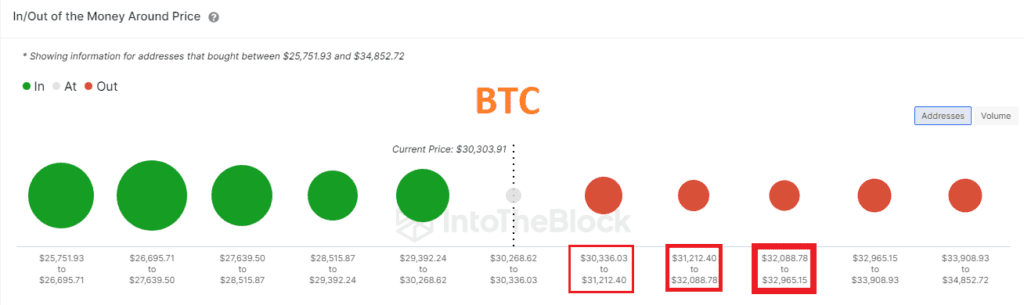

Onchain üzerinde $25750-$28515 maliyetli kullanıcılar yüksek karda görünüyor. $30335-$32088 maliyetli kullanıcıların zararı ise oldukça azalmış durumda. Kırmızı küreler ne kadar büyük , yeşil küreler ne kadar küçük ise yükseliş ihtimali o kadar yükselir. Yeşil küreler ne kadar büyük, kırmızılar küreler ne kadar küçük ise düşüş ihtimali o kadar yükselir. Kürelerin bulunduğu seviye aralıkları güçlü destek ya da güçlü direnç olarak çalışabilir. Bitcoin, kısa vadede potansiyel tepe konumuna yaklaşmış görünüyor, long yönlü işlemlerde dikkatli olmakta fayda olacaktır.

