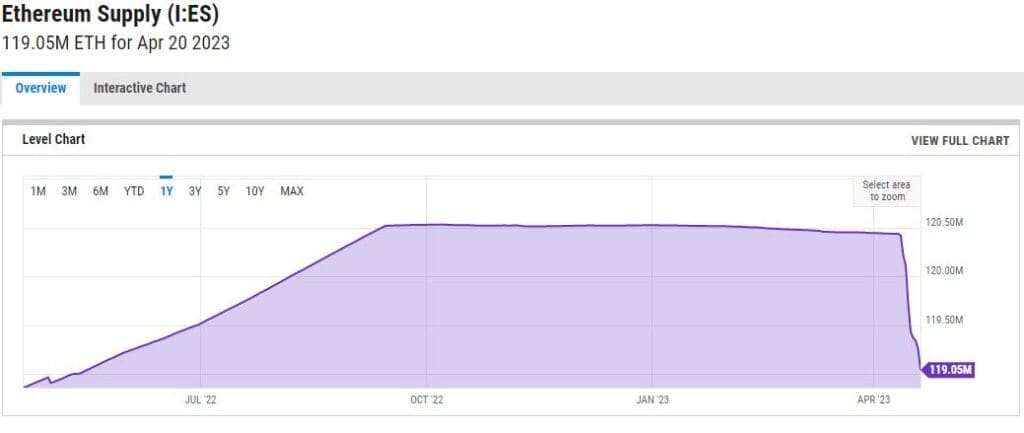

Merge’in Ethereum’un enerji tüketen iş ispatından (energy-consuming proof-of-work) çevre dostu iş ispatına (eco-friendly proof-of-stake) geçişi, Ether arzında 100.000 tokenin üzerinde bir azalmaya yol açtı. Son 217 günde, Ethereum’un toplam arzı 103.092 token azaldı ve değeri 200 milyon doları aştı.

The Merge gerçekleşmemiş ve Ethereum madenci korumalı olarak kalsaydı, Ether arzı 2,52 milyondan fazla coin (4,9 milyar $) ve yıllık %3,53 oranında artacaktı. Ancak, birleşme sonrası yıllık düşüş %0,144 olarak kaydedildi. Ek olarak, ultrason.money’e göre bu süre zarfında Ether arzından 1,2 milyar dolar çekildi. Şu anda dolaşımda kabaca 120.418.032 milyon ether coin bulunmakta.

Ateş Ethereum İyileştirme Önerisi 1559 tarafından yakıldı

Ethereum İyileştirme Önerisi 1559 (EIP-1559), Londra yükseltmesiyle dahil edilen değişikliği başlattı. Bu uygulama, işlem ücretlerini bir taban ücret (burn edilen tutar) ve bir öncelik ücreti (artık kullanılmayan madencilere ödeme) olarak ikiye ayırdı.

EIP-1559, base fee’yi (taban ücreti) yakarak Ethereum ağ enflasyonunu azaltarak Ether arzı üzerinde deflasyonist baskı uygulamayı amaçladı. Bununla birlikte, toplam arz, Londra’nın etkinleştirilmesinden bu yana 3,21 milyon token arttı.

Ethereum’un Shapella yükseltmesi, bir haftadan biraz daha uzun bir süre önce stake edilmiş Ether çekilmesini etkinleştirdiğinden beri Ether yakımı yoğunlaştı.