Ünlü NFT platformu OpenSea’deki eski Ürün Başkanı Nate Chastain’in NFT içeriden ticareti davasında, seçtiği NFT’leri OpenSea’nın ana sayfasında yer alacakları bilgisini kullanarak satın alarak ve ticaretini yaparak yaklaşık 50.000 dolar kazandığı suçlamaları ile New York federal mahkemesinde para aklama ve elektronik dolandırıcılık suçlarından mahkum edildiği öğrenildi.

Reuters haberine göre, Chastain’in yasa dışı faaliyetleri, kişisel olarak seçtiği NFT’leri satın alarak sadece kısa bir süre sonra büyük bir kar elde etmek için satmasıyla ilgiliydi ve bu durum dolandırıcılık ve para aklama suçlamalarına neden oldu.

OpenSea’deki konumunu kötüye kullandı

ABD Adalet Bakanlığı, kişisel kazanç sağlamak için OpenSea’deki konumunu kötüye kullandığı iddia edilen Chastain hakkında dava açtı. Ürün Başkanı olarak, OpenSea’nın ana sayfasında sergilenmesi için seçilen NFT’lerden sorumlu olan Chastain, bu gücü yasadışı kar elde etmek için kullandığı iddialarıyla Eylül 2021’de istifa etmek zorunda kalmıştı.

Haziran’dan Eylül 2021’e kadar Chastain, platformda düşük fiyatlara satışa sunulacağını bildiği NFT’leri satın alarak, sonrasında artan ilgi nedeniyle değerleri yükseldiğinde şişirilmiş fiyatlarla satışa çıkararak 50.000 dolardan fazla kazandı. Savcılar, Chastain’in anonim cüzdanlar ve OpenSea hesapları kullanarak faaliyetlerini gizlemeye çalıştığını iddia ettiler. Bugün itibariyle son 24 saat içinde OpenSea’da 4,5 milyon dolardan fazla işlem gerçekleşti, bu da platformun NFT piyasasındaki önemli varlığına işaret ediyor.

Chastain, 40 yıla kadar hapis cezası ile karşı karşıya.

“Nathanial Chastain, OpenSea’nın web sitesinde hangi NFT’lerin yer alacağına dair ileri düzey bilgisini kullanarak, kendisi için kârlı işlemler yaparak pozisyonunu istismar etti. Bu dava, kripto varlıklarında yeni işlemleri içermesine rağmen, onun davranışında özellikle yenilikçi bir şey yoktu – bir dolandırıcılıktı.”

ABD Başsavcısı Damian Williams.

OpenSea’deki yüksek rütbeli bir çalışan olarak, Chastain’in iddia edilen içeriden ticaret faaliyetleri, bu platformdaki kullanıcıların güvenini potansiyel olarak zedeleyebilir. Bu yasa dışı faaliyetlerden elde ettiği 50.000 dolarlık tutar, büyüyen merkezi olmayan platformlar için üzücü bir durum oluşturuyor. OpenSea her gün milyonlarca dolarlık NFT işlemlerinin yapıldığı en yaygın platform.

Chastain’in davası yasal sistemde ilerledikçe, platformlar ve düzenleyicilerin kullanıcıları korumak için açık yönergeler oluşturması ve önleyici adımlar atması, NFT piyasasındaki genel güveni korumak için önemli bir durum.

NFT trader’ı ve habercisi Lexie adında bir Twitter kullanıcısı, konuyla ilgili bir dizi tweet yayınlayarak davayla ilgili bilgi paylaştı. “OpenSea’nın eski yöneticisi Nate Chastain, dolandırıcılık ve para aklama suçlamalarından mahkum oldu” diye başladı.

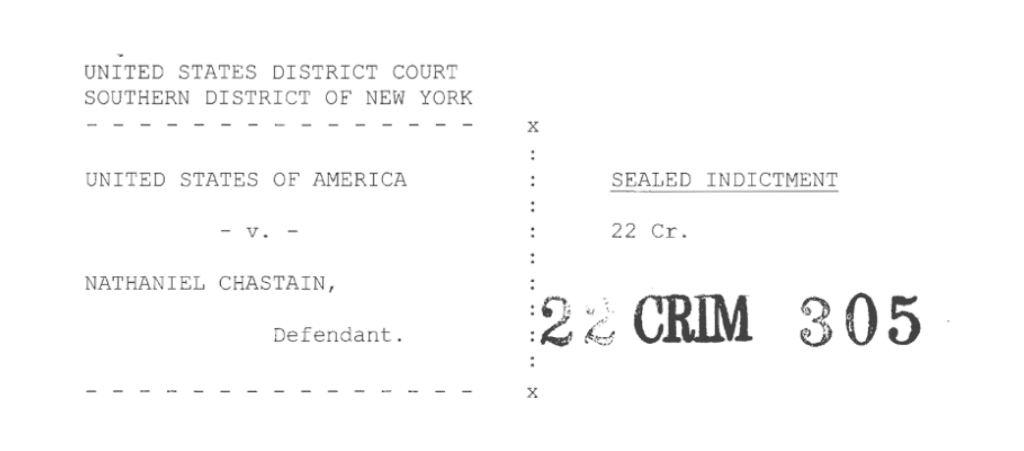

Bu dava Chastain’in ilk davası değil, Haziran 2022’de ABD Güney Bölgesi New York Mahkemesi, Chastain’e karşı dolandırıcılık ve para aklama suçlamalarıyla dava açtı ve bu, dijital varlıkları içeren ilk içeriden ticaret davası oldu. Prosedür nedenleriyle davayı düşürme girişimlerine rağmen, Chastain 24 Nisan’da başlayan Manhattan’daki duruşmada yargılanmaya devam etti. Üç gün süren müzakerelerin ardından, jüri Chastain’i her iki suçtan da suçlu bulmuştu.

Sonuç olarak, OpenSea’deki eski Ürün Başkanı Nate Chastain’in suçlu bulunması, hızla büyüyen NFT piyasasındaki potansiyel riskleri vurguluyor. Dijital varlıkları içeren ilk içeriden ticaret davası olarak, bu dava, NFT alanındaki şeffaflığın önemini hatırlatıyor. Platformların, NFT piyasasının itibarını korumak için önleyici tedbirler geliştirip geliştiremeyeceği henüz net değil. Merkezi olmayan bir platformda hangi önlemlerin uygulanabileceği hala belirsizliğini koruyor.