Bir balina, geçtiğimiz saatlerde sahip olduğu yaklaşık 33.000 $ETH teminat göstererek AAVE ve COMPOUND platformlarından 40 milyon dolar USDT borçlandı.

TEMİNAT GÖSTEREREK BORÇLANMAK

Balinanın bu işlemi neden yaptığını anlayabilmek için öncelikle borçlanma sistemi nedir onu bilmemiz gerek. Örnek olarak diyelim ki marketteki düşüş ve yükselişleri de değerlendirmek istiyorsunuz ancak elinizdeki sahip olduğunuz varlıkları satmak ya da daha fazlasını almak istemiyorsunuz. Bu durumda nakit paraya ihtiyacınız olacaktır. Bu nakiti, elinizdeki varlıkları teminat olarak gösterip belirli borçlanma platformlarını kullanarak karşılayabiliyorsunuz.

Örnek olarak;

Elinizde 1000 adet Ethereum var. Marketteki düşüşe karşı elinizde 2 seçenek var;

1. Ethereumlarınızı satmak,

2. Nakitinizle short yönlü işlem açmak.

Ethereumlarınızı satmak istemezseniz, Aave ve Compound gibi borçlanma platformlara giderek 1000 adet ETH coini teminat gösterip “1000 ETH değerinde” USDT borç alabilirsiniz. Aldığınız nakit para ile short yönlü işlem açarsınız ve market düşüşünde Ethereumlarınızın değeri düşse de short işleminizden para kazanırsınız. Ancak aldığınız bu nakit para borç olduğu için bir noktada ödemeniz gerekir. Ödemeniz de 1000 ETH değerinde olacaktır. Short işlemden kazandığınız parayla daha düşük değerden “daha fazla “ ETH alırsınız.

Örnek olarak 1200 ETH aldığınızı düşünelim. 1000 ETH’u borçlandığınız platforma ödemek zorundasınız, geri kalan 200 ETH ise cüzdanınızda kalır ve sizin olur. Aynı durum long işlem anlamında da böyle gerçekleşir. Ancak açtığınız işlemin tersi yönde bir market hareketinde ödeyeceğiniz borç miktarı aynı kalırken alacağınız ETH değerleri artaracağından, adet olarak daha az miktarda ETH alırsınız. Bu yüzden borçlanmak oldukça riskli bir işlemdir ve genelde yüksek hacim gerektirir.

Riskli durumu şu şekilde özetleyebiliriz;

1000 adet Ethereum’a sahipsiniz ve platformlara giderek 1000 ETH değerinde nakit para borç aldınız v e marketin düşeceğini düşünüyorsunuz. Aldığınız nakit ile Ethereum’a $2000 fiyatından short işlem açtığınız ancak Ethereum $2100 değerine yükseldi. Buradaki kötü senaryo, $2000 x 1000 adet = 2.000.000 dolarlık nakitiniz varken marketin yükselme senaryosunda 1000 x $2100 = 2.100.000 dolarlık borcunuzun olmasıdır. Aradaki 100.000 dolarlık farkı kendiniz ödemek durumundasınız.

