Binance, Altyapı Güncellemesi ile Güvenliğini ve Verimliliğini Artırıyor

Dünyanın en büyük kripto para borsası Binance, güvenliği artırmak ve operasyonel verimliliği artırmak için önemli bir altyapı yükseltmesi başlattı. Bu yükseltmenin bir parçası olarak Binance, Ethereum, Tron, BNB ve Stellar dahil olmak üzere birden çok blok zincirinde belirli eski para yatırma adreslerini devre dışı bırakacak.

Binance Kullanıcıları İçin Önemli Bilgiler: Para Yatırma Adreslerindeki Değişiklikler

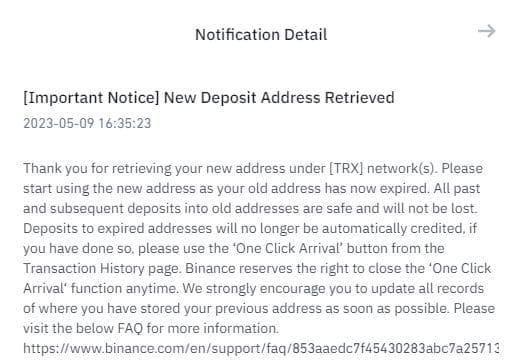

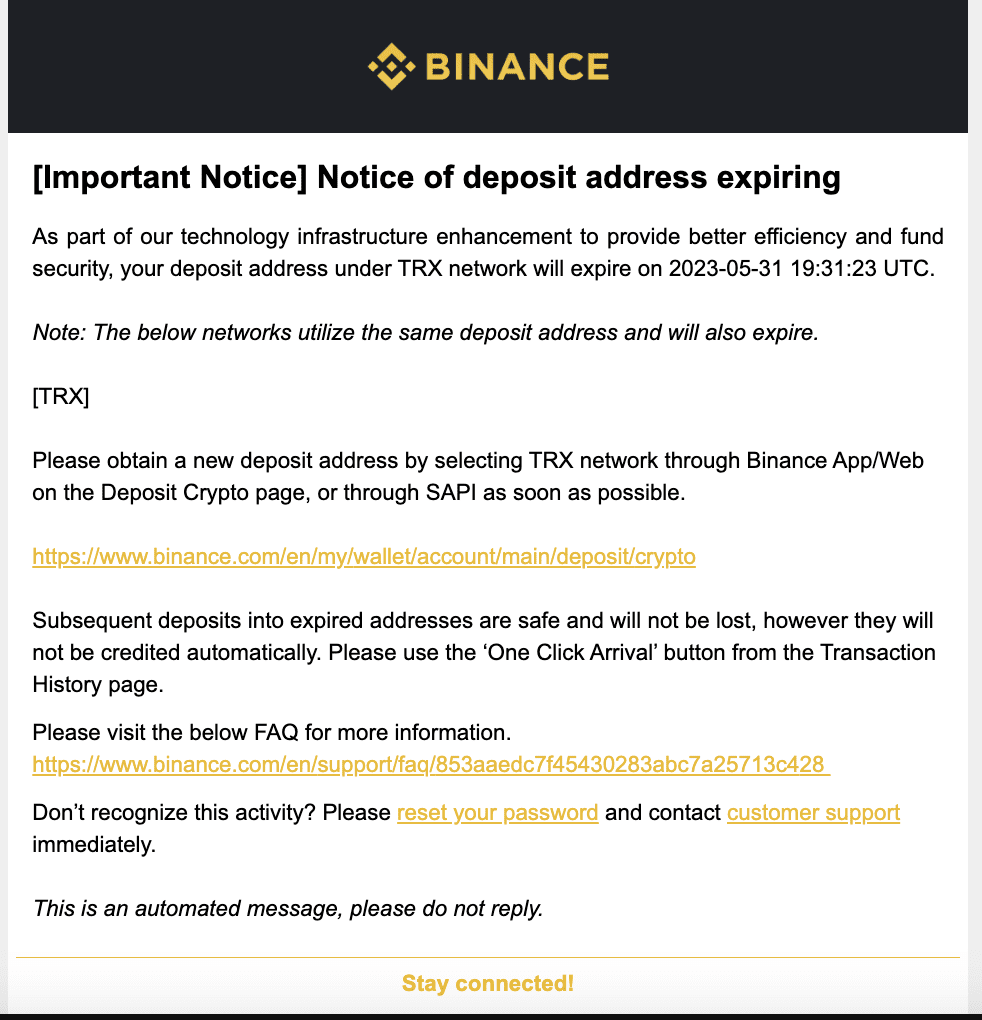

Binance kullanıcılarının, belirli blok zincirleri için para yatırma adreslerinde uygulanan değişiklikleri dikkate almaları önerilir. Binance, etkilenen kullanıcılara mevcut para yatırma adreslerinin sona erme tarihlerini özetleyen e-posta bildirimleri gönderecek. Kullanıcıların bildirimi aldıktan sonra yeni bir adres ve memo almaları önemle tavsiye edilir. Geçiş tamamlandıktan sonra eski para yatırma adresleri geçersiz olacaktır.

Varlık Güvenliğinin Sağlanması: Süresi Dolmuş Adreslere Yapılan Ödemelerin İşlenmesi

Binance, kullanıcılara süresi dolmuş para yatırma adreslerine gönderilen fonların kaybolmayacağını garanti ediyor. Ancak süresi dolmuş adreslere yapılan ödemelerde anında geri ödeme yapılamayacağını da belirtiyor. Bu fonları kurtarmak için kullanıcıların “işlem geçmişi” sayfasını kullanarak para yatırma işlemini manuel olarak başlatması gerekiyor. Karmaşıklığı önlemek ve varlıkların güvenliğini sağlamak için süresi dolmuş adreslere para yatırmaktan kaçınmak önemli.