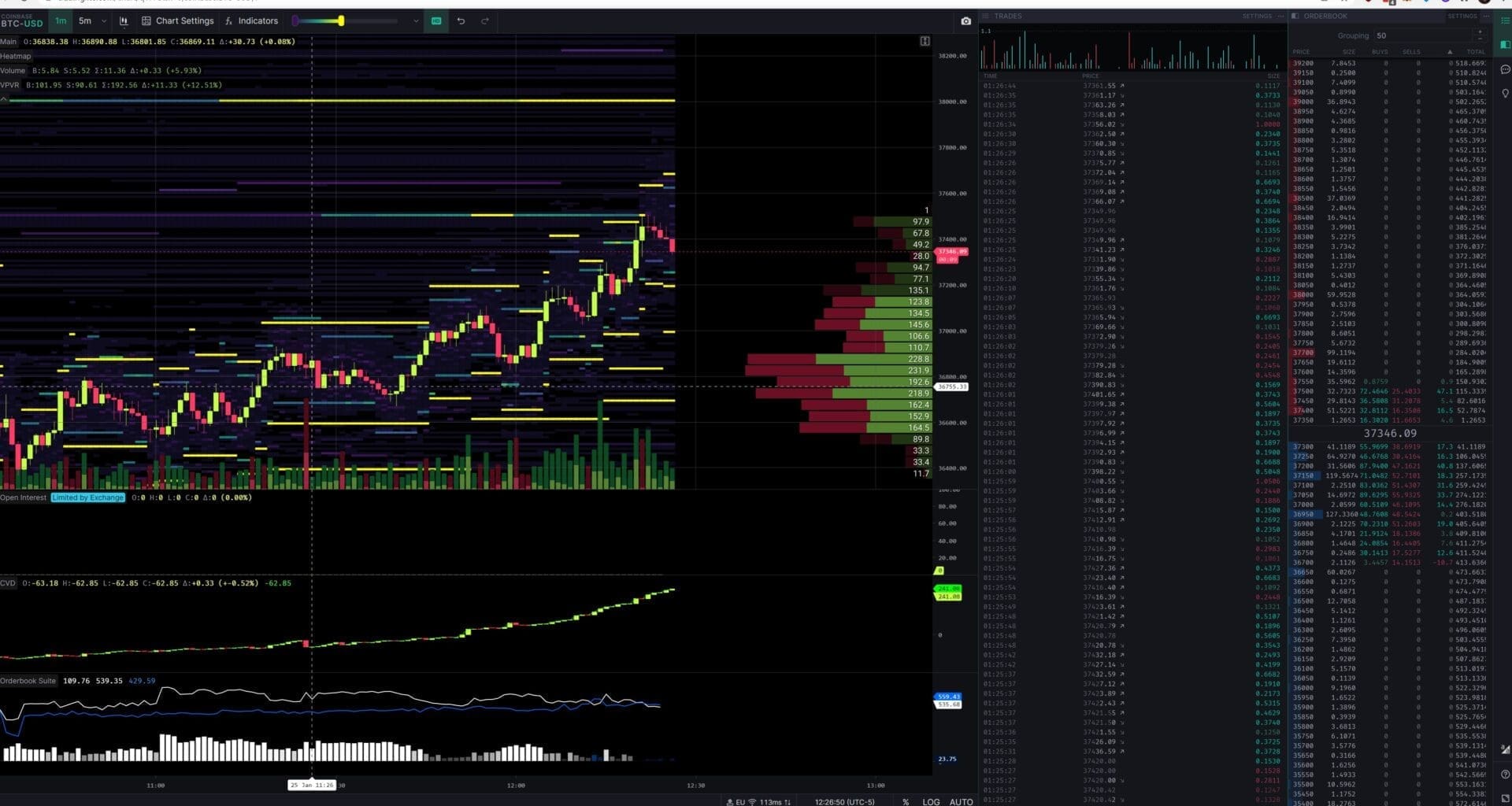

Trading’in geliştiği günümüzde, yatırımcıların al-sat hedeflerine ulaşmak için kullandığı çok sayıda emir türü bulunmaktadır. Algoritmik ticaret dünyasında öne çıkan bu emirlerden biri TWAP (Zaman Ağırlıklı Ortalama Fiyat) emridir.

TWAP Emir Nedir?

