Küresel piyasalar, Fed’in bugün açıklayacağı para politikası kararları ve toplantı sonrasında Powell’ın gelecek vaat eden yönlendirmeleri öncesi bankacılık sektörüne ilişkin artan endişelerle olumsuz bir seyir izliyor.

Fed’in geçen yıl enflasyonla mücadele kapsamında başlattığı “sıkı” politikalarının sonu yaklaşırken, ABD bankacılık sektörü yeniden alarm veriyor. Para piyasalarında ise Banka’nın politika faizini yüzde 90, muhtemelen 25 baz puan artıracağı ve “sıkı” politikalarına son vereceği tahmin ediliyor.

FED Faiz kararı, Türkiye saati ile 3 Mayıs (Bu Akşam) 21:00’da açıklanacak.

Mayıs 2023’te Federal Rezerv’in federal fon oranını 25 baz puan artırarak %5-%5,25 aralığına çıkarması ve bunun Eylül 2007’den bu yana 10’uncu artış ve en yüksek seviye olması bekleniyor. Fed’in faiz oranlarını artırmayı durdurmak üzere olduğuna dair işaretler, birçok kişi faiz oranlarını yıl sonuna kadar düşürebileceğine dair iddialarla. Enflasyon yavaşlıyor ve ekonomi stres belirtileri gösteriyor olsa da, hala merkez bankasının hedefinin iki katından fazla.

Bankacılık Tarafı, piyasalar üzerindeki satış baskısını artırıyor

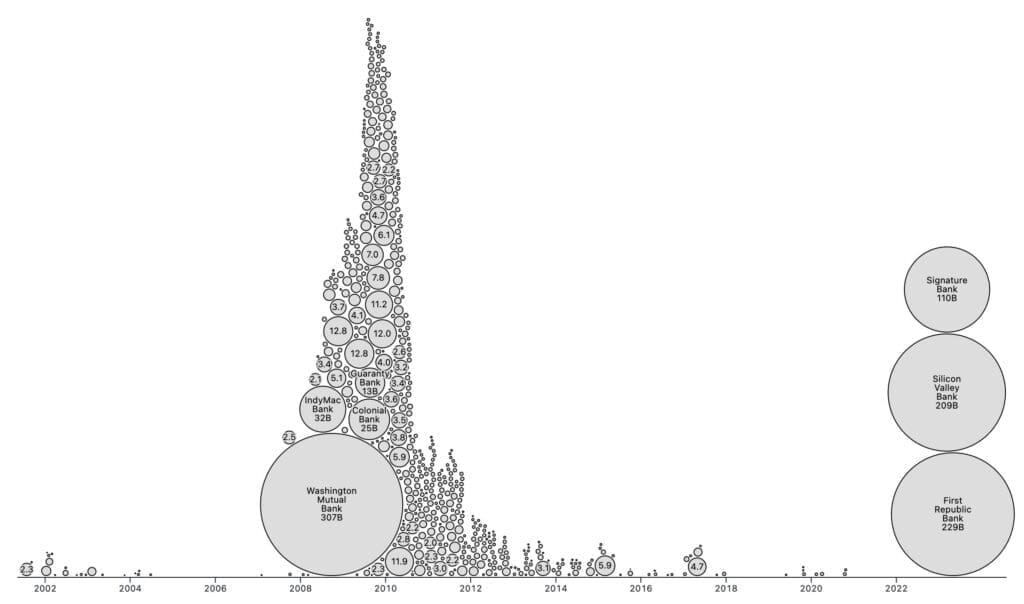

Öte yandan yurt içinde bankacılık sektörüne ilişkin endişelerin canlanması dün borsalarda satış baskısının artmasına neden oldu. Bölgesel bankalardaki PacWest hisseleri yüzde 30, Western Alliance hisseleri yüzde 15 ve Metropolitan Bank hisseleri yüzde 20’nin üzerinde değer kaybetti. Aşağıdaki grafik, 2008 krizinde yaşanan bankacılık krizinin ve günümüzdeki krizin boyutunu gözler önüne seriyor.

FED’in faiz artırımlarına Mayıs’ta mı ara vermesi bekleniyor yoksa bir tane daha mı?

Makroekonomik veriler açısından ekonominin soğuduğuna dair göstergeler belirginleşirken, Mart ayında ABD’de JOLTS Açık İş sayısı bir önceki aya göre 384 binden 9 milyon 590 bine geriledi. Piyasa beklentilerinin altında kalan doldurulmamış pozisyon miktarı, Nisan 2021’den bu yana en düşük noktasını gördü. Mart ayında ülkedeki fabrika siparişleri %0,9 artarken tahminlerin altında kaldı.

Bugün Fed’in para politikası kararları ve Fed Başkanı Powell’ın açıklamalarını ADP’nin ABD özel sektör istihdam verileri takip edecek (Saat dilimi UTC+3).

Faiz Artışlarının Piyasalara Etkisi

Faiz oranlarındaki değişikliklerin, tüketicilerin ve işletmelerin kritik satın almalar yapmak ve finansal planlar yapmak için krediye nasıl eriştikleri üzerinde etkisi vardır. Faiz oranları arttıkça, borçlanmanın maliyeti daha pahalı hale gelir. Bu, evler ve arabalar gibi belirli mal ve hizmetlerin satın alınmasını daha maliyetli hale getirir. Sonuç olarak müşteriler daha az harcar, bu da mal ve hizmetlere olan talebi azaltır.

Mal ve hizmetlere yönelik tüketici talebi düştüğünde, işletmeler üretimi azaltır, çalışanları işten çıkarır ve bu da işsizlik oranını artırır. Genel olarak, faiz oranları yükseldiğinde ekonomi zayıflar. Faiz oranları düşürüldüğünde bunun tersi geçerlidir.