Menkul Kıymetler ve Borsa Komisyonu’nun (SEC) şu anki başkanı Gary Gensler, ABD Temsilcisi Warren Davidson’un SEC başkanını görevden alacak bir yasa teklif etme ”niyetini” açıklamasıyla yakında kendisini işsiz bulabilir.

16 Nisan’da Ohio Kongre Üyesi, SEC Başkanını yeni bir direktörle değiştirmeyi amaçlayan bir yasa tasarısı sunmayı planladığını açıkladı. Bu eylem, kripto para sektörüne karşı alınan pek çok önleme cevaben, birçok siyasinin SEC’in aşırı düzenlemelerine karşı olduğunun kanıtı olarak görülebilir.

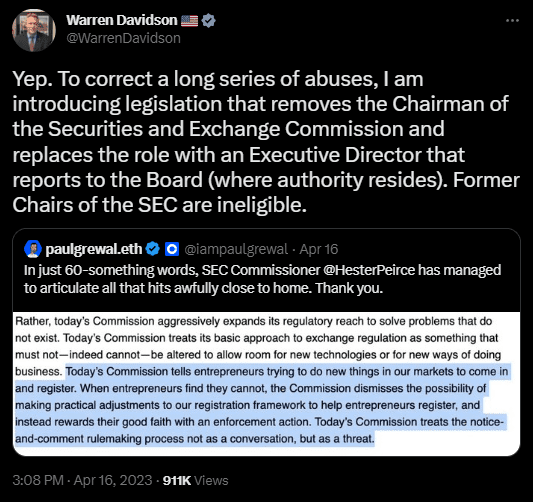

ABD Kongre Üyesi Warren Davidson, 15 Nisan’da bir tweet’te, Coinbase’in hukuk müdürü Paul Grewal’a yanıt vererek, Gary Gensler’in SEC Başkanı olarak görevinden alınmasını talep etme niyetini dile getirdi.

Bu yasa tasarısını duyurarak Davidson, SEC Başkanı Gary Gensler’in liderliğinde yapılan bir dizi suistimal konusundaki endişesini dile getirdi. Bu sorunları ele almak için yetkinin nihayetinde bulunduğu Yönetim Kurulu’na rapor verecek bir İcra Direktörü ile SEC Başkanını değiştirmeyi amaçlayan bir yasa öneriyor.

Bu hamle, Davidson’ın SEC yönetiminin yeniden yapılandırılması ve daha büyük hesap verebilirliği sağlama arzusu nedeniyle önemli bir adım. Ayrıca, özellikle kripto para sektöründe hızla gelişen finansal manzara içinde düzenleyici, aşırı erişime dair kaygıları hafifletebilir.

14 Nisan’da Gensler, önerilen düzeltmelerin belirli aracı kurumlara daha fazla düzenleyici denetim sağlayarak ve bir borsayı tanımlayan düzenlemeleri değiştirerek yatırımcı ve piyasalara yardımcı olabileceğini söylemişti.

İlk olarak Ocak 2022’de önerilen bu revizyonlar, SEC’in yargı yetkisinin kötüye kullanıldığını ve potansiyel olarak sektör katılımını engellediğini düşünen kripto savunucusu kuruluşlar tarafından eleştirildi.

Kripto Anne de SEC’e Karşı Bir Tutum İçinde

14 Nisan’da, pro-kripto tutumu nedeniyle “Kripto Anne” olarak anılan SEC komisyon üyesi Hester Peirce, yeni kural değişikliklerine güçlü bir şekilde karşı çıktığını ifade etti. Peirce, açıklamasında, SEC’nin son zamanlardaki önlemlerinin sektörde durgunluğa, merkezileşmeye, yabancılaşmaya ve nihai olarak yok olmaya yol açabileceği konusunda uyarıda bulundu.

“Geçmişte yaptığımız gibi yeni teknolojinin vaadini benimsemek yerine, burada durgunluğu, merkezileşmeyi zorlamayı, yabancılaşmayı teşvik etmeyi ve yeni teknolojinin yok olmasını kabul etmeyi öneriyoruz.”

Hester Pierce.

Teknoloji yanlısı ve yenilikçilik savunucusu, “Buna göre, karşı çıkıyorum” diye ekledi.

Peirce, geçmişteki teknolojik gelişmeleri memnuniyetle karşılama uygulamasının aksine, mevcut SEC’in var olmayan sorunları çözmek için yetkisini hızla genişlettiğini belirtti. SEC’in değişen teknoloji ve yaratıcı iş uygulamalarına uyum sağlamak için mevcut düzenlemeleri değiştirmeyi reddeden bir pozisyon aldığına inandığını belirtti.

Peirce yaptığı açıklamada, SEC’in piyasaya yeni fikirler sokmak isteyen girişimcilere esasen girişimlerini kaydetmelerini söyleyen mesajını eleştirdi. Ayrıca SEC’i, düzenleyicinin amaçları ve prosedürleri hakkında soru işaretleri uyandırarak yatırımcıları sindirmek için “bildirim ve yorum kural koyma süreci“ni kullanmakla suçladı.

“Girişimciler bunu başaramadıklarında, Komisyon, girişimcilerin kayıt olmalarına yardımcı olmak için kayıt çerçevemizde pratik düzenlemeler yapma olasılığını yok sayar ve bunun yerine iyi niyetlerini bir yaptırım eylemiyle ödüllendirir.”

Hester Pierce.

Son SEC hamleleri kripto meraklıları ve piyasa katılımcıları arasında endişeye neden oldu. Kongre Üyesi Warren Davidson tarafından önerilen, SEC Başkanını İcra Direktörü ile değiştirme teklifi, düzenleyici aşırılığı azaltmayı ve daha iyi hesap verebilirlik sağlamayı amaçlıyor. Önerilen düzenlemelerin ve yeniden yapılanmanın, hızla değişen finansal dünya için daha dengeli ve destekleyici bir düzenleyici çerçeve oluşturma konusunda istenen etkiyi yaratıp yaratmayacağı henüz net değil.