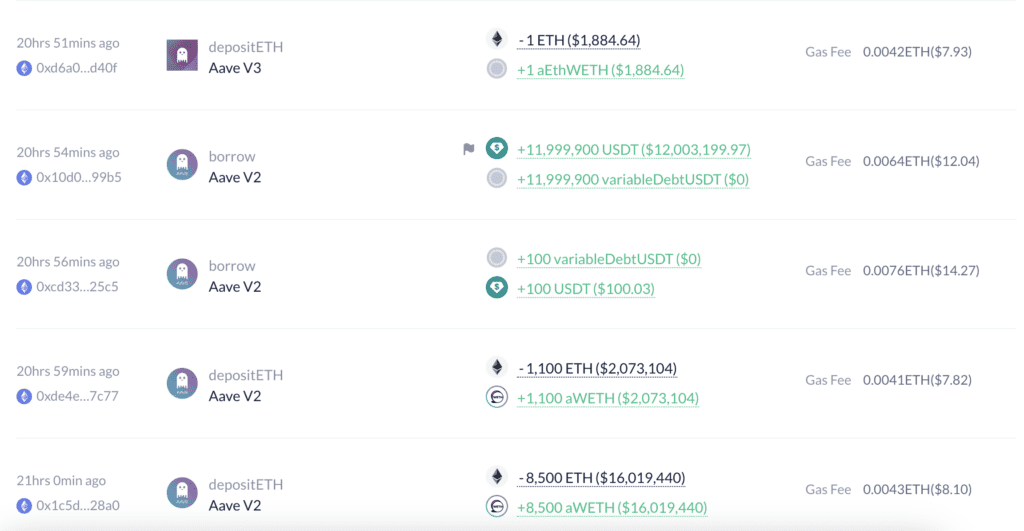

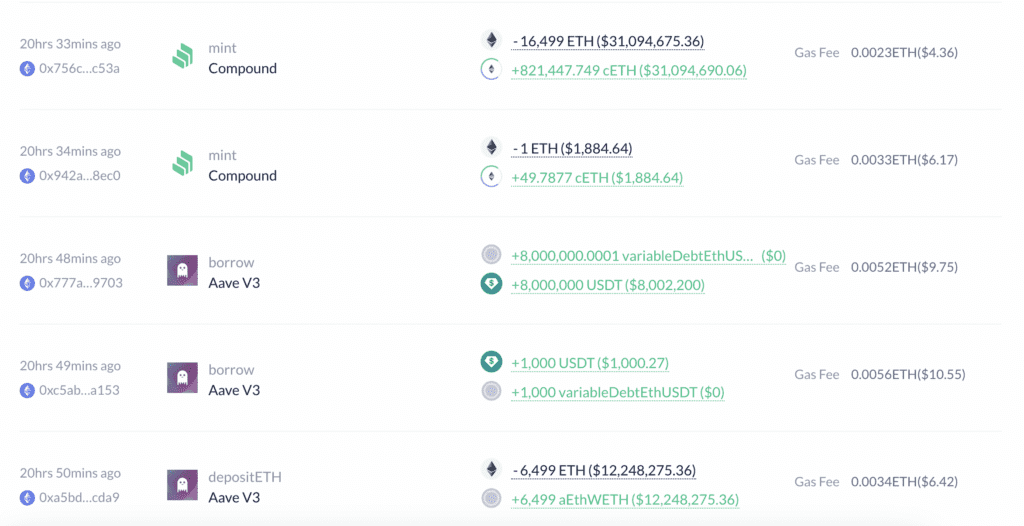

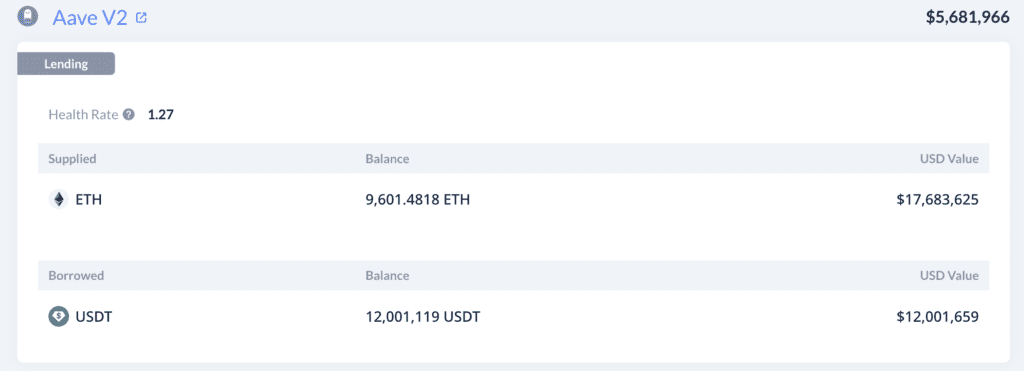

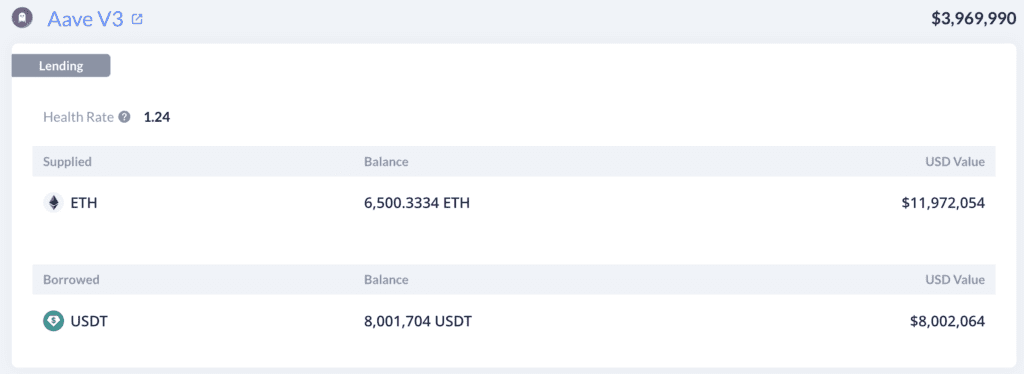

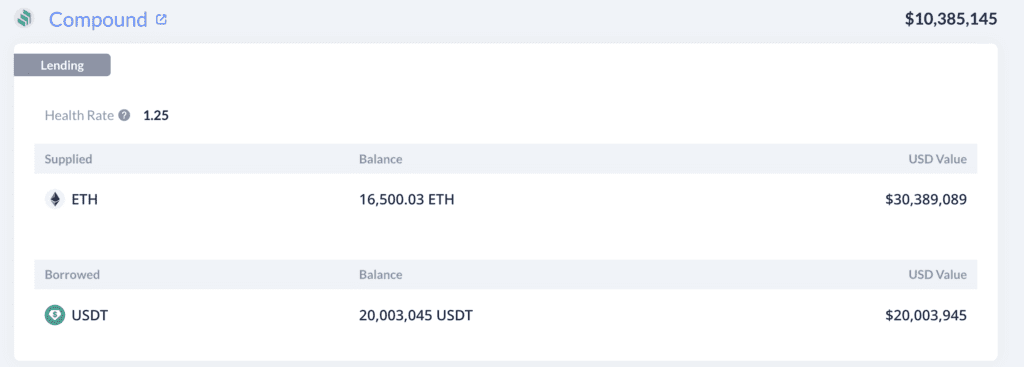

Şimdi balinanın yaptığı borçlanma işlemine gelebiliriz; Balina elindeki yaklaşık 33.000 adet ETH’u teminat göstererek yaklaşık 40 milyon dolarlık tether borçlandı ve bunların bir kısmını borsalara gönderdi.

Balina bu işlemi, Amerika Birleşik Devletleri Menkul Kıymetler ve Borsa Komisyonu (SEC)’in Binance borsasına dava açmasından sonra gerçekleştirdi. Bu da büyük hacimlerle işlem yapan yatırımcıların büyük bir fiyat hareketine hazırlandıklarını söylüyor olabilir.

Balina özet olarak AAVE platformundan toplamda 20 milyon dolar, COMPOUND platformundan toplamda 20 milyon dolar nakit para borçlandı.

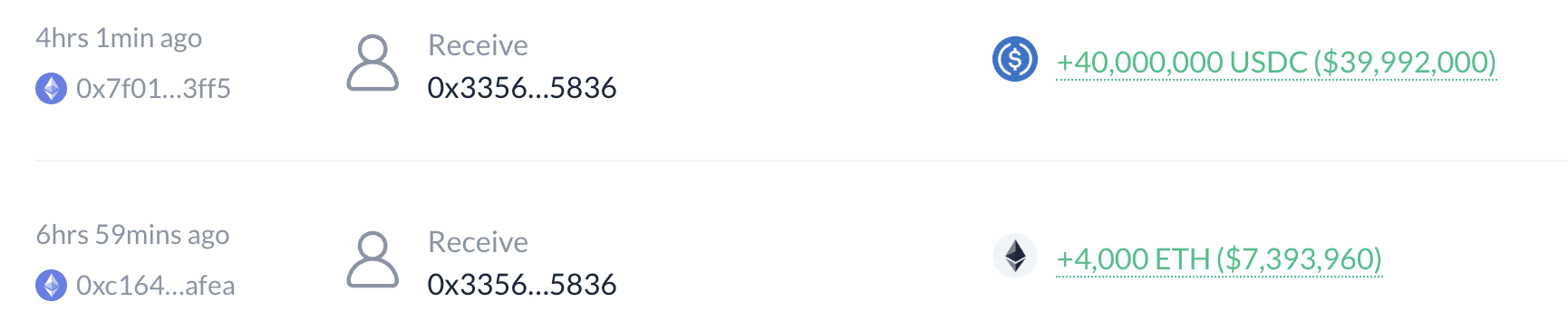

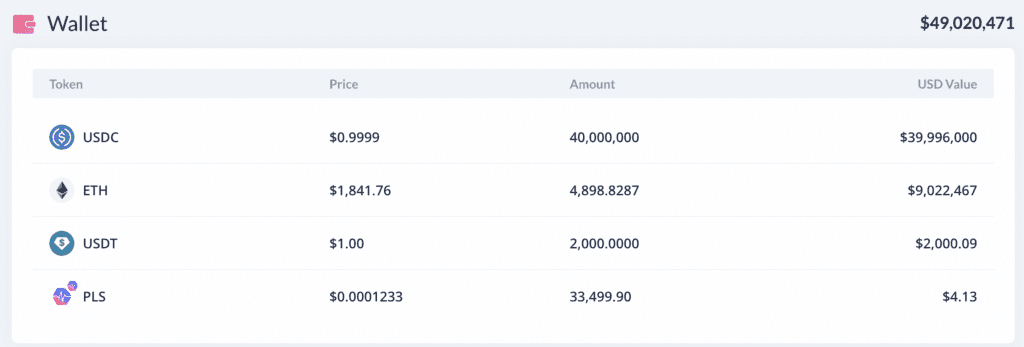

Cüzdanında ise toplamda 49 milyon dolarlık Ethereum (~$9M) ve nakit dolar ($40M) bulunuyor.

