Amerika’daki bankacılık krizi büyümeye devam ediyor. Amerika Merkez Bankası FED’in bir yıla aşkın süredir uygulamış olduğu faiz politikaları, öncelikli olarak bankalara ve diğer kuruluşlara sorun yaratmaya devam ediyor.

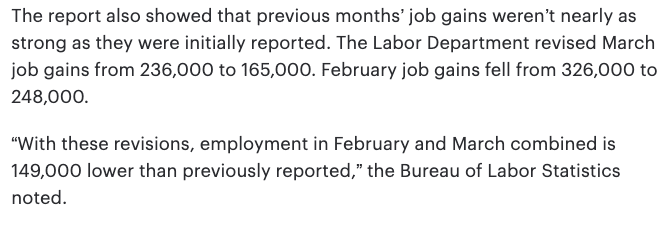

3 Mayıs 2023 tarihinde düzenlenen toplantıda FED, beklenti dahilinde 25 bps faiz artırımı yapmıştı. Marketler buna olumlu ya da olumsuz olarak tepki göstermedi. 5 mayıs 2023 tarihinde ise Tarım Dışı İstihdam verisi 253.000 (253.000) olarak açıklandı. Bu aslında Amerika ekonomisi için iyi bir gösterge çünkü piyasada uzmanlar Amerika ekonomisinin bir durgunluğa gireceğini düşünüyorlar, ancak açıklanan bu veri bununla tam tersi kanıda. Kısaca, insanlar ne kadar çok iş bulabiliyorsa, şirketler o kadar iyi durumda gibi görünüyor. Fakat bu tam olarak böyle değil.

The HILL şirketi, 5 mayısta açıkladığı bir yazıda Amerika Çalışma Departmanı’nın Şubat ayı istihdam verisini normalde açıklanan 326.000’den 248.000’e, Mart ayı istihdam verisini ise 236.000’den 165.000’e revize ettiğini açıkladı. Buradan anlaşılan şu ki, Amerika’dan gelen bu verilerin anlık açıklandığı değerlerle aynı değil ve bunu daha sonrasında düzeltiyorlar. Mayıs ayında gelen istihdam verisi ise 253.000 olarak açıklanmıştı, belli ki bu değer de gerçeği yansıtmıyor. Bu veri yanıltmasının sebebi, rakamlar düzeltildiği şekilde olsaydı piyasalar aşağı yönlü çok sert tepki verebilirlerdi. Buna engel olmak istedikleri için verileri farklı şekilde yayınlıyorlar. Bu veri yanıltmaları tabi ki ilk değil son da olmayacak.

İlgili habere buradan ulaşabilirsiniz.

Enflasyon

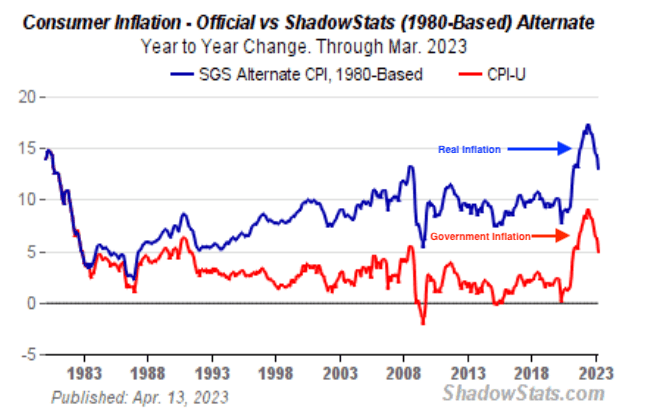

Amerika Birleşik Devletleri,1980’li yıllarda yeni bir enflasyon hesaplama sistemine geçiş yaptı. Aşağıdaki grafiklerde, yeni sistemin hesapladığı enflasyon ve gerçek enflasyon arasındaki farkı görebiliyoruz.

Grafiklerle birlikte paylaşılan resmi veri sitesine buradan ulaşabilirsiniz.

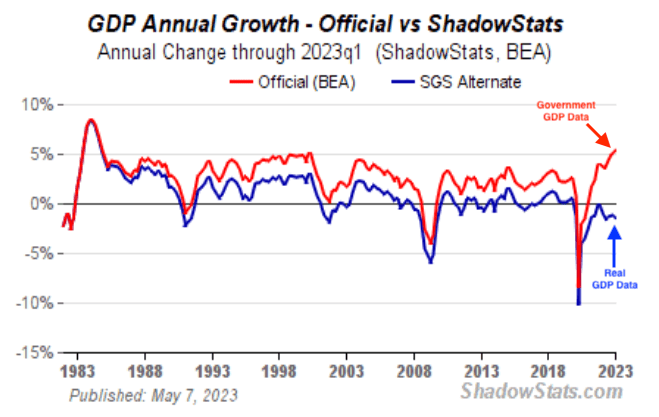

Büyüme Verisi

Bu grafik de ABD hükümetinin paylaştığı büyüme verisi ve gerçek büyüme verisinin karşılaştırıldığı grafik.

( Kırmızı, ABD hükümetinin paylaştığı büyüme verisi / Mavi ise gerçek büyüme verisi.)

