Küresel piyasalarda Amerika’daki borç limiti krizi endişesi devam ederken, Haziran ayı itibarıyla Amerika’nın borçlarını ödeyemeyecek olma ihtimali nedeniyle piyasalarda korku hakim olmaya devam ediyor. DXY’nin yükselişe geçmesiyle beraber dolar karşısındaki pek çok riskli varlığın değer kaybetmesine rağmen, yatırımcıların Nasdaq ve S&P500’e yönelmesiyle beraber önemli direnç bölgeleri kazanılmış durumda. Çarşamba günü ABD Hazine Bakanı Yellen’in konuşmasının ardından yayınlanacak olan FOMC tutanakları fiyatlar üzerinde etkili olacaktır.

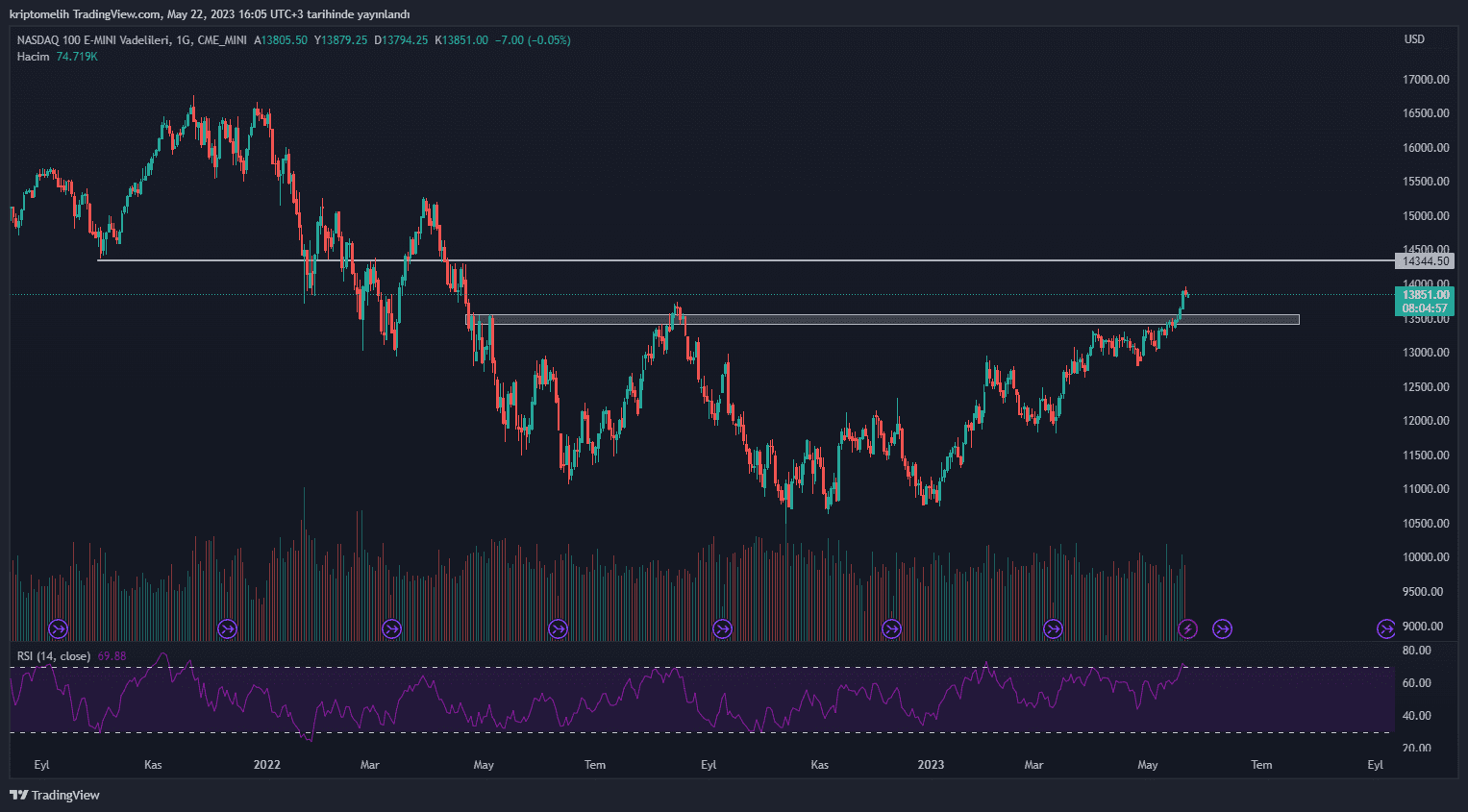

Teknik olarak incelediğimizde NQ, direnç bölgesini kazanmasıyla beraber yükselişini sürdürürken, tepki alması muhtemel ilk önemli direnç seviyesi 14.344$. Olası bir geri çekilmede tepki alabileceği destek, 13.355$ bölgesi.

Direnç bölgesi olan 4.206$ seviyesi henüz kazanılmış değil. Bu bölgenin kazanılmasıyla beraber bir üst direnç olan 4.306$ bölgesine kadar yükseliş görülebilir. Olası bir geri çekilmede ilk destek seviyesi olarak 4.150$ takip edilebilir.

Yaşanan bankacılık krizleri ve önemli ülkelerin altın rezervlerini artırma haberleriyle yükseliş trendi oluşturan altın, çok önemli bir direnç bölgesi olan 2.071$ seviyesinden ret yiyerek tekrardan destek bölgesine kadar geri çekildi. Şu an için tepki aldığı 1.955$ – 1.940$ bölgesi, fiyatı tutabilecek ilk destek seviyesi. Bu alanın kaybedilmesi durumunda bir alt destek bölgesi olarak 1.916$ takip edilebilir.

Emtia ve Index paritelerindeki fırsatları PrimeXBT borsasına %20 indirimli üye olarak değerlendirebilirsiniz.