Fork kelimesinin birden fazla anlamı var ancak genellikle yazılım geliştirme anlamında kullanılıyor. Bu makalede, fork’un yazılım geliştirme sürecindeki ve özellikle kripto para birimleri içindeki kullanımını inceleyeceğiz.

Fork Nedir?

Bir yazılım projesi için fork, kaynak kodunun bağımsız bir kopyasının alınması yada tamamen değiştirilmesi anlamına gelir. Bu, orijinal projeden ayrılmak veya kendi değişikliklerinizi yapmak istediğinizde kullanışlı olabilir. Fork işlemi, projenin orijinal geliştiricilerinden veya herhangi bir geliştiriciden yapılabilir.

Fork işlemi, bir yazılım projesinin alternatif bir sürümünün oluşturulması için de kullanılabilir. Bu durumda, fork edilen sürüm orijinal projeden ayrılır ve bağımsız olarak geliştirilebilir. Bu tür bir fork, yazılım geliştiricileri için farklı özellikler ekleyerek veya hataları düzelterek kendi sürümlerini geliştirmelerine olanak tanıyor.

Fork işlemi, iki farklı türe ayrılıyor: yumuşak fork ve sert fork.

Yumuşak Fork Nedir? (Soft Fork)

Yumuşak fork, orijinal blok zincirine (blockchain) herhangi bir değişiklik yapmadan, yeni bir protokolün benimsenmesi ile oluşan bir ayrılıktır. Bu, önceden var olan blokların tümünün kabul edileceği ve sadece sonrasındaki blokların farklılık göstereceği anlamına gelir. Yumuşak fork, daha az riske sahiptir. Bununla birlikte, tüm düğümlerin ve kullanıcıların bu protokol değişikliğine uymaları gerekiyor aksi halde gerçekleşemez.

Yumuşak forka örnek olarak Ethereum, 2016 yılında DAO saldırısı olarak bilinen bir güvenlik açığı yaşadı. Bu, çoğu kullanıcının paralarını kaybetmesine sebep oldu ve Ethereum topluluğu, kayıpları geri almak için yumuşak fork yapmaya karar verdi. Bu, blok zincirinde geriye dönük uyumluluğu korurken, güvenlik açığına bir çözüm sağlamış oldu.

Sert Fork Nedir? (Hard Fork)

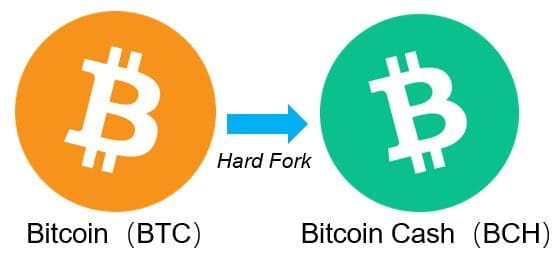

Sert fork, mevcut blok zincirinde geriye dönük uyumluluğu bozan bir işlemdir. Bu, eski blokların tamamen reddedilmesi ve zincirin tüm düğümlerinin güncellenmesi gerektiği işlemdir. Sert fork, yumuşak forka göre çok daha büyük bir risk taşıyor. Ancak, sert fork sayesinde yazılımcılar, blok zincirinde daha büyük değişiklikler yapabiliyorlar ve yeni özellikler ekleyebiliyorlar.

Sert forka örnek verecek olursak Bitcoin, 2017 yılında sert fork gerçekleştirdi ve Bitcoin Cash’i çıkardı. Bitcoin Cash yeni bir kripto para birimi olarak ortaya çıktı ve Bitcoin’in blok boyutunu, işlem hızını artırdı. Sonuç olarak sert fork sonucu Bitcoin Cash, Bitcoin’in orijinal blok zincirinden tamamen ayrılmış oldu.

Fork’un Bitcoin ve Kripto Para Birimleri ile İlişkisi Nedir?

Kripto para birimleri, açık kaynaklı yazılım kodlarına dayalı olarak çalışıyorlar ve bu kodlar, kripto para birimlerinin işleyişini belirliyorlar. Ancak, bazen bu kodlarda değişiklik yapılması gerekebiliyor. Bu değişiklikler için bir seçenekolarak akıllara forklama işlemi geliyor.

Fork, bir kripto para biriminin mevcut kod tabanını kopyalamasıyla veya yeni bir ağ oluşturmasıyla gerçekleşiyor. Bu yeni ağda, mevcut ağın özellikleri değiştirilmiş yada yeni özellikler eklenmiş olabilir. Fork işlemi, genellikle kripto para birimlerinin geliştirilmesi veya iyileştirilmesi için gereklidir. Örneğin, bir kripto para biriminin işlem süresini hızlandırmak veya daha güvenli hale getirmek için kodunda değişiklik yapabilir. Fork işlemi ise, bu değişikliklerin tüm ağa uygulanmasını sağlar.

Sonuç olarak, fork işlemi, yazılım geliştirme sürecinde yaygın bir uygulamadır ve aynı zamanda kripto para birimleri için de sık sık kullanılır. Fork işlemi, mevcut blok zincirinde veya yeni bir blok zincirinde yapılan bir değişiklikle gerçekleştirilebilir ve genellikle blok boyutları, madencilik ödülleri, işlem onay süreleri veya benzeri protokol değişiklikleri ile ilgilidir.