Bitcoin (BTC) Halving Nedir?

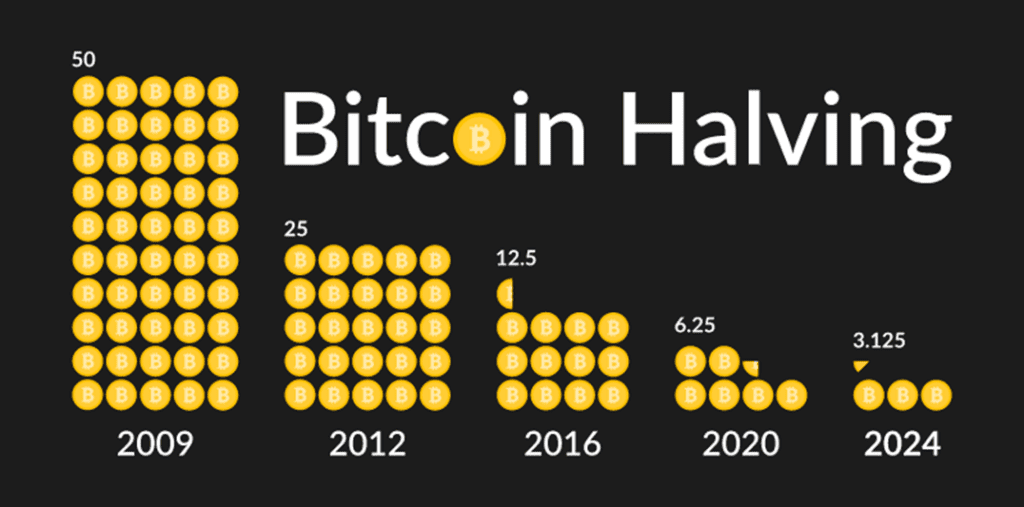

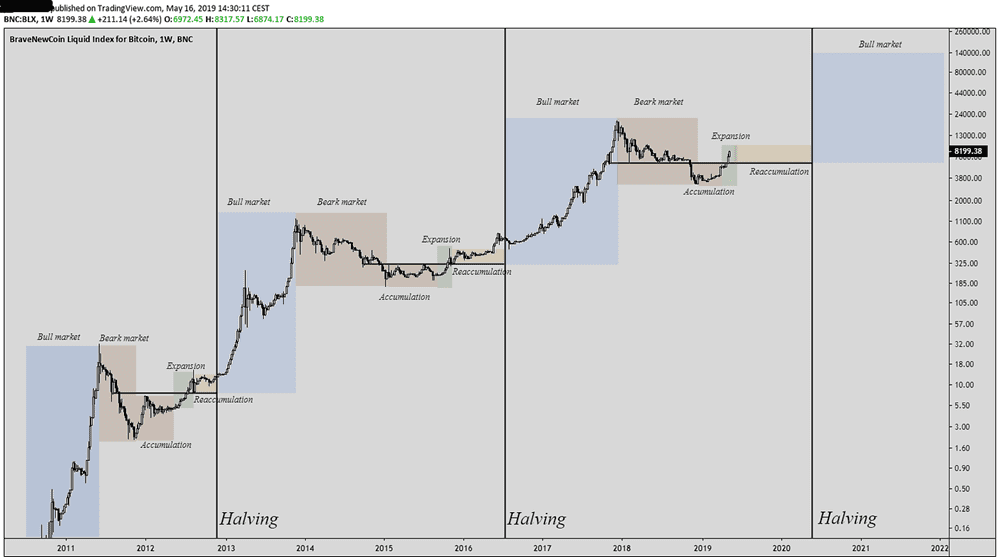

Bitcoin halving, blok zincirindeki blok ödüllerinin yarıya indiği bir olaydır. Örneğin, Bitcoin’in blok başına ödülü her 210.000 blokta bir yarıya iner. Başlangıçta 50 Bitcoin olan blok ödülü, ilk halving’de 25 Bitcoin’e, ikinci halving’de 12.5 Bitcoin’e düşmüştür ve her halving’te blok ödülü, yarıya düşerek devam edecektir. Bu, Bitcoin’in maksimum arzının yavaş yavaş tükenmesi anlamına gelir ve bu da uzun vadede Bitcoin’in değerinde artışa yol açar çünkü arz azalırken talep sabit kalır ya da artmaya devam eder. Bu sebeplerden halving, kripto para birimlerinin arzını kontrol etmeye ve değerlerini korumaya yardımcı olur.

