Çarşamba günü, kripto para piyasası, piyasa değeri bakımından en büyük dijital para birimi olan Bitcoin’in değerinde önemli bir düşüş yaşanmasıyla büyük bir değer kaybına uğradı. Bitcoin, 15 dakika içinde 30.000 doların altına düştü ve düşüş Bitcoin’in 29.000 dolara kadar gerilemesiyle sonuçlandı.

Bu keskin düşüş birçok yatırımcı için sürpriz oldu ve altcoinlerde de önemli gerilemelere neden oldu. Bazı altcoinlerde %10 ila %15 oranında değer kayıpları yaşandı. Bu düşüşle birlikte, Shapella güncellemesi nedeniyle yakın zamanda 2.000 dolar sınırını geçerek 2.150 dolara kadar ulaşan Ethereum’un değeri de büyük ölçüde düştü. Madencilik hisseleri de düşüş yaşadı.

Bitcoin’deki Bu Sert Düşüşün Sebebi Ne?

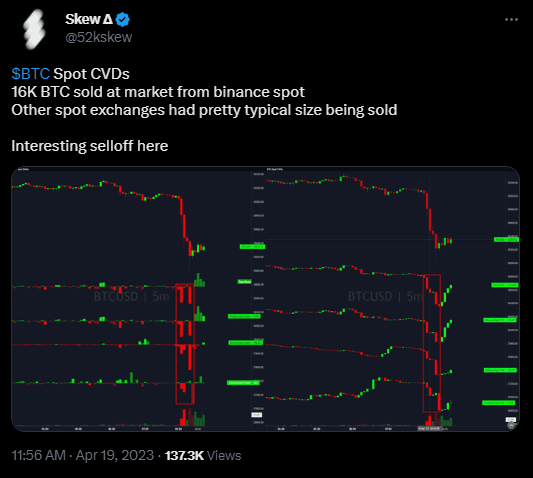

Bu düşüşün sebebi tam olarak bilinmese de, ortaya atılan bir iddiaya göre, başlıca nedenlerinden biri dünyanın önde gelen kripto para borsalarından biri olan Binance’de gerçekleştirilen büyük bir piyasa satış emri oldu.

Önemli bir Kripto Twitter traderi olan @52kskew, şu anki fiyatlarla 467 milyon doların üzerinde değere sahip 16.000 Bitcoinlik satış emrinin, bu hızlı düşüşe yol açan uzun süreli sıkışmanın başlamasına muhtemelen sebep olduğunu belirtti.

Şimdilik bu sadece bir iddia ve gerçek kanıt bulunmamakla birlikte, bu satış emri, milyonlarca dolar değerindeki vadeli işlem varlıklarının tasfiyesine yol açarak Bitcoin’in değerindeki düşüşü etkilediği düşünülüyor. Piyasa şu anda stabil devem ederken, geri çekilmenin sonucu olarak altcoinlerde %5’lik bir toparlanma gözlemleniyor.

Yorumlar kapatılmış.