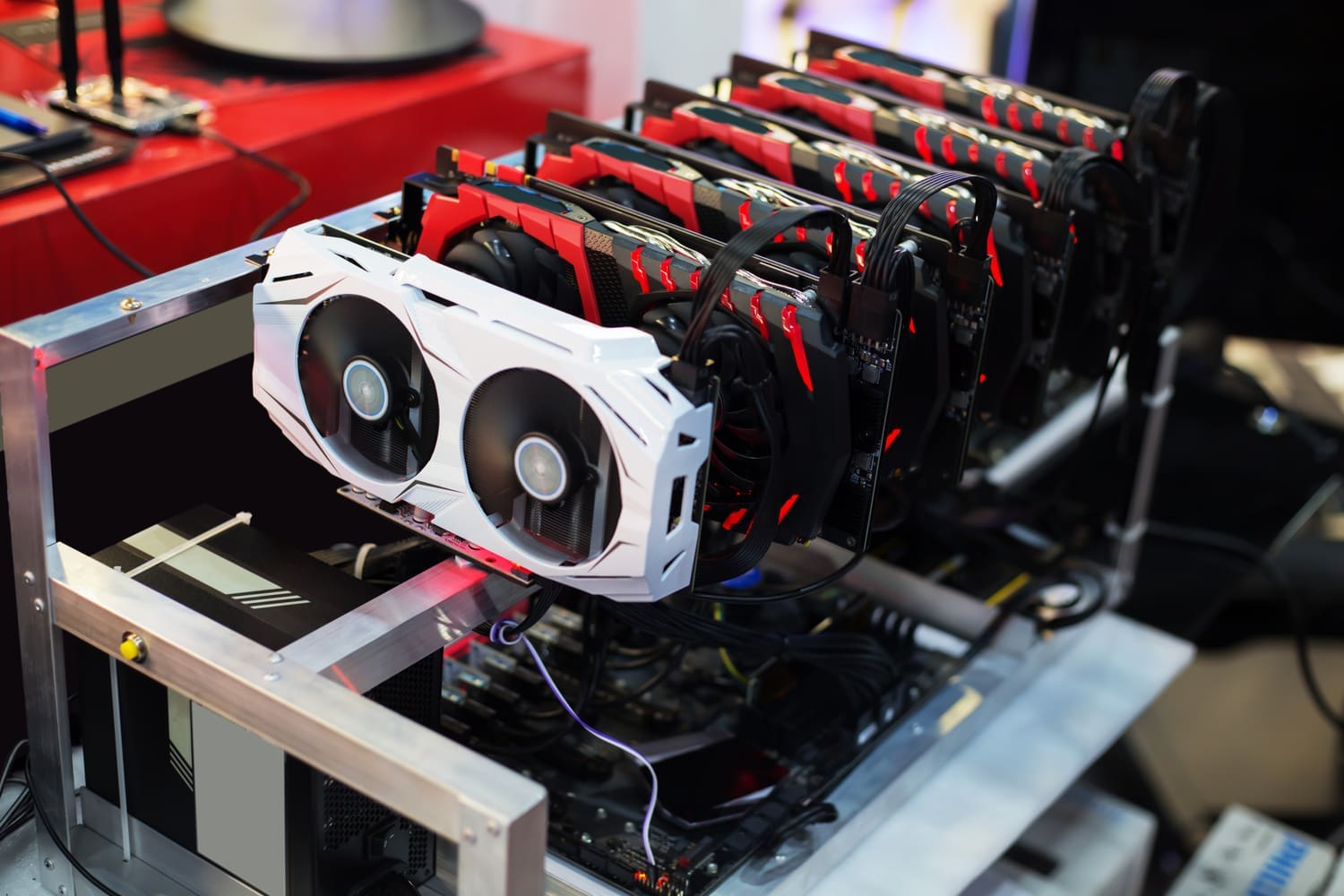

Biden yönetimi, son dönemde federal bütçede önerilen bir vergiyi aktif olarak destekliyor ve kripto para madencilerinin enerji giderlerinin %30’unu ödemeleri gerektiğini savunuyor. Salı günü bir dijital yayında Beyaz Saray’ın Ekonomik Danışmanlar Konseyi (CEA) tarafından yapılan bir argümana göre, Başkan Joe Biden, kripto madencilik girişimlerine yönelik katı bir vergi uygulamayı, “topluma verdikleri olumsuz etkiler” nedeniyle amaçlıyor.

İdarenin online post’u, bir madencilik şirketinin enerji tüketiminin %30’u tutarında bir ABD vergisi için zorlayıcı bir durum olduğunu ortaya koydu – bu işletmelerin kârlılığını potansiyel olarak tehlikeye atabilecek, alışılmadık, sektöre özgü bir ceza.

“Şu anda, kripto madenciliği şirketleri, yerel çevre kirliliği, daha yüksek enerji fiyatları ve artan sera gazı emisyonlarının iklim üzerindeki etkileri şeklinde başkalarına yükledikleri maliyetin tamamını ödemek zorunda değiller.”

Beyaz Saray’ın Ekonomik Danışmanlar Konseyi.

Önerilen vergi, diğer enerji tüketen sektörleri aynı şekilde etkilemeyecek olsa da, CEA, “kripto madenciliğin, genellikle benzer elektrik kullanımına sahip işletmelerle ilişkilendirilen geleneksel yerel ve ulusal ekonomik avantajları sağlamada başarısız olduğunu” öne sürerek kararı destekliyor.

Biden yönetimi, önerilen özel tüketim vergisini ilk olarak 9 Mart’ta Amerikan Hazine Bakanlığı tarafından yayınlanan ve gelecek yıl için gelir sağlayıcı teklifleri özetleyen “Greenbook” adlı belgede sunmuştu. Ancak bu tür teklifler genellikle Kongre onay sürecinden geçemiyor. Vergi, on yıl içinde 3,5 milyar dolar gelir elde etmeye potansiyel olarak sahip.

Mart ayında, yönetimin Ekonomik Danışmanlar Konseyi, endüstri hakkındaki daha geniş endişeleri dile getiren bir rapor yayımladı. Bu endişeler arasında potansiyel kirlilik, yerel topluluklara maliyetler ve temiz enerji kaynaklarını kullanan madencilik şirketleri için bile artan enerji tüketimi bulunuyor.

Sonuç olarak, Biden yönetiminin kripto para madencilik girişimlerine yönelik %30 enerji vergisi teklifi, endüstrinin sosyal ve çevresel sonuçları konusunda ciddi bir endişeyi işaret ediyor. Bu alışılmadık, sektöre özgü yaptırımın tartışması sürerken, verginin Kongre onay sürecinden geçip geçmeyeceği henüz net değil.