Blend, DeFi ve NFT Dünyalarını tek platformda birleştirmeyi hedefliyor.

Paradigm tarafından desteklenen Blur, Ethereum platformu üzerine inşa edilmiş ve NFT kullanıcıları için dizayn edilmiş bir NFT pazaryeridir. OpenSea’den farklı olarak Blur, tek bir sayfada daha fazla veri sunarak diğer pazarlarda yer alan NFT listelemelerini de kolayca erişilebilir hale getiriyor. Blur, NFT’ler de dahil olmak üzere isteğe bağlı teminatı destekleyen Lending (borç verme) protokolü olan Blend‘i tanıttı.

NFT’ler için P2P borç verme protokolü olan Blend, DeFi’de 10 kat daha yüksek getiri fırsatları sunuyor. NFT Lending ve sorunsuz zincirler arası işlevsellik ile her seviyeden kullanıcı için DeFi ve NFT ekosistemlerinde devrim yaratıyor.

Basitçe tarif etmek gerekirse, bir Punk sahibi olduğunuzu hayal edin. Artık Blend’de saniyeler içinde 42 ETH’ye kadar ödünç alabilirsiniz. Azuki’ye sahip olmak isterseniz, sadece 2 ETH peşin ödeyerek satın alabilirsiniz. Blend ile NFT sahipleri artık satmaya gerek kalmadan NFT’leri karşılığında ETH ödünç alabiliyorlar.

Blend Nedir?

- Blend, Blur tarafından tanıtılan ve merkezi olmayan finans (DeFi) ile non fungible token (NFT) dünyalarını birleştirmek için tasarlanmış yeni bir platformdur.

- Platform, likidite, zincirler arası işlevsellik (cross-chain functionality) ve çeşitli DeFi protokolleri ile NFT pazar yerlerinin sorunsuz entegrasyonunu sağlamayı amaçlıyor.

- Blend, tüm deneyim seviyelerindeki kullanıcılar için DeFi ve NFT teknolojilerinin benimsenmesini kolaylaştırmak için kullanıcı dostu bir arayüz sağlamayı da ihmal etmiyor.

Blend neyi çözmeyi hedefliyor?

Blend, aşağıdaki çözümleri sunarak DeFi ve NFT ekosistemlerindeki çeşitli zorlukları çözmeyi amaçlamakta:

- Daha yüksek getiri fırsatları: NFT’ler için P2P Borç Verme Protokolü Blend, mevcut DeFi protokollerinden 10 kat daha yüksek getiri fırsatları sunarak onu kullanıcılar ve yatırımcılar için daha çekici hale getirmeyi hedefliyor.

- NFT’ler için daha fazla likidite: Blur Lending’in kısaltması olan Blend, NFT’ler için likiditenin kilidini açarak NFT pazarındaki büyümenin bir sonraki aşamasına olanak tanıyor. Blend, NFT’ye özgü finansal ilkelleri tanıtarak, NFT’ler için daha verimli bir piyasayı yaratmayı hedefliyor.

- NFT’lerin finansallaştırılması: Blend, NFT kredilerini sunarak trilyon dolarlık NFT piyasasına finansallaştırma getirmeyi amaçlıyor. Bu, NFT fiyatının bir kısmını peşin ve geri kalanını bir borç verme mekanizması aracılığıyla ödemelerini sağlayarak, NFT’lerin daha geniş bir alıcı yelpazesi için daha uygun fiyatlı ve erişilebilir olmasına yardımcı oluyor.

- Sezgisel ve güvenli borç verme deneyimi: Blend, borç alanlar için sezgisel ve borç verenler için güvenli ve esnek olacak şekilde tasarlanmış, NFT kredisinin de etkili bir şekilde ölçeklenebilmesini sağlamayı hedefliyor.

Blend’i en etkili şekilde nasıl kullanabiliriz?

Blend’i etkili kullanabilmek için, ilkelerini anlamak önem taşıyor. Blend, NFT kredisi sunarak NFT pazarını etkili bir şekilde ölçeklendirmeyi hedefliyor.

