2023, sıkılaşan para politikaları, ABD dolarının güçlenmesi ve devam eden enflasyon gibi küresel ekonomik etkenler nedeniyle hem zorlu hem de öngörülemeyen bir yıl oldu. Ancak bu, yatırımcıların ve merkez bankalarının kripto paralara olan ilgisinin azaldığı anlamına gelmiyor. Tam tersine, birçok uzmana göre, bu dönemde Bitcoin’in küresel alandaki önemi daha da arttı.

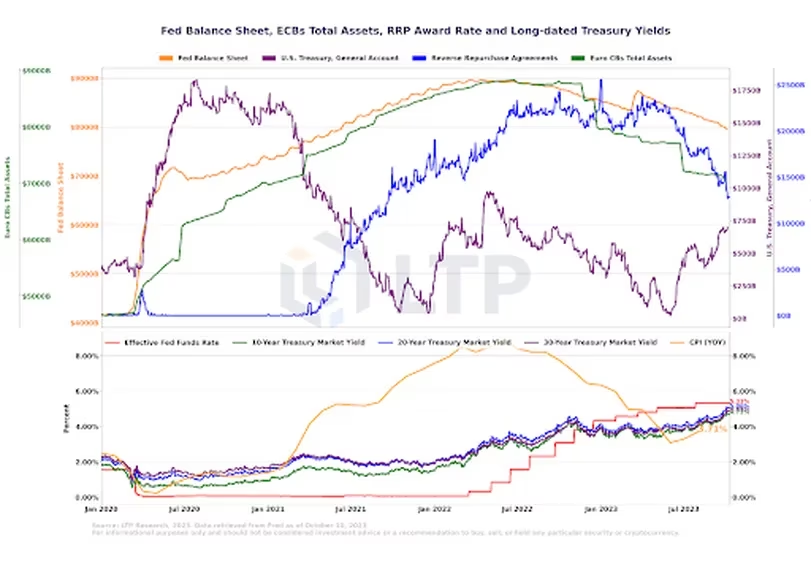

Yılın en önemli olaylarından biri, Federal Reserve (FED) ve Avrupa Merkez Bankası’nın sıkılaştırma politikaları oldu. Bu politika, Hazine tahvillerinin satışıyla getirilerde yukarı yönlü baskı oluşturdu.

Detaylar; ABD Tahvil Faizlerinde 16 Yılın Zirvesi: Piyasalar Powell’ın Konuşmasını Bekliyor

2023’te, FED ve Avrupa Merkez Bankası’nın niceliksel sıkılaştırması Hazine tahvil getirilerini yükseltti. Agresif faiz artırımları bu baskıyı daha da artırarak getirileri yılın en yüksek seviyelerine çıkardı.

2008’den bu yana rekor seviyeye ulaşan Hazine tahvili getirileri ve ABD dolarının güç kazandığı yönündeki yorumlar, yatırımcıların daha riskli kripto varlıklarından, geleneksel ve daha güvenli finansal araçlara yönlenmesine neden oldu. Altın, bu dönemde en çok yükselen emtialardan biri oldu.

