BTC

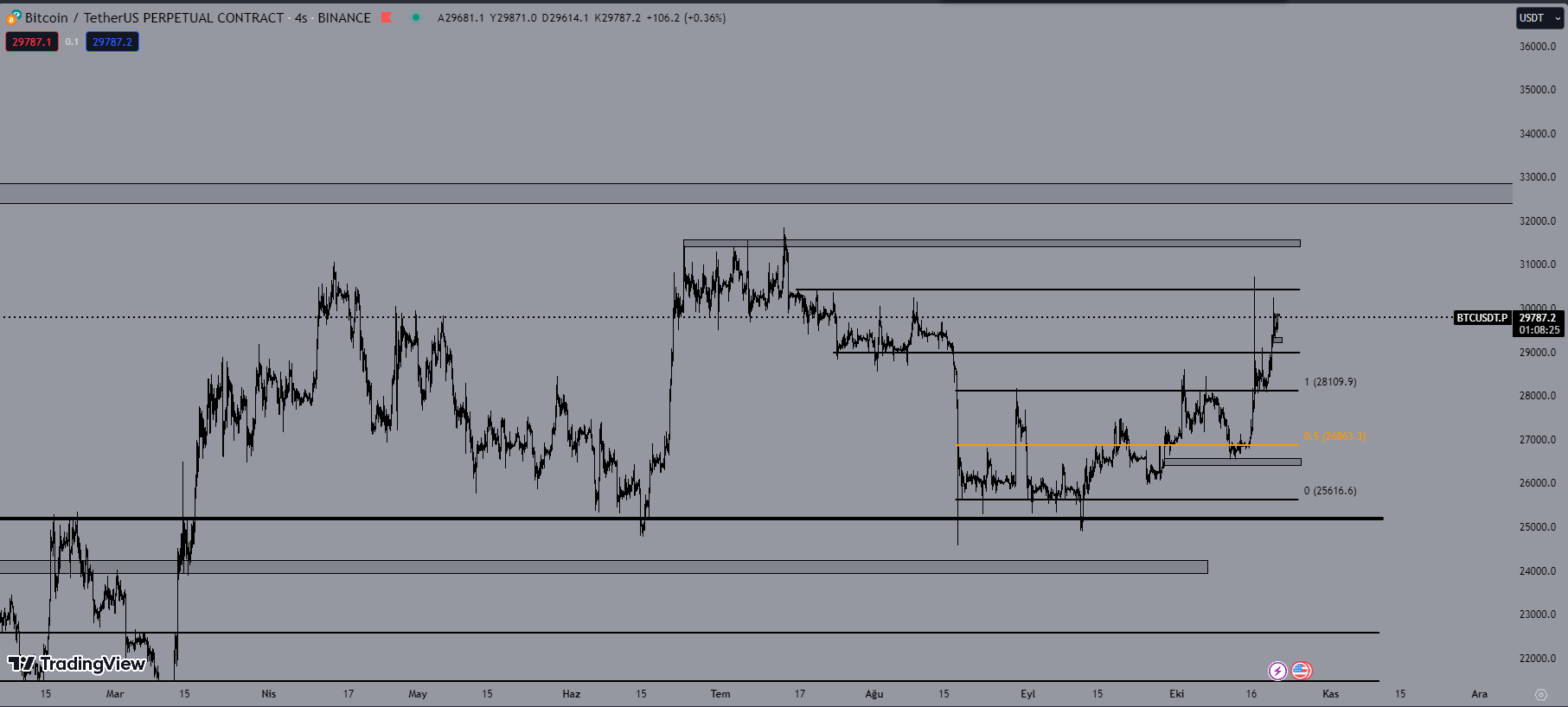

Güncel görünüme baktığımızda BTC bullish yapısını koruyor. Savaş ortamlarında arzı sınırlı ürünlerin her zaman tercih edildiği bir dönemde BTC de altın gibi pozitif ayrıştı piyasadan. Fake ETF haberiyle beraber güzel bir ivme kazandı ve sonrasında momentumu kaybetmedi. Takip ettiğim ilk destek seviyesi 29000$ seviyeleri. Bu seviye kaybedilmediği sürece BTC ye bullish bakmaya devam edeceğim. Bir sonraki takip ettiğim destek seviyesi ise eski range yüksek noktası olan 28100$ seviyelerini takip ediyorum. Direnç olarak ise 30400$ seviyesinin önemli olduğunu düşünüyorum. Bu bölge üzerini kazanması durumunda fiyatın ilk önce 31500$ seviyesini ardından 32500$ seviyelerine kadar yükselebileceğini düşünüyorum. Bu senaryo için bullish yapının korunması gerekmektedir ve temel tarafta negatif bir haber akışı gelmemesi gerekmektedir. Bullish yapı bozulana kadar geri çekilmeleri long yönlü değerlendirmeyi düşünüyorum.

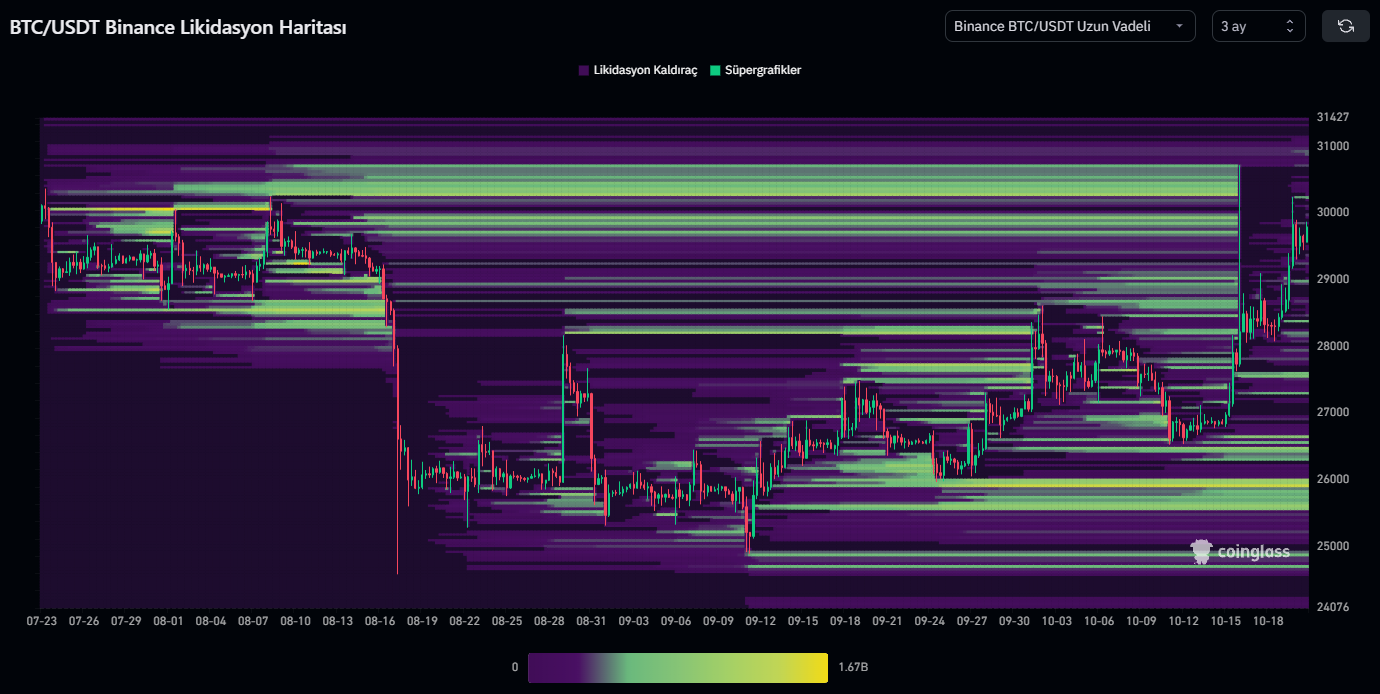

Yükselişi spot tarafıda destekliyor.