Bitcoin Ağı Temelleri

Blok zinciri, Bitcoin’in temel teknolojisi olarak bilinen bir ağdır. Bu ağda, Bitcoin işlemlerinin tam veya kısmi geçmişini içeren bilgisayarlar bulunur. Bu bilgisayarlar düğüm olarak adlandırılır. Bir düğüm, Bitcoin üzerinde gerçekleşen tüm işlemlerin geçmişini saklar ve yeni işlemleri onaylama veya reddetme yetkisine sahiptir. İşlemi doğrulamak için çeşitli kontroller yapar ve uygun olduğuna karar verirse, işlemi onaylar. Her işlem ayrı ayrı onaylanır ve bir bloktaki tüm işlemler onaylandıktan sonra gerçekleşir. Onaylanan işlemler blok zincirine eklenir ve diğer düğümlere iletilir. Bu şekilde, Bitcoin ağında işlemlerin güvenli ve güvenilir bir şekilde gerçekleşmesi sağlanır.

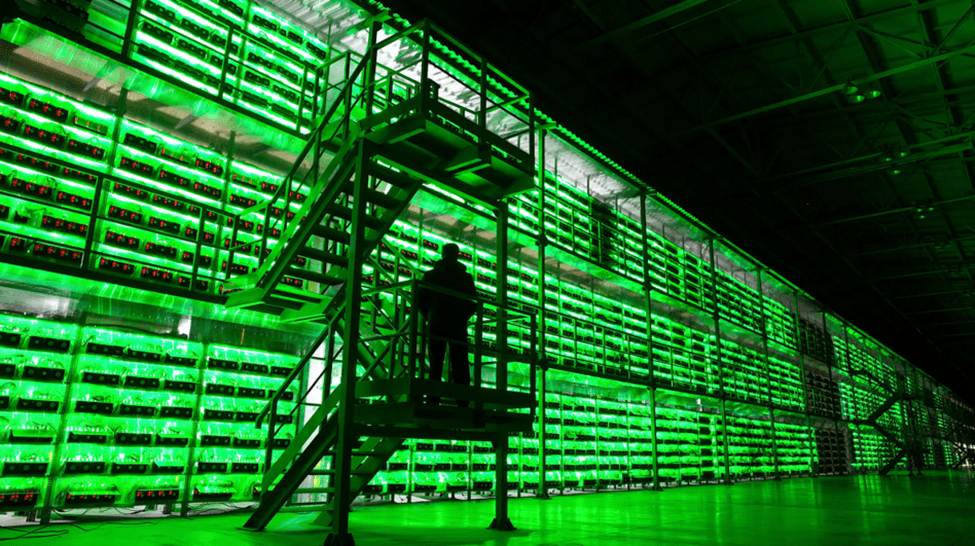

Bitcoin Madenciliğinin Temelleri

Bitcoin madenciliği, insanların bilgisayarları veya özel donanımları kullanarak Bitcoin’in blok zinciri ağına katılarak işlem işleme ve onaylama sürecidir. Bu süreçte, “proof-of-work” (PoW) adı verilen bir sistem kullanılır. PoW, şifreli karmayı çözmek için zaman ve enerji gerektiren bir süreci ifade eder ve yapılan işin kanıtı olarak kabul edilir.

Terim olarak “madencilik”, gerçek anlamıyla değil, değerli metallerin kazılma sürecine benzetilmiştir. Bir blok, işlemlerle doldurulduğunda kapatılır ve madencilik kuyruğuna eklenir. Doğrulama için sıraya alındığında, Bitcoin madencileri, önceki bloğun şifreli bilgilerinden daha düşük bir değere sahip bir sayıyı bulmak için yarışırlar. Bu değer, önceki bloğun tüm şifreli bilgilerini içeren onaltılık bir sayıdır.

Madencilik, bir bloktaki işlemlerin geçerliliğini onaylar ve yeni bir blok oluşturur. Düğümler, işlemleri daha fazla doğrular ve ardışık onayların bir serisini takip eder. Bu süreç, blok zincirinin bir zincir oluşturmasını sağlar.

