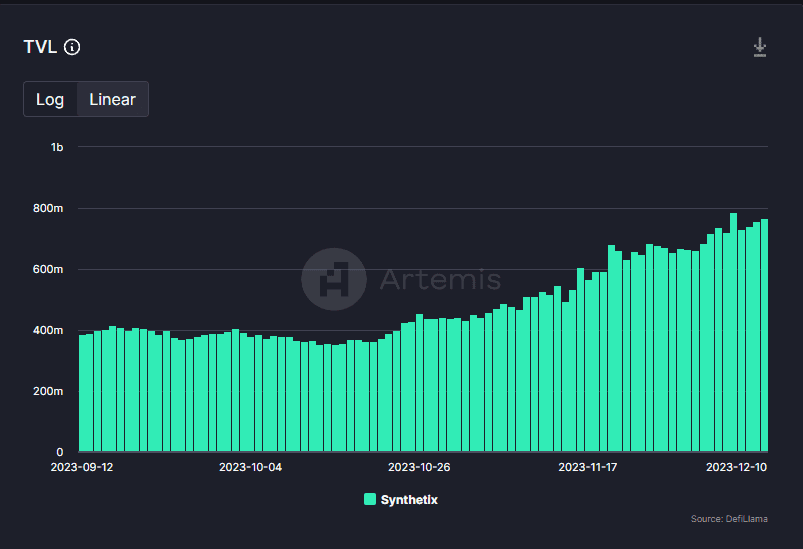

17 Aralık’ta $SNX resmi olarak token enflasyonunu bitiriyor. Ardından Build On Base üzerindeki perps’in yakın gelecekte devreye girmesiyle, al ve yak mekanizması devreye girecek ve SNX token arzı deflasyonist haline gelecek. Daha önceden bu durumun SNX coin üzerinde oluşturduğu satış baskısının artık azalacağına işaret.

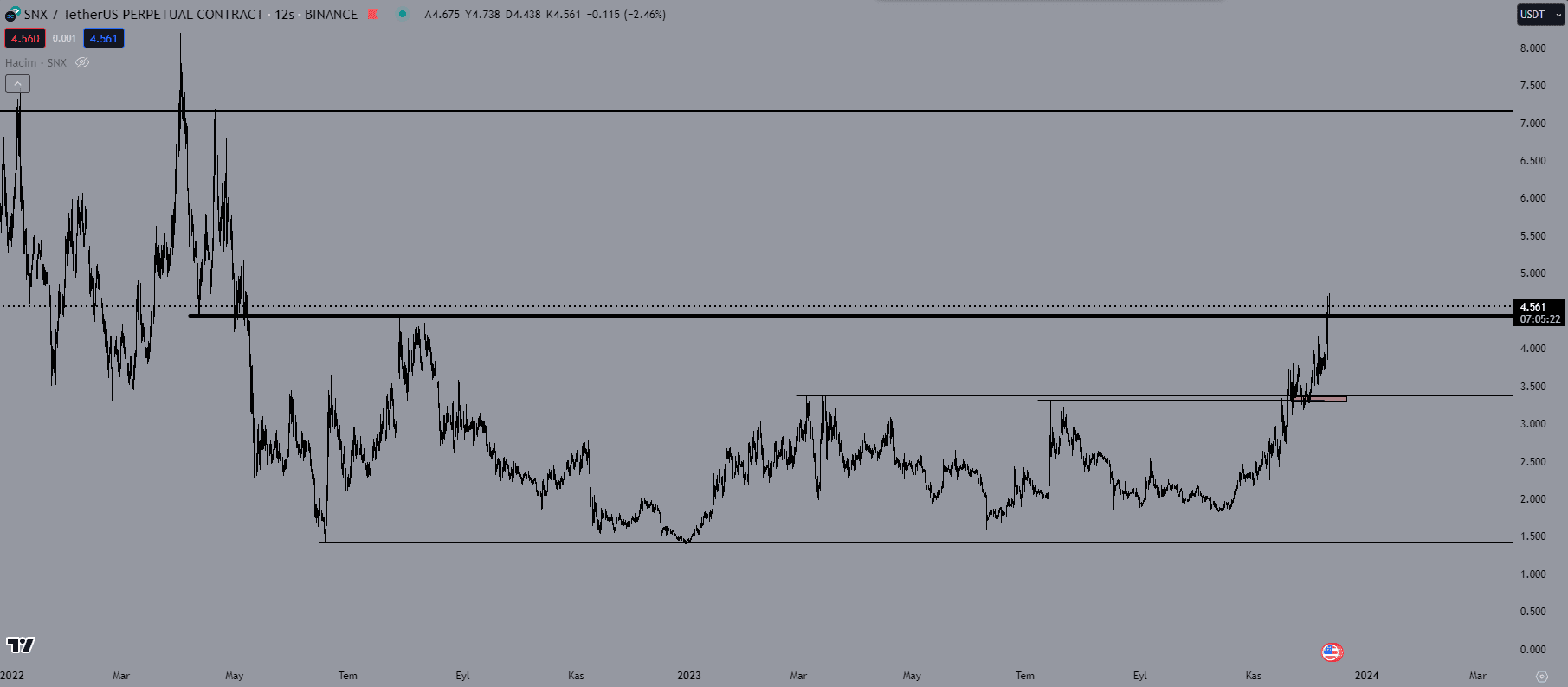

Yüksek zaman diliminde fiyat 3.387$ seviyesini kazandıktan sonra o bölgeyi destek haline getirip 4.446$ seviyesine kadar yükseliş gerçekleştirdi. Bu noktada fiyatın 4.446$ seviyesi üzerinde kalıcılık göstermesi durumunda, bir sonra ki direnç alanı olarak takip ettiğim seviye 7.172$ seviyesi. Enflasyonist yapısının değişeceği açıklandığı günden beri fiyat yükseliş momentumunu hiç kaybetmedi. Temel tarafta bullish olduğu için bu paritede short aramaktansa uygun destek seviyelerinden long denemelerinin daha mantıklı olacağını düşünüyorum.

Burada paylaşılan analizler yatırım tavsiyesi olmamakla beraber, piyasada kısa-orta vade işlem fırsatı verebileceğini düşünülen destek direnç seviyeleridir. İşlem alma ve risk yönetimi sorumluluğu kullanıcının kendisine aittir. Paylaşılan işlemlerde stop loss kullanmanız şiddetle tavsiye edilir.