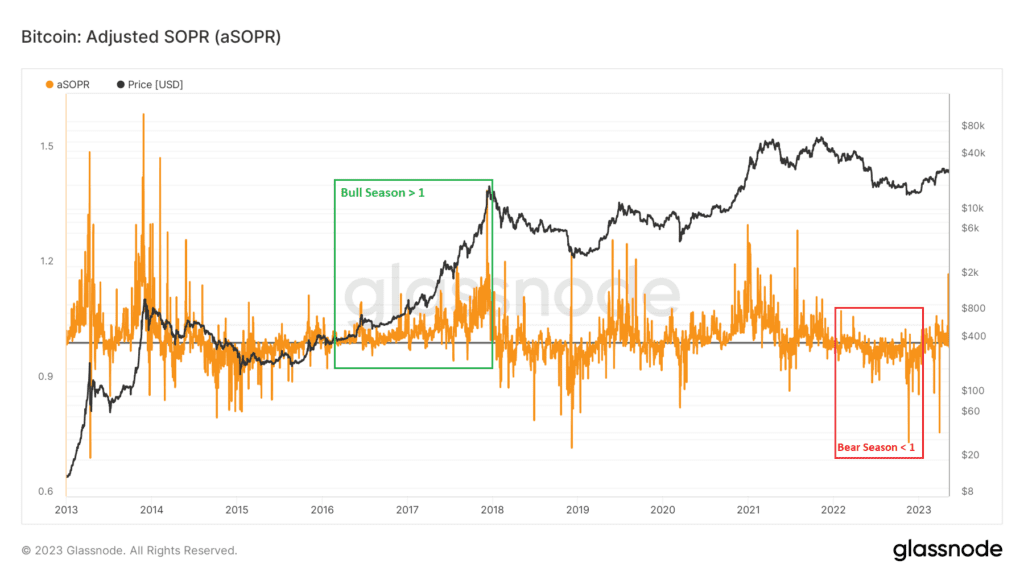

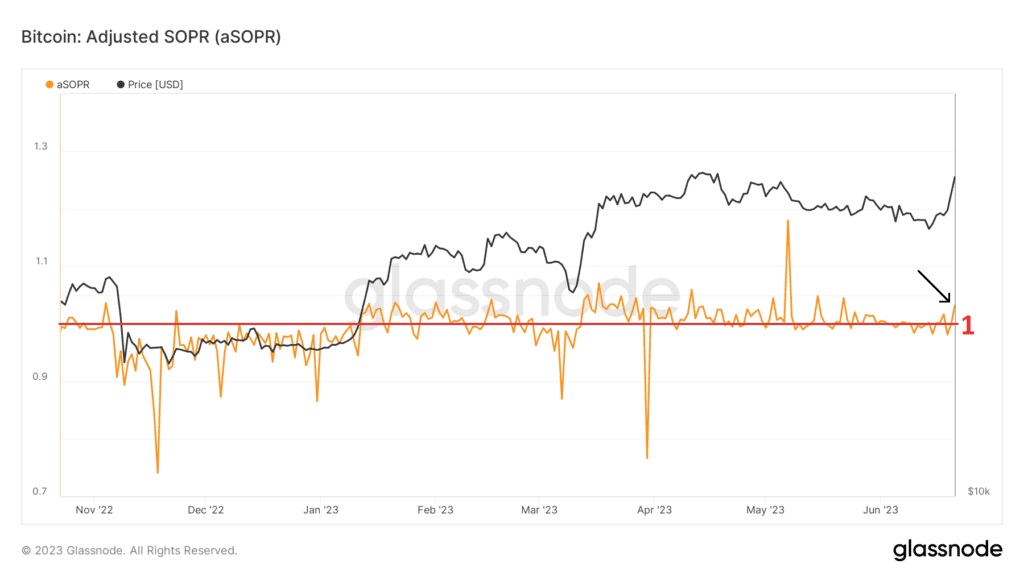

ASOPR verisi boğa sezonlarında çoğunlukla 1 seviyesi ve üzerinde, ayı sezonunda 1 seviyesi ve altında performans göstermiş. Bitcoin boğa sezonunda ise bu verinin 1 seviyesinden yukarıda tutunması gerekir. Mevcut görünüm kısa vadede olumlu görünüyor.