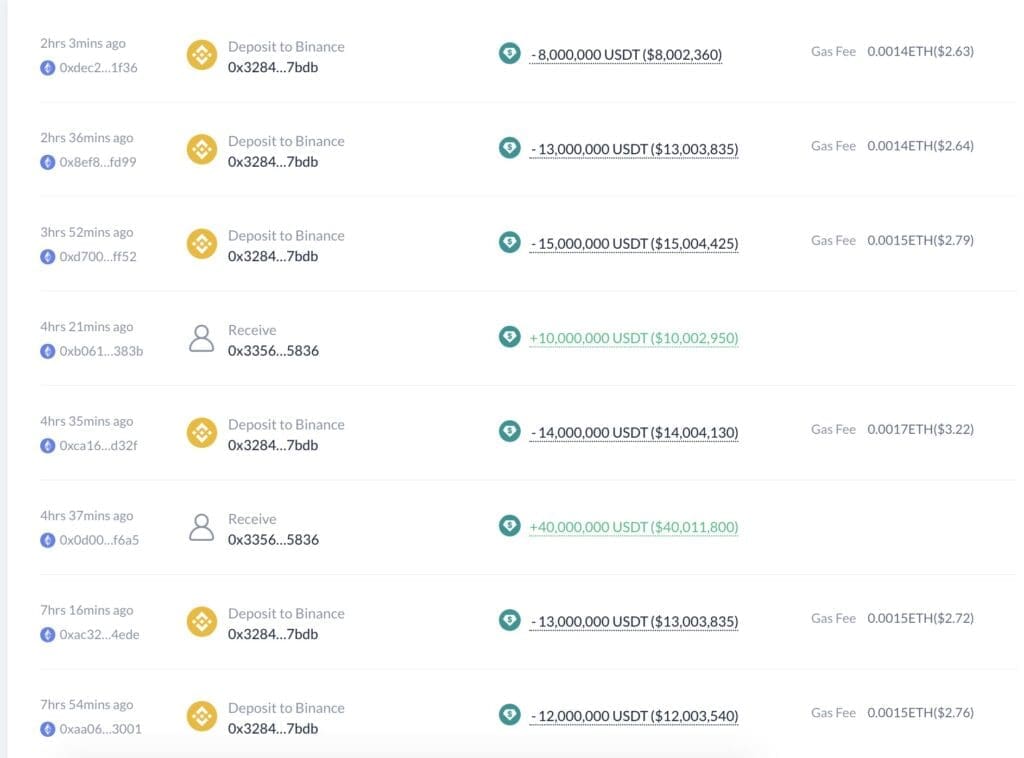

Balina borçlanma işleminden saatler sonra başka cüzdanındaki yaklaşık 100 milyon dolarlık nakit varlığını Binance borsasına aktardı. Bu işlem de büyük bir fiyat hareketine hazırlık yaptığı ihtimalini güçlendirir nitelikte.