Grafikle birlikte paylaşılan resmi veri sitesine buradan ulaşabilirsiniz.

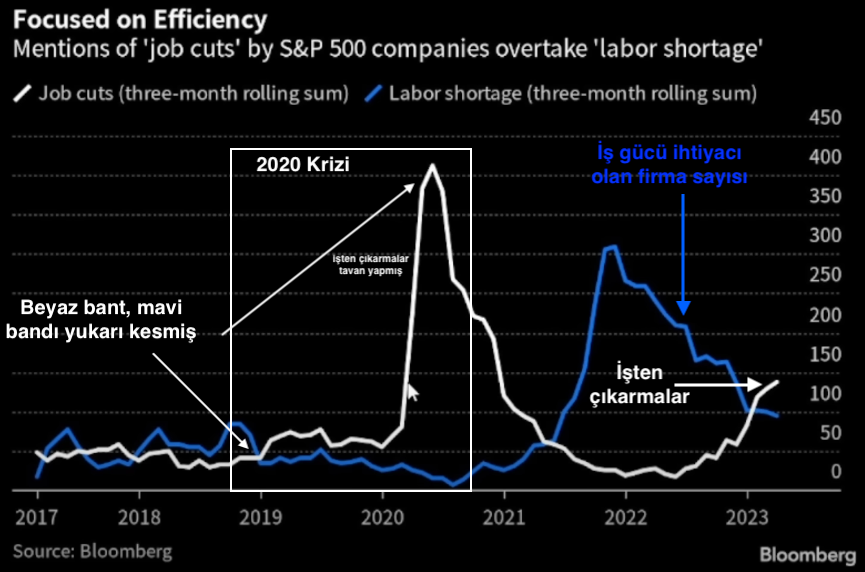

İşsizlik Oranı

İşsizlik rakamlarındaki doğruluk ile alakalı bir başka problem ise firmalardan alınan bilgilerle alakalı. Firmalar her ne kadar işçi alımı yapıyor ve istihdam sağlıyor gibi görünse de bu grafiklerde öyle olmadığını anlayabiliyoruz. 2020 krizinden önce iş gücü arayışındaki firma sayısı azalırken işten çıkarmalar artmaya devam etmiş ve bir süre sonra inanılmaz şekilde tavan yapmış. Aynı durumun şu anda da olduğunu grafikten anlayabiliyoruz.

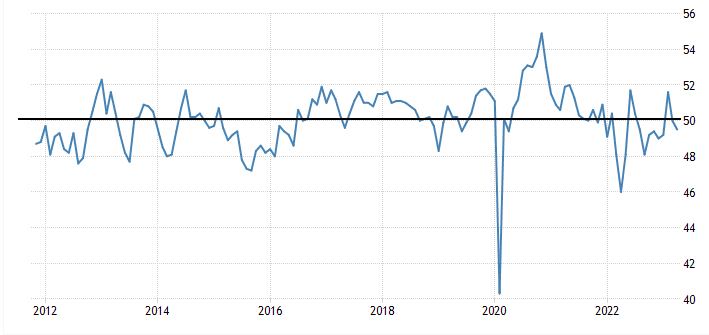

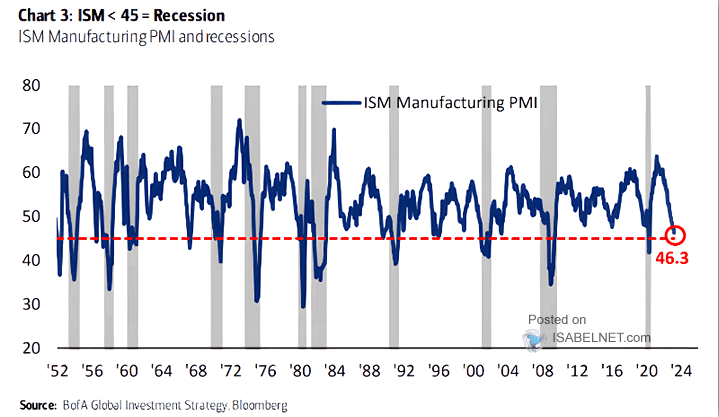

İmalat Verisi

Bu sorunların sadece ABD ile kısıtlı kalmadığını ya da kalmayacağını bize gösteren başka bir veri de Çin İmalat verisi. Aşağıda ABD ve Çin’e ait “imalat” verilerini görmektesiniz. Bu veri, belli bir değerin altına düştüğünde ekonomik olarak büyük sıkıntılar oluşmuş. Bazı seneler ekonomik kriz, bazı seneler ekonomik durgunluk ve bazı senelerde ise ekonomik depresyon denilen çok zor zamanlar yaşanmış.

Amerika ve Çin‘e ait İmalat Verilerine buradan ulaşabilirsiniz.

Bütün bu veriler ve haberler sonucunda Amerika’nın bazı durumları geciktirmek istediği, bazı verileri ise yayınlamak istemediğini anlayabiliyoruz. Ancak gerçekçi olmak gerekirse hem Amerika hem de dünya ekonomik olarak güzel zamanlardan geçmiyor ve uzun bir süre daha geçmeyecek gibi duruyor.