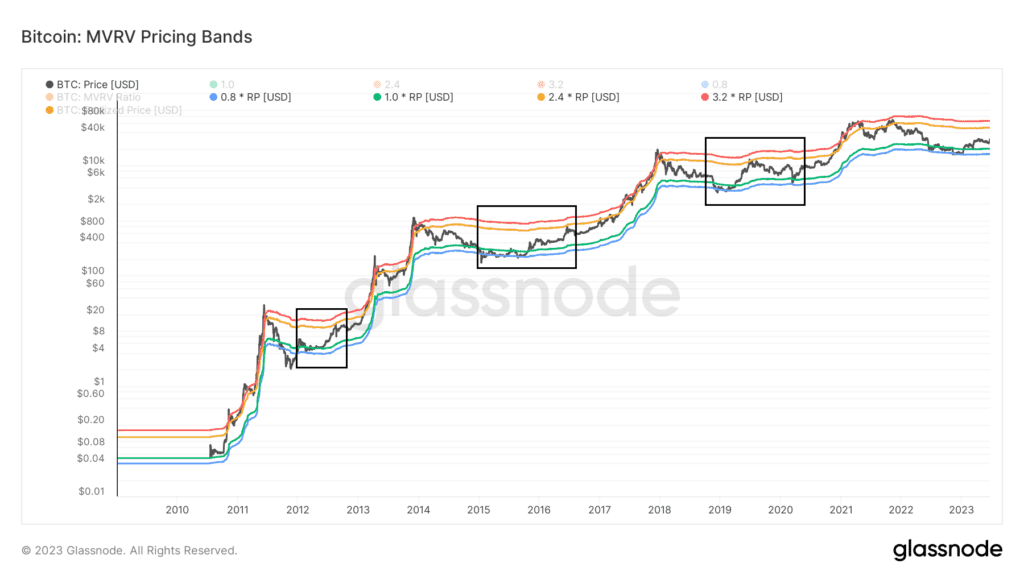

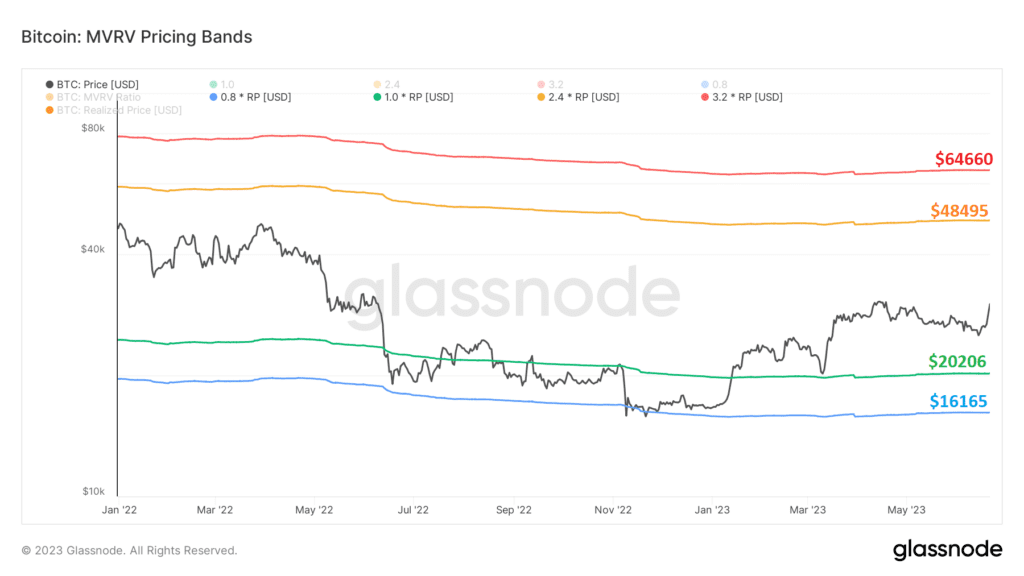

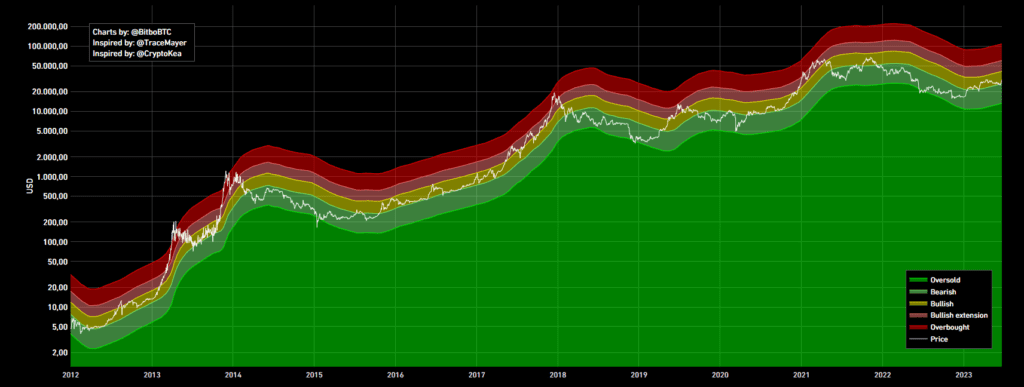

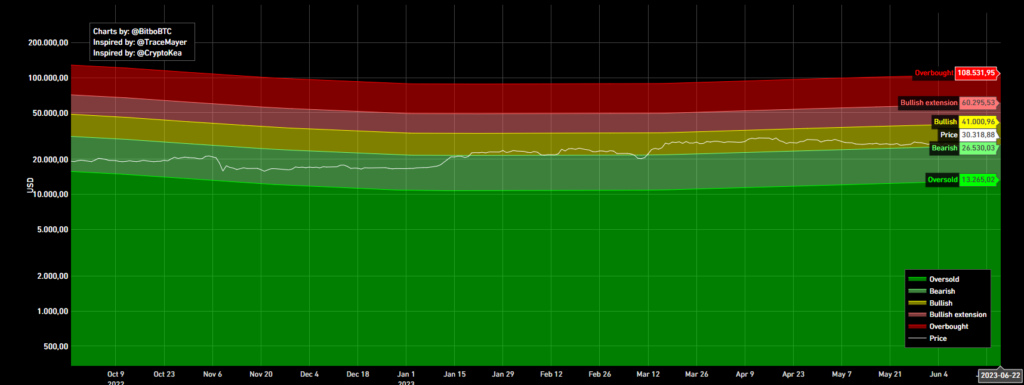

Bitcoin, geçmişte yeşil ve mavi bantlar arasındaki hareketinden sonra yükseliş yaşamış ve ardından turuncu banda kadar yükseliş göstermiş. Kesinlik yok ancak şu anki fiyat hareketi de aynı şekilde olursa bugünkü turuncu direnç $48495. Yeşil destek bandı fiyatı $20206.

Bir önceki analizimizde MVRV Z-Score tablosunun kısa vadeli desteğini kaybettiğini ve daha güçlü desteğe geçtiğini belirtmiştik. Bu destekten çok iyi tepki almış gibi görünse de kısa vadede potansiyel dirençlere yaklaştığını söyleyebiliriz. Önündeki direnci aşabilirse bir sonraki dirence ilerlemek isteyecektir. Bu fiyata oldukça olumlu şekilde yansıyacaktır.