Blend aynı zamanda, Paradigm, Dan Robinson (Uniswap V3’ün mucitlerinden biri) ve Transmissions11 (Paradigm’de araştırmacı ve Seaport’a en çok katkıda bulunan kişi) arasındaki bir işbirliği. Blend’in tasarımı, kullanıcılar için sezgisel, güvenli ve esnek bir borç verme deneyimi sağlamaya odaklanıyor.

Kullanıcılar ayrıca sıfır komisyondan yararlanabilirler. Borç alanlar ve borç verenler için Blend’in sıfır komisyonu bulunuyor. Ücretler $BLUR sahipleri tarafından kontrol ediliyor ve 180 gün sonra açılabiliyor. Blend’in kodu, Uniswap V3 gibi BSL altında lisanslı ve $BLUR sahipleri tarafından yönetilen ek kullanım izinleri de bulunuyor.

Kullanıcılar, bu ilkeleri anlayarak DeFi ve NFT ekosistemlerinde yeni fırsatların kilidini açmak için Blend’in yenilikçi özelliklerinden yararlanabilir. Örneğin elinde yeterli varlık bulundurmayan bir kullanıcı, elindeki NFT’sini satmak yerine onu teminat göstererek ve karşılığında borç alarak ulaşmak istediği NFT’lere ulaşabiliyor.

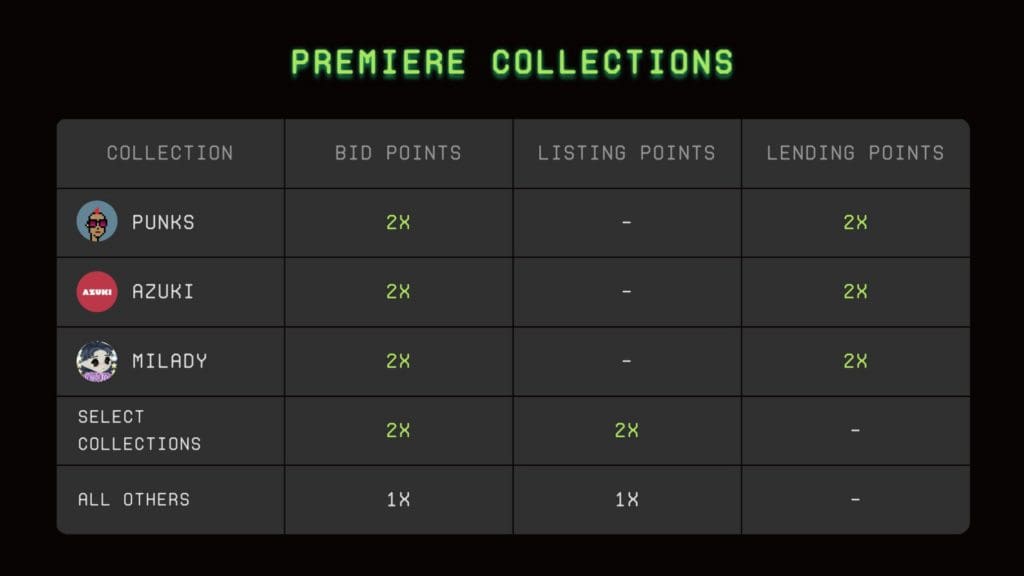

Blur Sezon 2 Ödülleri & Sadakat Puanları

Sezonun sonuna yaklaşırken Blend, BLUR tokeninin 300 milyon dolarlık airdrop’u için Blur’a katılıyor. Blur, birkaç aydır en iyi NFT pazarı konumunu koruyarak OpenSea‘yi açık ara farkla geçse de, toplam NFT işlem hacimleri son haftalarda düşüş gösteriyor.

Blur artık Teklif Puanları ve Listeleme Puanlarının yanına Ödünç Verme Puanları’nı (Lending Points) da ekledi. Ödünç Verme Puanları hakkında daha fazla bilgi için Blur’un Mirror yayınına göz atabilirsiniz.