Bitcoin madenciliği, blok zinciri ağının ve uzlaşma mekanizmasının temelini oluşturur. Bitcoin ödülü, blok zincirinin güvenliğini sağlamak için katılımı teşvik eden madencilik sürecinin bir sonucudur.

Bitcoin Halving Neden Olur?

Bitcoin halvingi, Bitcoin’in tedarikinin azalması ve kıtlıkla ilişkilendirilmiş bir mekanizma olan Bitcoin protokolünün bir parçasıdır. Bitcoin’in yaratıcısı Satoshi Nakamoto, Bitcoin’in yaklaşık her dört yılda bir blok ödülünün yarıya indirilmesini planlamıştır. Bu, her halvingde madencilerin yeni Bitcoin üretimi için ödül olarak aldıkları miktarın yarıya indirilmesi anlamına gelir. Günümüzde Bitcoin, madenci olarak tabir edilen bilgisayarlar tarafından çıkartılır. Bu bilgisayarlar yüksek enerji tüketimi ile bitcoin çıkartır ve elektrik harcarlar. Bitcoinin fiyatı, elektrik masrafından fazla olduğu durumda piyasaya bitcoin girişi azalır ve arz talep dengesi sonucu fiyat belirli fiyatların altına düşmez. Bu da halvingin önemini bizlere bir kere daha gösterir.

Bitcoin Halving’in Avantajı Nedir?

Halving, Bitcoin’in sınırlı ve kıt bir varlık olduğunu vurgular. Bitcoin’in toplam arzı 21 milyon adet ile sınırlıdır ve her halving, bu kıtlığı daha da vurgular. Kıtlık, geleneksel para birimlerinin aksine, Bitcoin’in değerini korumasına ve zamanla artmasına yardımcı olabilir.

Ayrıca, halving madencileri teşvik etmek için önemli bir rol oynar. Madenciler, Bitcoin ağının güvenliğini sağlamak için büyük miktarda işlem gücüne ve enerjiye yatırım yaparlar. Halving, madencilerin azalan ödüllere rağmen faaliyetlerini sürdürmelerini teşvik eder ve Bitcoin ağının sağlamlığını korur.

Bitcoin Halving Geçmişi

Önceki Bitcoin halving tarihleri; 28 Kasım 2012, 9 Temmuz 2016 ve 11 Mayıs 2020 dir. Bu halvingler, madenciler için blok ödüllerinin yarıya indirildiği anlamına gelir ve Bitcoin ekosisteminde önemli kilometre taşlarını temsil eder. Blok ödüllerinin azalması, Bitcoin’in enflasyon oranını kontrol etmeye ve kıtlığını korumaya yönelik olarak işlev görür. Her yarılanma etkinliği, Bitcoin’in geleneksel fiyat para birimlerinden farklı kılan eşsiz para politikasını vurgular.

Bitcoin Halving Ne Zaman?

Bitcoin’in gelecekteki halvingi, öngörüldüğü gibi 2024 ün nisan ayında gerçekleşecek ve blok ödülü, madencilerin kazma işlemi için ödüllendirildiği miktarı yarıya indirecek. Bu durumda, blok ödülü 6.25’ten 3.125’e düşecek ve Bitcoin’in dolaşımdaki arzı daha da sınırlanmış olacak.

Bitcoin halving günü için tam bir gün vermek doğru değildir. Kazılan son blok ne zaman biterse halving o zaman gerçekleşir. Fakat tam olarak bilmesek te yaklaşık olarak tahmin edebiliyoruz. Binance borsasının hesaplarına göre 18 Nisan 2024 tarihinde halving gerçekleşecek.

