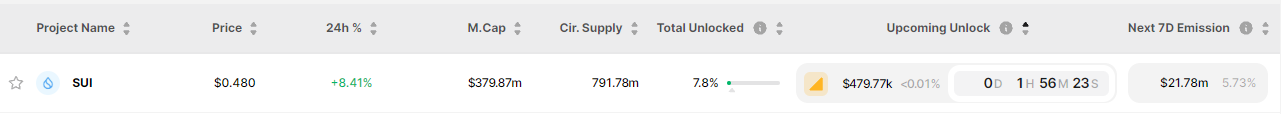

29.09.2023 günü saat 20:00 da kilitli tokenlerin açılımı olacak. Bir milyon adet SUI token açılacak. Bu kilit açılımının fiyat üzerinde çok fazla etkisi olacağını düşünmesem de, kilit açılımı öncesi short işlem alan insanları bu tarz durumlarda bir çok kez likidite etmek için fiyatın fake yükselişler yaptığını gözlemledim.

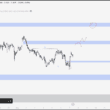

Bugün yaklaşık olarak %12 yükseliş gerçekleştirdi. Uzun süredir takip ettiğim düşen trendini ve önemli bir yatay bölgeyi kırdı. Yükseliş hareketini başlatan bölge olan 0.45$ seviyesi long yönlü işlem yapmak için beklediğim bir bölge. Fiyat kilit açılımlarından ve marketin negatif yönlü devam etmesinden dolayı üst bölgelerde sürekli açık likidite bırakarak düşüş gerçekleştirdi. Fiyat beklediğim hareketi yapar ve tekrardan trend üzerine kendini atarsa, takip ettiğim ilk ara direnç seviyesi 0.58$ seviyesi. Sonrasında ise 0.66$ seviyesi takip ettiğim ana dirençlerden bir diğeri. Fiyatın 18 Ağustos tarihinde bıraktığı fitilin temizlenmesi de long yönlü bakış açımı destekliyor.

ARB

Düşen trend kırılımı gerçekleştikten sonra %10 yükseliş gösterdi. 0.87$-0.878$ takip ettiğim ilk destek seviyesi. Bu seviyeye retest gerçekleşti. Fiyatın 0.9254$ seviyesini test etmesini bekliyorum bu aşamada. 0.94$ seviyesinde ise görselde işaretlediğim şekilde fvg bölgesine kadar bir fitil görülebilir. Bu bölgeye fiyat geldiğin de marketin durumuna göre bearish bir yapı görülürse short aranabilecek bir bölge ama fiyat bu bölgeyi hacimli kazanır ve markette olumlu bir görünüm hakim olursa o an, bu bölgede kapanışlar bekleyip long yönlü işlemler alınabilir. O yüzden bölgelere direk emir atmaktansa, şuan için market karar aşamasında olduğu için fiyatı izleyip işlemlere dahil olmak en sağlıklısı olacaktır. Bir sonra ki takip ettiğim direnç seviyesi ise 1.0247$-1.0350$ aralığı.

Burada paylaşılan analizler yatırım tavsiyesi olmamakla beraber, piyasada kısa-orta vade işlem fırsatı verebileceğini düşünülen destek direnç seviyeleridir. İşlem alma ve risk yönetimi sorumluluğu kullanıcının kendisine aittir. Paylaşılan işlemlerde stop loss kullanmanız şiddetle tavsiye edilir.