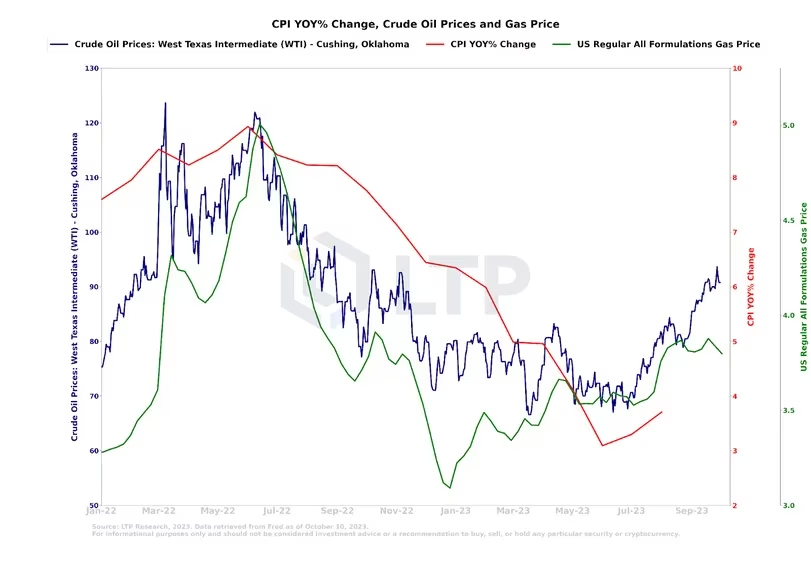

Bu dönemde ise, İsrail-Hamas çatışması devam ederken, altın ve petrolde gerçekleşen yükseliş dikkat çekti.

Ancak, yıl içindeki belirsizlikler sadece bu faktörlerle sınırlı değildi. Mart 2023’te yaşanan banka krizleri sonrasında Federal Reserve, likidite sıkışıklığına yanıt olarak Banka Hazine Kolaylığı Programını (BTFP) devreye aldı. Ne var ki, bu programın uzun vadeli etkisi henüz gözlenebilmiş değil.

Enerji Fiyatları Zirvesine Ulaştı

Bu dönemin en dikkat çekici özelliklerinden biri, ABD’de enerji fiyatlarında yaşanan sıradışı artış oldu. Hem gaz hem de ham petrol fiyatları yılın zirvesine ulaştı. Bu, kripto piyasaları üzerinde de belirgin bir etkiye neden oldu; ticaret hacimleri de yılın başından bu yana azalmıştı.

SEC’nin kripto para endüstrisine yönelik artan denetimi, piyasa katılımcıları arasında düzenleyici belirsizliklere yol açtı. Bunun yanında, artan jeopolitik belirsizlikler, İsrail-Hamas savaşı, öncesinde devam eden Ukrayna-Rusya savaşı gibi etkenler yatırımcıların kripto para birimleri gibi volatil varlıklarından çıkmalarına yol açtı.

Küresel Petrol Ulaşımı Tehlikede

Reza Falakshahi gibi uzmanlar, artan gerginliklerin, global petrol ticaretinin büyük bir bölümünün gerçekleştiği Hürmüz Boğazı gibi stratejik noktalarda aksamalara yol açabileceği konusunda endişeli. Potansiyel çatışma bölgelerinde meydana gelebilecek ciddi arz kesintileri, enflasyonist baskıları artırabilir ve dünya genelinde merkez bankalarını tüketici fiyatlarındaki yükselişle başa çıkmak adına daha agresif faiz politikalarını benimsemeye itebilir.

Ancak, kripto paraların geleceği hakkında olumlu bazı görüşler de var. Bazı uzmanlar, Bitcoin’in ilerleyen zamanlarda altın benzeri bir değer saklama yöntemi haline gelebileceğini savunuyor. Nitekim Bitcoin, son dönemdeki onca belirsizliğin arasında yükselişine devam ediyor.

Bitcoin Tekrardan 30 Bin Dolar Üzerinde İşlem Görüyor

Bitcoin, son dönemde 27.500 dolarlık destek seviyesinden güçlü bir yükseliş gerçekleştirdi. Bitcoin artık 30.000 doların üzerinde seyrediyor. Fiyat, son birkaç haftanın en yüksek seviyesi olan 30.600 doları gördü.

Bitcoin’in bu başarısı sadece teknik verilere dayalı değil. Kripto paralar, Amerika’daki belirsizlikler, savaş tehditleri ve ekonomik zorluklar gibi küresel çalkantılar devam ederken bir kaçış yolu olarak kendini ortaya çıkartıyor. Bu olumsuzlukların ortasında ise birçok yatırımcı, Bitcoin’e yöneldi, bu da onun değerindeki artışta etkili oldu.

BTC Yükselişine Devam Edecek mi? 21.10.2023

Kaynak: Coindesk, Ninja News.