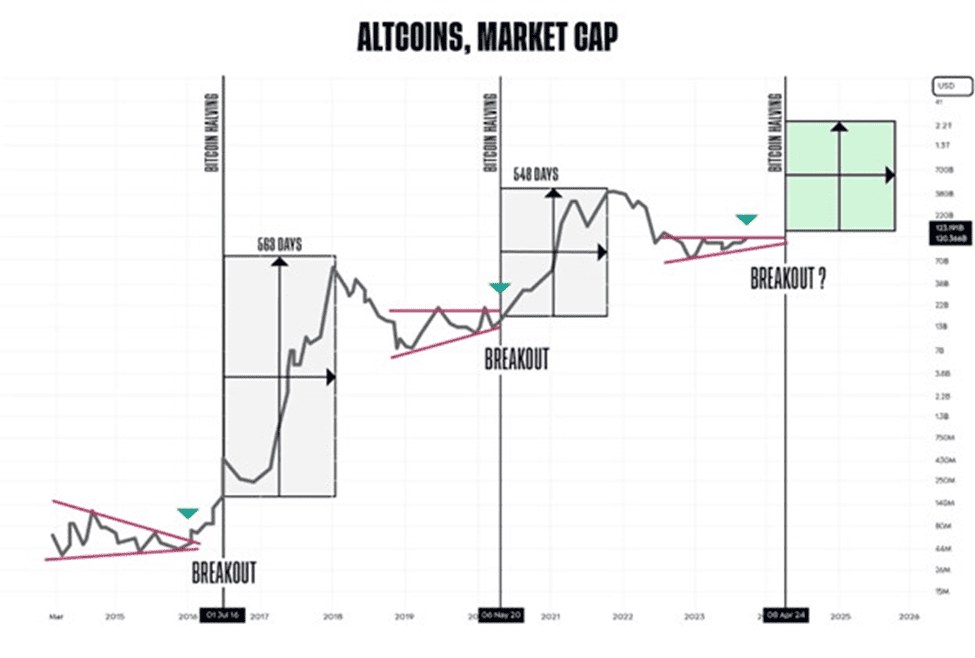

Bitcoin Halving Altcoinleri Etkiler mi?

Bitcoin halving, kripto para piyasasına olan ilgiyi arttırarak Altcoin’leri de etkiler. Yatırımcılar, diğer kripto para birimlerinin fiyatlarının potansiyel olarak artabileceği konusunda daha umutlu hale geleirler. Bu artan ilgi, Altcoin’lere yönelik yatırımların artmasına ve fiyatlarının yükselmesine neden olabilir. Ek olarak, Bitcoin’in madencilik ödülü azaldıkça, bazı madenciler Bitcoin’e alternatif olarak daha yüksek ödüller sunan Altcoin’leri tercih edebilirler.

Halving Yaşayan Diğer Coinler Nelerdir?

Bitcoin dışında da halving yaşayan ve madenciler tarafından kazılan birçok başka kripto para birimi bulunmaktadır. Bu coinler bitcoin kadar popüler olmasa da farklı sebeplerden birçok madenci tarafından kazılmaktadır.

Litecoin (LTC)

Litecoin, 2011 yılında Charlie Lee tarafından oluşturulan bir kripto para birimidir. Litecoin, Bitcoin’in bir alternatifi olarak piyasaya sürüldü ve “gümüşe benzeyen Bitcoin” olarak adlandırıldı. Litecoin’in blok süresi Bitcoin’den daha hızlıdır (ortalama 2.5 dakika) ve toplam arzı 84 milyon LTC ile sınırlıdır. Her 4 yılda bir gerçekleşen bir halving sürecine sahiptir. Son Litecoin halvingi, 5 Ağustos 2019’da gerçekleşti.

Bitcoin Cash (BCH)

Bitcoin Cash, Bitcoin’in 1 Ağustos 2017’de gerçekleşen bir çatallaşmasıyla ortaya çıktı. Blok boyutunu artırarak daha hızlı ve daha düşük maliyetli işlemler sağlamak için tasarlanmıştır. Bitcoin Cash’in blok başına ortalama ödülü ve toplam arzı, Bitcoin ile benzerdir. Bitcoin Cash de kendi halving sürecine sahiptir.

Monero (XMR)

Monero, 2014 yılında CryptoNote protokolüne dayanan bir kripto para birimi olarak başlatıldı. Monero, gizliliğe odaklanan ve izlenemez işlemler sağlayan bir kripto para birimidir. Blok ödülleri her 2 yılda bir yarıya düşmektedir ve toplam arzı 18.4 milyon XMR’dir.

Zcash (ZEC)

Zcash, gizliliğe odaklanan bir kripto para birimidir ve 2016 yılında piyasaya sürüldü. Zcash, şeffaflık ve gizlilik arasında seçim yapma olanağı sunar. Zcash’in “z-adresleri” adı verilen gizli adresleri vardır. Zcash de belirli aralıklarla halving yaşar ve toplam arzı 21 milyon ZEC’dir.