Kredi Risk Primi (CDS) Nedir?

Kredi Risk Primi (Credit Default Swap(CDS)), bir ülkenin, bir şirketin ya da borçlanma kağıdı çıkarmış olan bir kurumun borcunu ödeyememesi halinde ödenecek olan sigorta primi demektir. Bu değer ne kadar yüksekse, o kurum veya ülkenin mevcut borçlarını ödemesi o kadar zordur.

Geçmiş yıllardaki krizlerde bu değer genelde 60 ve üzerine çıkmış. Grafikte şu anki ABD CDS değerini 104.480, dolayısıyla geçmiş yıllardaki krizlerden daha da yukarı çıktığını görebiliyoruz. Burada dikkat etmemiz gereken kısım, bu grafik bir kurum veya şirkete değil, direkt ABD devletine ait.

(Beyaz bant 1 yıllık ABD CDS)

(Turuncu bant 5 yıllık ABD CDS)

(Mavi bant ABD borsasının volatilite/korku endeksi)

Borçlanma Limiti

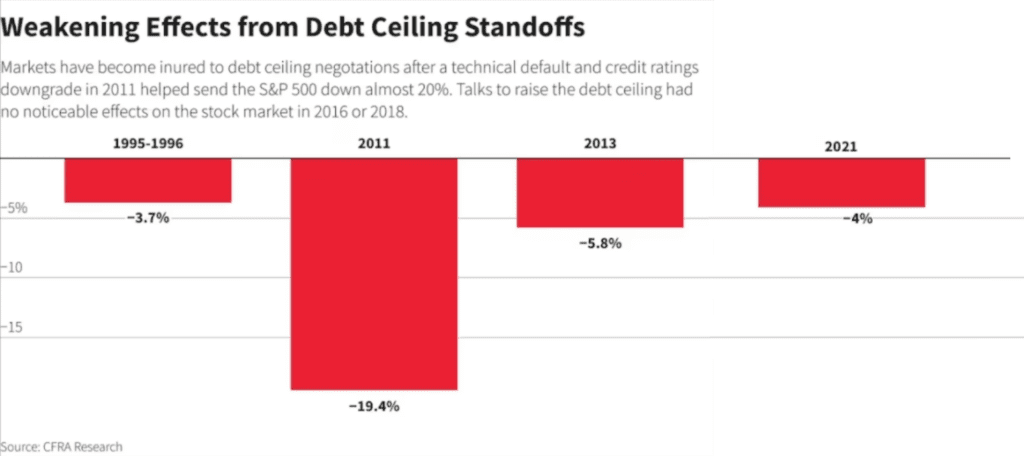

1995-1996 yıllarında borçlanma limitine ulaşılması durumunda Amerikan borsası 3.7% değer kaybetmiş. Bu değer 2011 krizinde 19.4%, 2013 yılında 5.8%, 2021 yılında ise 4% değerine ulaşmış.

Hazine Tahvilleri

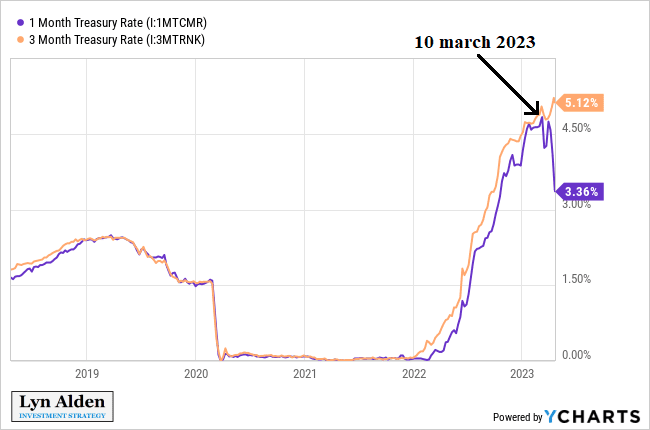

Bu grafiğe göre insanlar, 1 aylık hazine tahvillerine 3 aylık hazine tahvillerinden daha çok ilgi gösteriyor ve daha çok satın alıyor. Bu da bize, insanların Amerika’nın 1 aydan fazla elde tutulan hazine kağıtlarının değerini ödeyebileceklerini düşünmediklerini gösteriyor. 1 aylık ve 3 aylık hazine tahvillerindeki farkın, 10 mart 2023, Amerik’anın 3 büyük bankasının (Silicon Valley Bank, Signature Bank ve Silvergate Capital) battığı tarihte artmaya başladığını görebiliyoruz.

