Liquid Staking Türevleri (LSD’ler) nedir?

Bir kullanıcının stake edilen varlıkları, stake ödemelerine ek gelir elde etmek için DeFi faaliyetlerinde kullanabilecekleri likit stake etme türevleri ile temsil edilir. Lido, TVL’de yaklaşık 20,83 milyar dolarlık bir zirveye ulaşırken, Ethereum Shapella yükseltmesiyle liquid staking popülerlik kazandı.

Kullanıcılar, staking teşvikleri almak için şu anda bir Proof-of-Stake zinciri olan Ethereum’da ETH’lerini stake edebilirler. Ethereum ana ağına bağlı olduğu için, durdurulan ETH, sermaye açısından verimsizdir. En yeni gelişmelerden biri olan liquid staking, kullanıcıların DeFi’de kullanabilecekleri staking ETH karşılığında liquid stake edilmiş bir türev token almalarını sağlayarak bu sorunu ele alıyor.

Liquid Staking Türevleri (LSD’ler) hakkında daha detaylı bilgi almak için lütfen kütüphanemizde yer alan Ninja News gönderisini inceleyin.

LSD’ler yeniden diğer tokenlardan daha iyi performans gösterme yolunda mı?

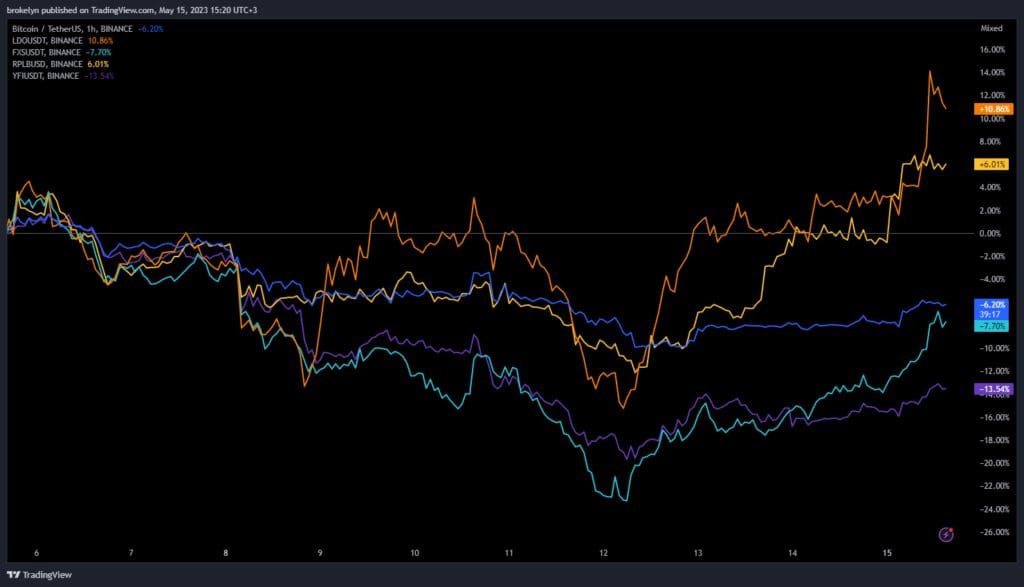

RPL, YFI, LDO, FXS dahil olmak üzere LSD belirteçlerinde hem TVL’de hem de piyasa fiyatında büyük bir büyüme gördük. Ethereum’un Shapella yükseltmesi ve Proof-of-Stake zincirine geçişinden sonra, kullanıcılar ETH’lerini LSD’ye yatırıyorlar. ETH artık Shanghai güncellemesi ile staking yapılabileceğinden, daha fazla kullanıcının ETH’lerini likit stake etmesi bekleniyor ve bu da likit staking sağlayıcılarının karlılığını artırıyor. Ethereum’da giderek daha fazla likit staking sistemi mevcut hale geliyor.

WuBlockchain‘in gönderisine göre, çok büyük miktarda ETH unstake edilerek çekilecek. Piyasa katılımcıları, bu kullanılmayan ETH’lerin ETH LSD‘lere doğru yöneldiği ve bu beklentilerin fiyat etkisinin yukarıdaki grafikte de görülebileceği şekilde LSD tokenlara pozitif etkisinin olabileceği görüşünde.

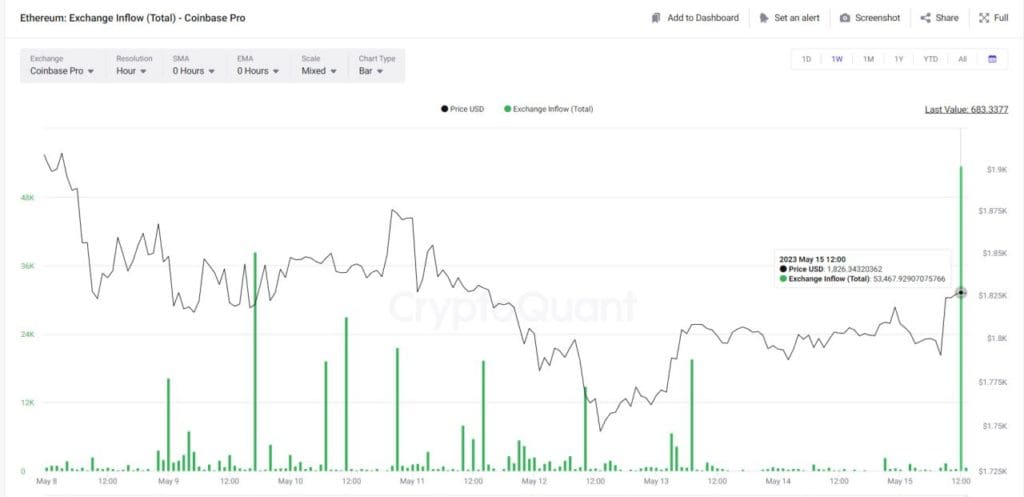

CryptoQuant’a göre Coinbase bugün 53.400’den fazla ETH girişine sahipti ve bunun 44.000 ETH’si Coinbase cbETH yatırma adresi 0xc7…a019’dan Coinbase 10’a aktarıldı, bunun nedeni ETH staking’in iptali olabilir.

-WuBlockchain Araştırması

Yeni denetim önerileriyle protokoller daha merkeziyetsiz bir hale geliyor

Frax Finance’ın GitHub paylaşımına göre, protokol şu anda bir denetimden (Audit) geçiyor. Teklifin amacı ve hedefi, Frax Finance’in tamamen merkezi olmayan bir protokol haline gelmesi. FrxGov, bir multisig imzalayan tarafından önerilen herhangi bir işlemi veto edebilir; bir multisig imzalayanı değiştirebilir veya herhangi bir işlem türü önerisinde bulunabilir.