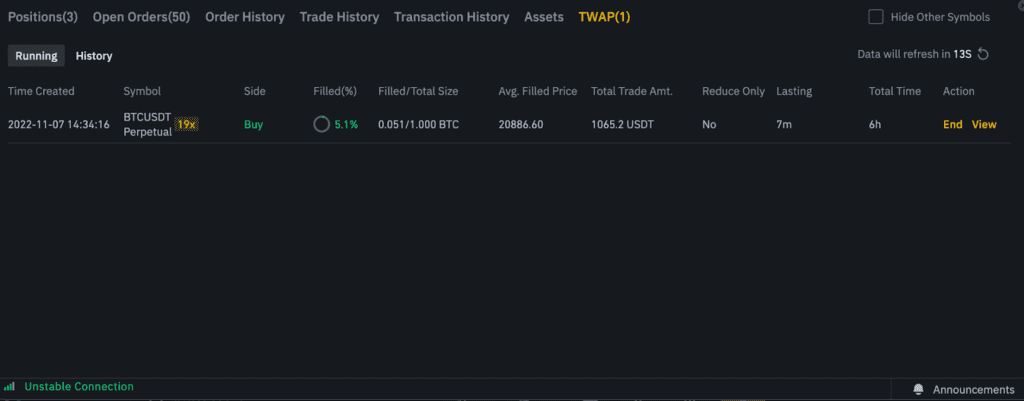

TWAP, Zaman Ağırlıklı Ortalama Fiyat anlamına gelir. Bu, belirli bir zaman dilimi boyunca varlığın o dönemdeki ortalama fiyatında bir emri gerçekleştirmeyi amaçlayan algoritmik bir emir türüdür. Özünde, büyük bir emri birden gerçekleştirmek yerine, TWAP emri bunu daha küçük parçalara böler ve gerçekleştirmeleri belirlenen zaman dilimi boyunca eşit olarak dağıtır.

TWAP Emri Neden Kullanılır?

Büyük emirler için birden gerçekleştirmek önemli fiyat dalgalanmalarına neden olabilir. Emri dağıtarak, TWAP piyasa etkisini en aza indirir, bu da özellikle büyük kurumsal yatırımcılar için oldukça kullanışlıdır.

TWAP Emir türü aynı zamanda daha dar bir aralıktan fiyata girmemizi sağlar ve işlemlerdeki kaymayı büyük çoğunlukla önler. Bir işlemin beklenen fiyatı ile gerçekleştirildiği fiyat arasında bir fark olduğunda kayma meydana gelir. Zamanla işlemlerin ortalamasını alarak, TWAP potansiyel kaymayı azaltmada yardımcı olabilir.

Bu emir türü aynı zamanda daha adil bir fiyatlandırma sağlar. Bir işlemin belirli bir dönem boyunca ortalama fiyatta gerçekleştirilmesini garantileyerek, yatırımcılar al-satları için adil bir fiyat aldıklarından daha emin olabilir.

TWAP Emir Türü Nasıl Çalışır?

Diyelim ki 5 saat içinde A Şirketi’nin 10.000 hissesini satın almak istiyorsunuz. Bunların hepsini birden satın almak yerine, bir TWAP emri bunu her saat 2.000 hisse olacak şekilde bölebilir ve 5 saat boyunca ortalama fiyatın elde edilmesini sağlar.

Başka bir örnek ise kripto para al satından örnek verilebilir. Diyelim ki ETHUSDT sürekli kontratında uzun (long) veya kısa (short) pozisyon almak istiyorsunuz. 20 Ethereum büyüklüğünde uzun ya da kısa almak yerine, emrinizi daha küçük parçalara bölebilir ve bunları her saat gönderebilirsiniz. Kullanıcılar belirli bir zaman süresi veya boyutu kendi diledikleri stratejilerine göre seçebilir.

TWAP Emri Ne Zaman Kullanılmalıdır?

TWAP emir türleri faydalı olabilirken, her durum için her zaman doğru seçenek değildirler. İşte TWAP’ın özellikle kullanışlı olabileceği bazı senaryolar:

Büyük Emirler: Bahsedildiği gibi, piyasayı etkileyebilecek büyük emirler için, TWAP etkiyi dağıtmada yardımcı olabilir.

Volatil Piyasalar: Yüksek volatiliteye sahip piyasalarda, TWAP emirleri maliyetleri ortalamada ve hızlı fiyat değişiklikleriyle ilişkili riskleri azaltmada yardımcı olabilir.

Varlık Birikimi veya Elden Çıkarma: Bir yatırımcı, çok fazla dikkat çekmeden belirli bir varlığın büyük bir miktarını zamanla biriktirmek veya elden çıkarmak istiyorsa, TWAP gizli bir yöntem olabilir.

TWAP emri, modern yatırımcıların cephaneliğinde stratejik bir araçtır. Kurumsal bir yatırımcı da olsanız, veya bireysel bir yatırımcı, TWAP’ı nasıl ve ne zaman kullanmanız gerektiğini anlamak finansal piyasalarda bir önem taşır.