Kripto paralar, son yıllarda yatırımcılar için cazip bir seçenek haline geldi. Bu alanda birçok farklı yatırım seçeneği mevcutken, APR (Yıllık Yüzde Oranı) yatırımcıların getirilerini hesaplamak için kullandıkları önemli bir ölçüttür. APY, Yıllık Yüzde Getiri anlamına gelir. APY, APR’ye benzer bir kavramdır, ancak bir farkla: APY, bileşik faizin etkisini de hesaba katar.

APR Nedir?

APR, bir yatırımın yıllık faiz oranını veya getiri oranını temsil eder. Kripto para dünyasında APR, staking, likidite sağlayıcılığı (LP) ve yield farming gibi çeşitli yatırım araçları için kullanılır. Basitçe, APR size bir yıl boyunca ne kadar kazanmayı bekleyebileceğinizi gösterir.

APR Nasıl Hesaplanır?

APR’yi hesaplamak için kullanılan formül şudur:

APR = (Faiz / Anapara) * 365

Burada faiz, yatırımınızdan elde ettiğiniz kazanç ve anapara ise yatırım için kullandığınız kripto paranın miktarıdır.

APR’nin Önemi

APR, farklı yatırım araçlarını karşılaştırmak için kullanışlı bir araçtır. Daha yüksek APR sunan bir yatırım, daha fazla kazanç sağlayabilir. Ancak, APR’nin tek başına bir yatırımın karlılığını belirlemediğini unutmamak önemlidir. Yatırım yapmadan önce, riskleri ve diğer faktörleri de göz önünde bulundurmanız gerekir.

Kriptoda APR Kullanırken Dikkat Edilmesi Gerekenler:

- APR’nin bileşik faizi hesaba katmadığını unutmayın. Bileşik faiz sayesinde, kazançlarınız zamanla daha da büyür.

- Farklı platformlarda sunulan APR oranlarını karşılaştırın. En yüksek APR’yi sunan platform her zaman en iyi seçenek olmayabilir.

- Yatırım yapmadan önce platformun güvenilirliğini araştırın. Dolandırıcılık riskine karşı dikkatli olun.

- Piyasa risklerini göz önünde bulundurun. Kripto para piyasası oldukça volatildir ve yatırımınızın değeri düşebilir.

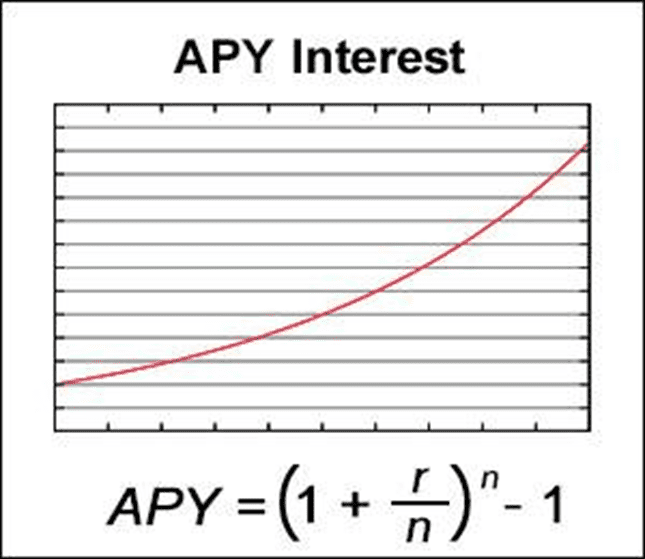

APY Nedir?

APY, Yıllık Yüzde Getiri anlamına gelir. Bir yatırımın, bileşik faiz etkisini de hesaba katarak, bir yıl boyunca ne kadar kazanç sağlayacağını temsil eder.

APY Nasıl Hesaplanır?

APY hesaplamak için kullanılan formül şudur:

APY = (1 + Faiz Oranı/Bileşik Faiz Dönemi Sayısı)^Bileşik Faiz Dönemi Sayısı – 1

Burada:

- Faiz Oranı, yatırımın yıllık faiz oranıdır.

