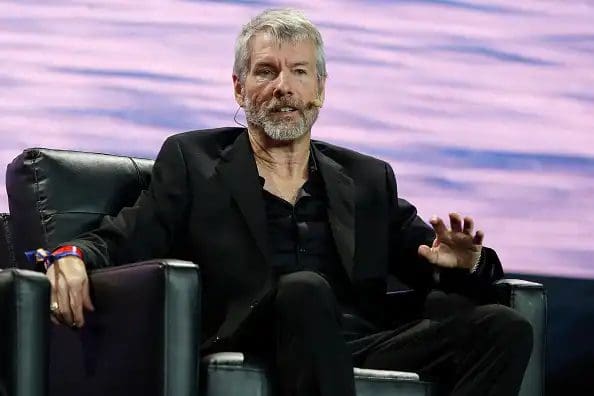

Michael Saylor, MicroStrategy’nin kazanç raporlarının açıklanmasının ardından CNBC’yle bir röportaj gerçekleştirdi. MicroStrategy’nin CEO’su olarak tanınan Saylor, Bitcoin konusundaki pozitif tutumuyla biliniyor.

“Asla çok fazla Bitcoin’e sahip olamazsınız.”

”Bitcoin’in Değeri Artacak, Halving Önemli”

Saylor açıklamalarında ilk olarak, Bitcoin’in arz-talep dengesinde önemli bir değişiklik olacağını belirtti. Bitcoin madencilerinin ayda yaklaşık 1 milyar dolar, yıllık neredeyse 12 milyar dolar değerinde Bitcoin sattığını belirten Saylor, Nisan 2024’te gerçekleşmesi beklenen Bitcoin yarılanması (halving) ile bu satışların yarıya düşeceğini öngörüyor. Bu durumun Bitcoin’in değerini artırabileceğini söylüyor.

Spot Bitcoin ETF’leri de Etki Edecek

Saylor’a göre spot bitcoin ETF’lerinin talep yaratması da değerin artışında rol oynayacak. Bunun yanı sıra, şirketlerin Bitcoin varlıkları için uygulayacakları yeni muhasebe kuralları, Bitcoin’in daha geniş bir kabul görmesini sağlayacak.

“Uzun vadede bu, şirketlerin Bitcoin’i bir hazine varlığı olarak benimsemeleri ve bilançolarıyla hissedar değeri yaratmaları için kapıyı açacak.”

Saylor, endüstrinin mevcut sorunlarına da değindi. Özellikle kripto para sektöründeki dolandırıcılık davalarının Bitcoin’in itibarını zedelediğini belirtti.

MicroStrategy Kazanç Raporu Yayımlandı: Zarar Artışına Rağmen Bitcoin Alımı Devam Ediyor

Ekim ayında 155 BTC daha satın aldıklarını açıklayan şirketin 3. çeyrekte 6.067 Bitcoin satın alarak toplamda 158.400 Bitcoin‘e ulaştığı belirtildi. Ancak şirketin finansal durumu pek de parlak değil. 3. çeyrekte 129,5 milyon dolar gelir elde edilmesine rağmen, 143,4 milyon dolar net zarar açıklandı.

Kaynak: Coindesk