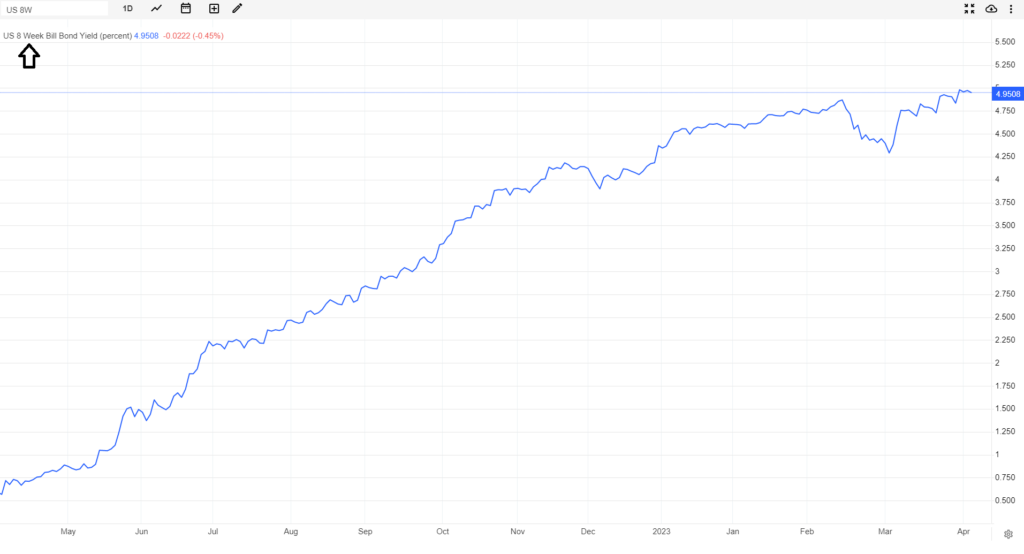

8 Haftalık (2 aylık) hazine tahvilleri için de durum aynı şekilde görünüyor.

Amerika Bankalarından Mevduat Çıkışı

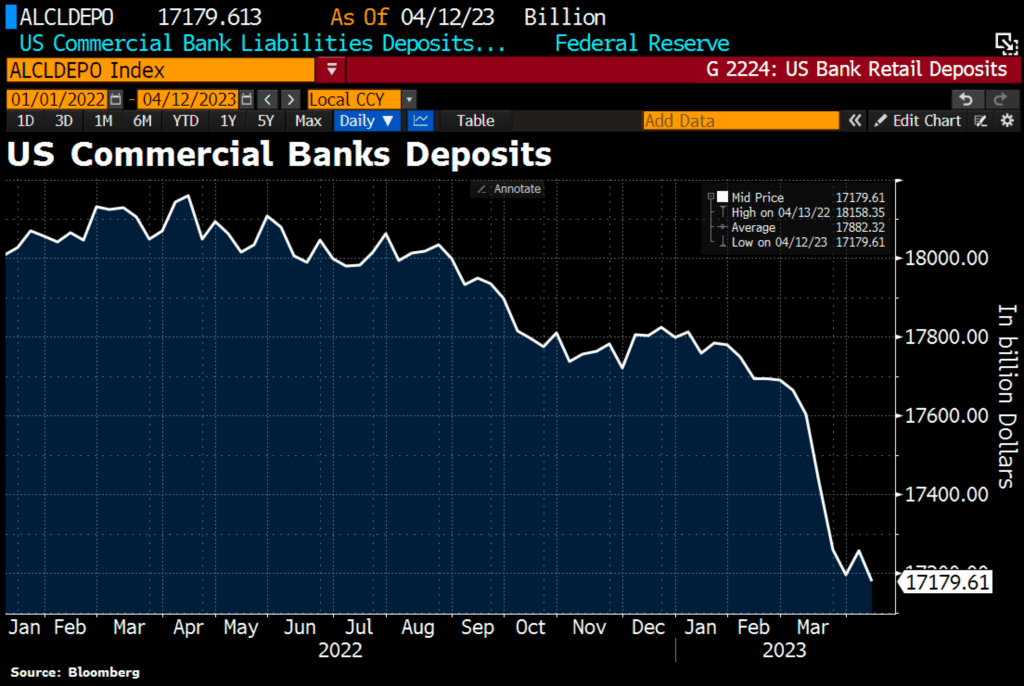

Bu grafik bize Amerika bankalarında bulunan mevduatlardaki azalmayı gösteriyor. Diğer bir deyişle insanlar varlıklarını bankalardan kaçırmaya devam ediyor. Geçtiğimiz 2-3 ay içerisinde bankalardan $76.2 Milyar dolarlık mevduat çıkışı oldu. Mevduatların azalması demek kredi verme koşullarının daralması demektir bu da kredi almanın zorlaşacağını ve nakit ihtiyacı olan kurum ve kuruluşların kredi alamamasını açıklar. Aynı doğrultuda ekonomik zorlukların devam edeceğini hatta ileride daha da büyüyüp yayılacağını gösterir.