- Bileşik Faiz Dönemi Sayısı, faizin ne sıklıkla hesaplanacağını gösterir.

APY’nin Önemi

APY, yatırımcıların farklı yatırım araçlarını daha doğru bir şekilde karşılaştırmak için önemli bir ölçüttür. Bileşik faizin etkisini hesaba kattığı için, APY size gerçekte ne kadar kazanacağınızı daha net bir şekilde gösterir.

APY ve APR Arasındaki Farklar Nelerdir?

APY (Yıllık Yüzde Getiri) ve APR (Yıllık Yüzde Oranı), finansal ürünlerde kullanılan iki önemli faiz oranı kavramıdır. İlk bakışta benzer görünseler de, aralarında önemli bir fark vardır: bileşik faiz.

APR:

- Basit faiz oranını temsil eder.

- Bileşik faizi hesaba katmaz.

- Daha basit bir hesaplama yöntemine sahiptir.

- Genellikle kredilerde ve kredi kartlarında kullanılır.

APY:

- Bileşik faiz oranını temsil eder.

- Faizin faiz getirmesini de hesaba katar.

- Daha karmaşık bir hesaplama yöntemine sahiptir.

- Genellikle tasarruf hesaplarında, yatırım fonlarında ve staking gibi kripto para araçlarında kullanılır.

APY ve APR Karşılaştırmalı Örnek

Şimdi bir örnek ile inceleyelim.

Yatırım: 10.000 ABD Doları

Faiz Oranı: %10

Süre : 1 Yıl

APR ile Hesaplama:

Bir yılda kazanılacak faiz: 10.000 ABD Doları * %10 = 1.000 ABD Doları

Toplam tutar: 10.000 ABD Doları + 1.000 ABD Doları = 11.000 ABD Doları

APY ile Hesaplama:

Bileşik faiz dönemi sayısı: 12 (aylık)

APY: ((1 + 0.1/12)^12) – 1 = 0.10471

Bir yılda kazanılacak faiz: 10.000 ABD Doları * 0.10471 = 1.047,10 ABD Doları

Toplam tutar: 10.000 ABD Doları + 1.047,10 ABD Doları = 11.047,10 ABD Doları

Görüldüğü gibi, APY kullanarak hesaplama yaptığımızda, bir yıl sonra 47,10 ABD Doları daha fazla kazanacağımızı görebiliriz.

Şimdi başka bir örnek ile inceleyelim:

Yatırım: 10.000 ABD Doları

Faiz Oranı: %10

Süre : 3 Yıl

APR ile Hesaplama:

Bir yılda kazanılacak faiz: 10.000 ABD Doları * %10 = 1.000 ABD Doları

Üç yılda kazanılacak faiz: 3 * 1.000 ABD Doları = 3.000 ABD Doları

Toplam tutar: 10.000 ABD Doları + 3.000 ABD Doları = 13.000 ABD Doları

APY ile Hesaplama:

Bileşik faiz dönemi sayısı: 12 (aylık)

APY: (1 + 0.1/12)^12 – 1 = 0.10471

Bir yılda kazanılacak faiz: 10.000 ABD Doları * 0.10471 = 1.047,10 ABD Doları

Üç yılda kazanılacak faiz: 3 * 1.047,10 ABD Doları = 3.141,30 ABD Doları

Toplam tutar: 10.000 ABD Doları + 3.141,30 ABD Doları = 13.141,30 ABD Doları

Görüldüğü gibi, APY ile hesaplama yaptığımızda, üç yıl sonra 141,30 ABD Doları daha fazla kazanacağımızı görebiliriz.

Örneklerde de gördüğümüz üzere APY, APR’den her zaman daha yüksek veya ona eşittir. Bileşik faizin etkisini hesaba kattığı için, APY size gerçekte ne kadar kazanacağınızı daha net bir şekilde gösterir. Yatırım yapmadan önce, farklı platformların sunduğu APR ve APY oranlarını karşılaştırarak en karlı yatırımı seçebilirsiniz.