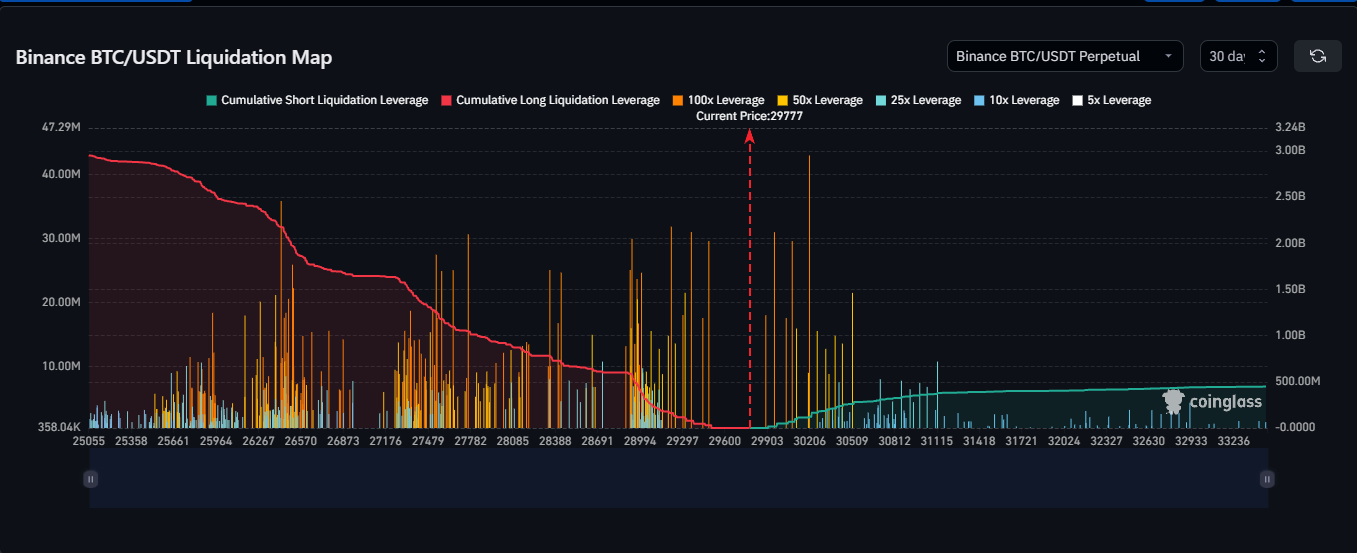

Fiyat düşüş trendine girecekse bile en azından 30000$ seviyesi üzerinde ki likiditeleri de temizlemek isteyebileceğini düşünüyorum.

BTC CME

26300$ , 20000$-21000$ aralığında ve 34000$-35000$ aralığında fiyat boşluğu (gap) bulunmakta.

USDT.D

Yükselen trendini kırdıktan sonra verdiği retest ile birlikte BTC de 26560$ seviyesinden long işlem almıştık. Şuan bulunduğu seviye destek seviyesi. 7.60%-7.50% seviyesinin kaybedilmesi durumunda, markette ki yükselişin devamı gelecektir. Takip ettiğim bir sonra ki seviye ise 7.23% seviyesi. Takip ettiğim direnç ise 7.92% seviyesi.

TOTAL

Güncel görünüme baktığımız da total market cap direnç seviyesinde. 1.02T$ seviyesi ilk takip ettiğim destek seviyesi ardından 980m$ seviyesini takip ediyorum. Bulunduğu direnci aşması durumunda en üstte bulunan mavi kutuyu (1.30T$) test etmesini beklerim.

Burada paylaşılan analizler yatırım tavsiyesi olmamakla beraber, piyasada kısa-orta vade işlem fırsatı verebileceğini düşünülen destek direnç seviyeleridir. İşlem alma ve risk yönetimi sorumluluğu kullanıcının kendisine aittir. Paylaşılan işlemlerde stop loss kullanmanız şiddetle tavsiye edilir.