Hong Kong merkezli kripto finans hizmetleri şirketi HashKey Group’un yatırım bölümü olan HashKey Capital, altcoin odaklı bir likit fon oluşturma planlarına dair açıklamalar yaptı. Şirketin portföy yöneticisi Jupiter Zheng Jialiang’a göre, yeni oluşturulan fonun varlıklarının yarısından azını Bitcoin ve Ethereum gibi büyük kripto paraları oluşturacak. Geri kalanında ise ana odak noktası altcoinlere yatırım yapmak ve portföyü çeşitlendirmek olacağı belirtildi.

HashKey Capital, Cuma günü başlatılan bu yeni ikincil piyasa kripto fonuyla özellikle yüksek net değerli yatırımcıları ve Asyalı aile ofislerini hedeflemeyi amaçlıyor. Reuters’e göre ise, firma potansiyel müşterilere yönelik olarak fonun güvenli ve karlı bir yatırım fırsatı sunduğunu vurgulamaya devam ediyor.

1 Miyar Doların Üzerinde Varlık Yönetiyor

Ayrıca toplamda HashKey Capital’ın yönetimi altında 1 milyar doların üzerinde varlık bulunuyor. Bununla birlikte portföyün çeşitlendirilmesi ve daha küçük kripto paraların dahil edilmesi, getiri potansiyelini büyük ölçüde artıracağı planlanıyor.

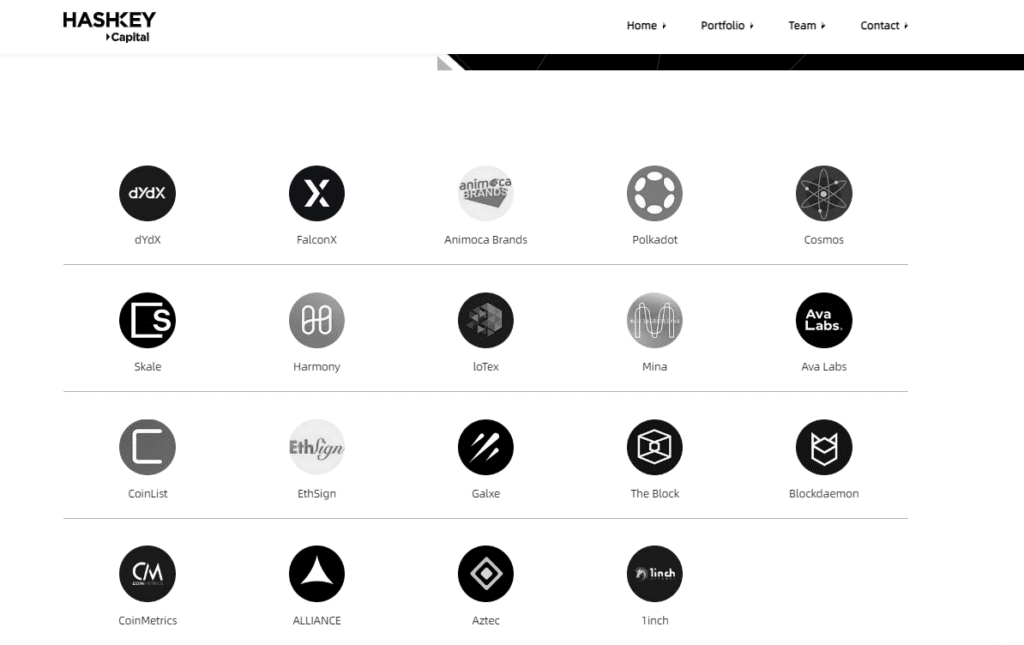

Bununla birlikte HashKey Capital’ın girişim portföyünde çeşitli projeler bulunuyor. Bu projeler;

“Kripto piyasasında alfa getirisi elde etmek isteyen profesyonel yatırımcılar arasında benzeri görülmemiş talepler olduğunu görüyoruz.”

Zheng Jialiang

Son olarak şirketin altcoin odaklı yaklaşımı, kripto piyasasında farklı ve potansiyel olarak daha kazançlı yatırım fırsatları arayışındaki yatırımcılara hitap etmeyi amaçladığını bizlere gösteriyor.