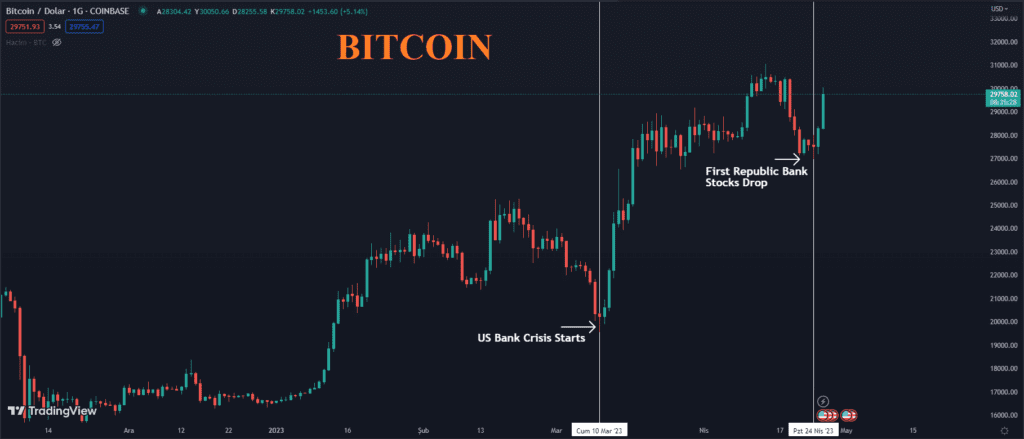

Yukarıdaki grafiklerde Bitcoin ve Altın fiyatlarının bankacılık krizine verdiği tepkileri görebiliyoruz. Amerika’daki bankalara olan güvenin azalmasının ardından insanların, kaçırdıkları mevduatlarını Altın ve Bitcoin gibi yatırım araçlarına yönelttiğini anlayabiliyoruz.

Ayrıca First Republic Bank ile ilgili haberimize buradan göz atabilirsiniz.

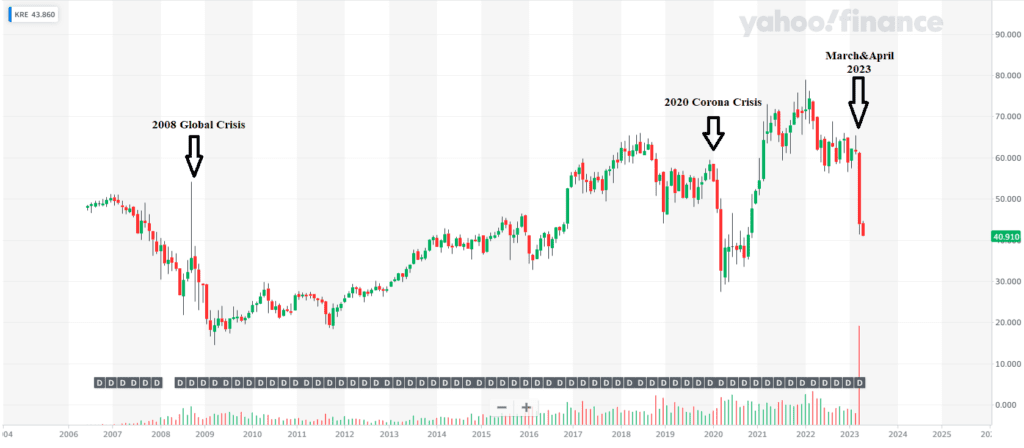

Borsa Yatırım Fonu (ETF) Nedir?

Borsa Yatırım Fonu (ETF), yetkili aracı kurumlar eşliğinde borsadan alıp satabileceğiniz bir menkul kıymetler sepetidir. Borsada işleme açılan fonlar, aynı anda çok sayıda menkul kıymete ve farklı özelliklere sahip yatırım araçlarına yatırım yapmanızı mümkün hale getirir.

Bu grafikte 2008, 2020 krizlerindeki Amerika bölgesel bankalarındaki ETF düşüşlerini ve aynı durumun şubat 2023 ve mart 2023 tarihlerinde de olduğunu görebiliyoruz. Dolayısıyla Amerikan bankalarındaki kriz henüz çözülebilmiş değil hatta bazı konularda daha da kötüye gitmeye devam ediyor.

Genel anlamda bakıldığında Amerika Bankaları üzerindeki kriz henüz çözülebilmiş değil. Yöneticiler her ne kadar sorun kalmadığını belirtse de insanlar varlıklarını, güvenmedikleri bankalardan kaçırmaya, altın ve kriptopara gibi varlıklara yönlendirmeye devam ediyor. İlerleyen günlerde bankacılık krizinin ne şekilde devam edeceğini beraber izleyeceğiz.