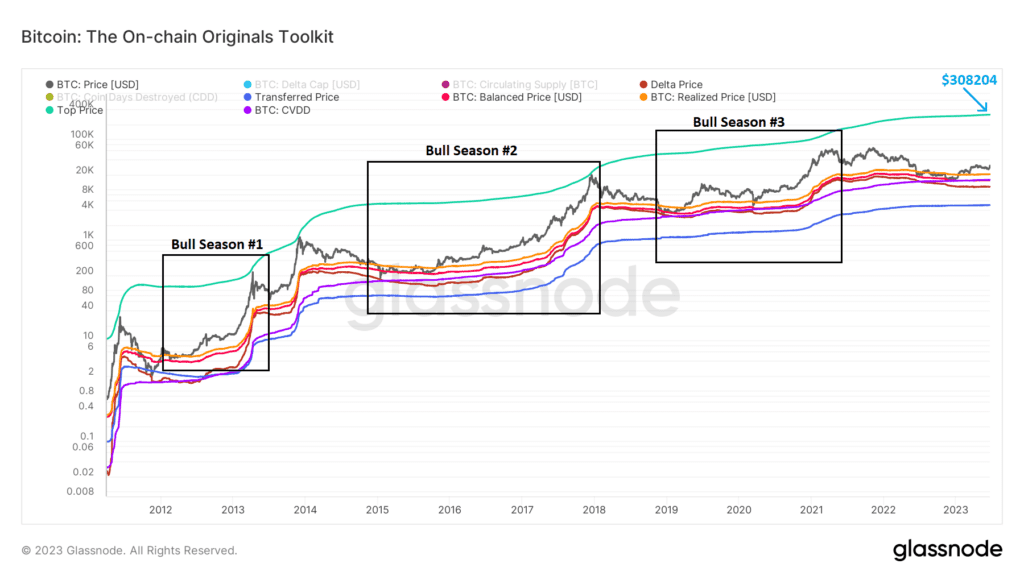

Bu grafikteki veriye göre Bitcoin, bordo ve mor bantlarda tutunduktan sonra turuncuya ilerlemiş. Turuncu bant üstünde tutundukça boğa sezonu yaşanmış ve turkuaz banda ilerleme görülmüş. Bugünkü turuncu bant desteği $20206. Bu değer aynı zamanda Bitcoin’in “gerçek değerini“ temsil ediyor. Önceki boğa sezonlarında bitcoin aynı hareketi yaptı, bu sefer hareket olarak ne yapacağını çok yakından takip edeceğiz.