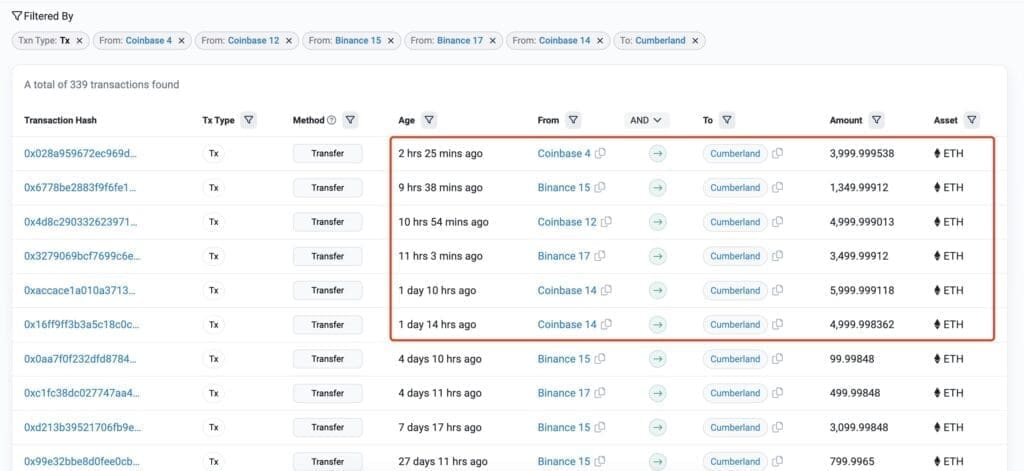

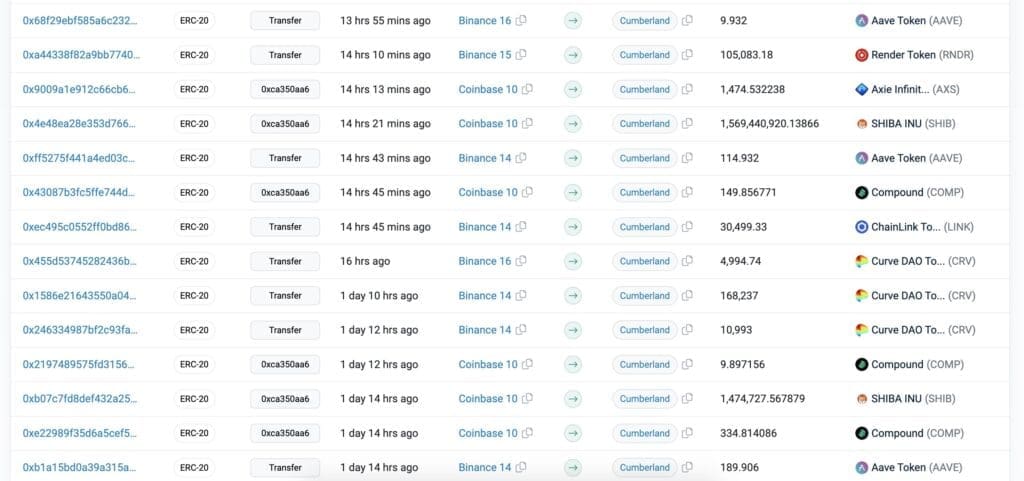

Balina aynı zamanda sahip olduğu 20 bin adet ($37 milyon) Ethereumu Binance’den, 4850 adet ($9 milyon) Ethereumu Coinbase’den cüzdanına çekti. Ayrıca SEC tutanaklarında adı geçen altcoinler arasından $AXS, $SHIB, $COMP, $LINK, $CRV, $AAVE, $RNDR adlı coinleri borsalardan kendi cüzdanlarına çekti.

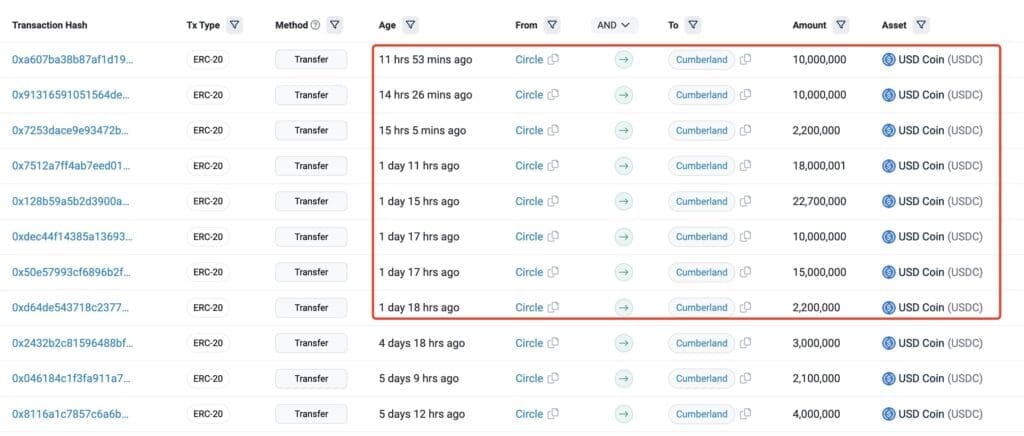

Ardından Circle platformunda bulunan 90 milyon dolar değerindeki USDC varlığını çekerek 85 milyon dolarlık kısmını Coinbase, 3.5 milyon dolarlık kısmını Binance’e aktardı.

Balinaya ait cüzdanları Debank veya Etherscan üzerinden görüntüleyebilirsiniz.

Konuyla ilgili Lookonchain araştırmasına buradan göz atabilirsiniz.