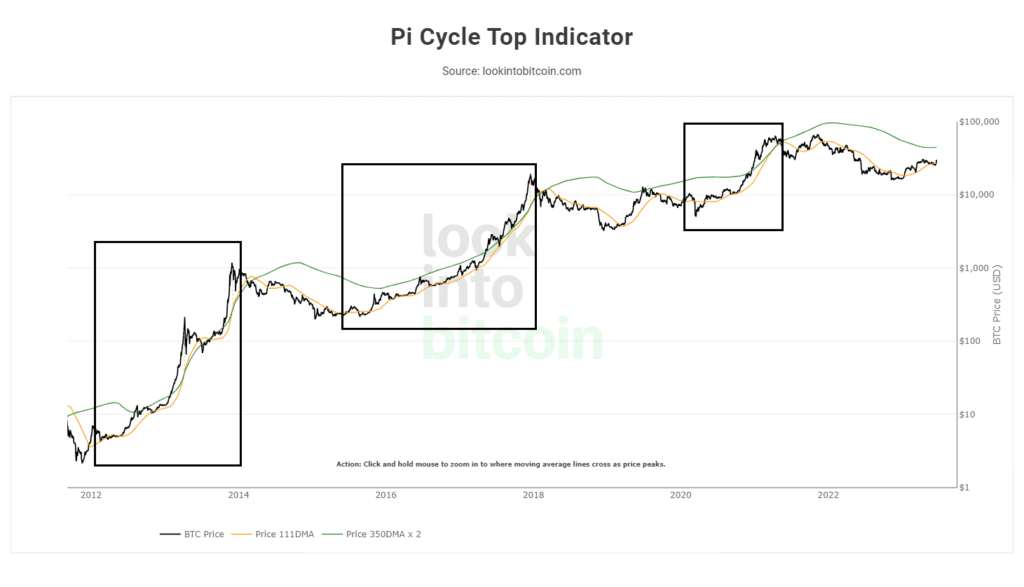

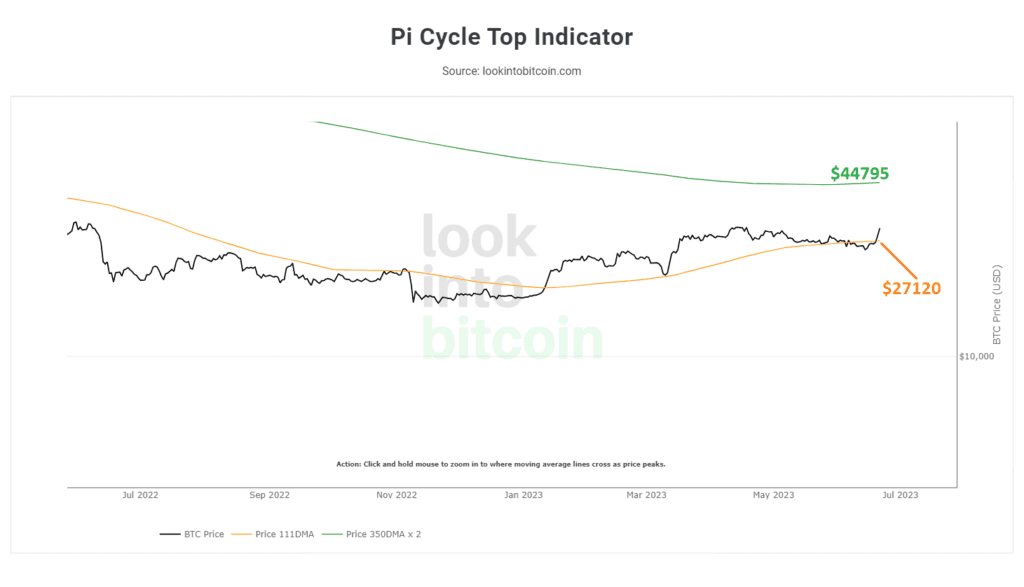

Bitcoin, 111 Günlük Hareket Ortalamasını (111D MA) tekrar kazandı. Bu fiyat hareketi için çok olumlu bir gelişme. Bitcoin önümüzdeki günlerde bu desteği dolardan kaybetmemeli. Önceki boğa sezonlarında, Bitcoin turuncu bandı kazandıktan sonra yeşil banda geçmişti. Yeşil Bant şu anlık $44795 dolar. Bu hareket olursa diye takip ediyor olacağız.

Bitcoin, önceki günlerde, bearish bant desteğini kaybetti ve $24750 dolarlara sert şekilde düştü. Ancak Bitcoin, bu desteğini yeniden kazandı ve çok hızlı şekilde yükseldi. $26530 desteğini kaybetmemeli ve sert yükselişler için Boğa Bandı Desteğini $41000 kazanması gerekiyor.

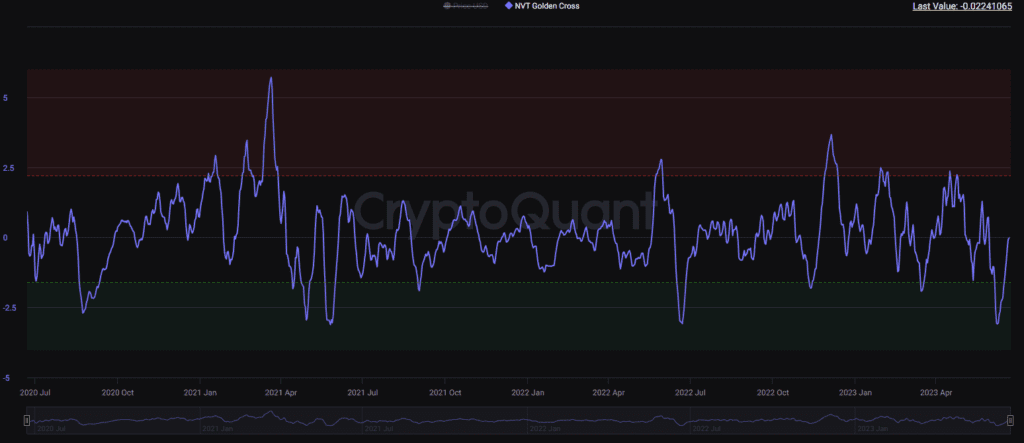

NVT Golden Cross indikatörü, fiyat düşüşü sırasında güçlü destek alanına ilerledi. Bitcoin o alanı korudu ve destek bölgesinden büyük tepki aldı. Şu an, orta bant direncine doğru ilerliyor. Önümüzdeki günlerde takip ediyor olacağız.

Onchain verileri ve açıklamalarına yazımızdan göz atabilirsiniz.

Onchain analiz, blockchain piyasalarından elde edilen verilerden oluşur ve sadece borsalara giriş ve çıkışları yansıtır. Bu veriler olumlu veya olumsuz şekilde yorumlanabilir, ancak boğa veya ayı piyasasıyla ilgili kesin bir öngörü içermez. Yukarıda paylaşılan tüm analizler eğitim amaçlıdır, bu gönderi herhangi bir finansal tavsiye içermez.