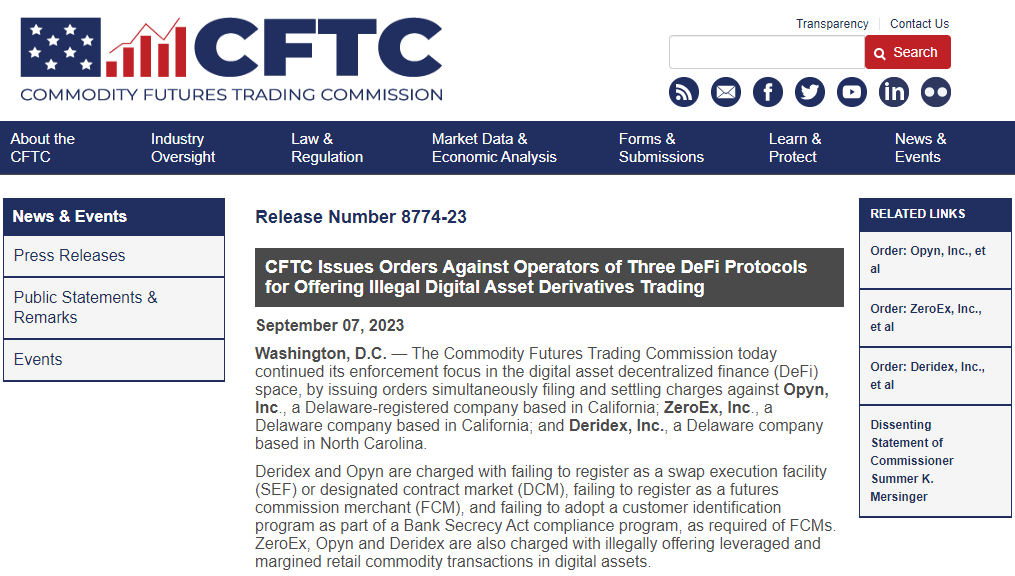

Merkeziyetsiz Finans (DeFi) sektöründe dalgalar yaratabilecek bir dönüm noktası kararında, ABD Emtia Vadeli İşlemler Komisyonu (CFTC), önde gelen üç DeFi şirketi—Opyn, ZeroEx ve Deridex’a karşı yaptırım eylemleri duyurdu.

Çeşitli düzenleyici ihlallerle suçlanan bu şirketler, ağır para cezaları ve katı operasyonel kısıtlamalarla karşı karşıya.

Suçlamaların Ayrıntıları ve Detaylar

CFTC, Opyn ve Deridex’ı takas işlemi yapabilen bir tesis (SEF) veya belirlenmiş bir kontrat pazarı (DCM) olarak kaydolmamış olmaktan suçladı. Ayrıca, vadeli işlemler komisyon tüccarı (FCMs) olarak kaydolmamış olmak ve Müşteri Tanıma Programını Banka Gizliliği Yasası uyum programının bir parçası olarak uygulamamış olmakla da suçlandılar. ZeroEx, sonraki suçlamalara katılırken, üç şirket de dijital varlıklarda kaldıraçlı ve marjlı perakende emtia işlemleri sunarken yasadışı davranmakla suçlandı.

Bu terimlerle aşina olmayanlar için, bir SEF, katılımcıların takas işlemleri yapabileceği bir ticaret platformudur. DCM’ler, gelecek sözleşmelerinin ticaretinin yapıldığı resmi borsalardır ve FCM’ler, gelecek veya opsiyon sözleşmeleri için sipariş talep eden veya kabul eden bireyler veya firmalardır.

Yaptırımlar

Bu şirketler (Opyn, ZeroEx ve Deridex) sivil para cezalarıyla karşı karşıya.

Opyn 250.000 dolar, ZeroEx 200.000 dolar ve Deridex 100.000 dolar para cezası alacak. Ayrıca, Emtia Değişim Yasası (CEA) ve CFTC düzenlemelerine daha fazla ihlal yapmamaları gerekiyor.

Dava Arka Planı

- Opyn, Inc.: Kayıtsız bir platformda oSQTH adlı dijital varlık türevi tokenin ticaretini sundu. Platform, FCM kaydı gerektiren faaliyetlerde bulundu.

- Deridex, Inc.: “Sürekli sözleşmeler” adı verilen, sanal paralarda kaldıraçlı türev pozisyonları sunuyordu, fakat uygun bir şekilde kayıtlı değildi.

- ZeroEx Inc.: Çeşitli dijital varlıkların ticaretini kolaylaştıran Matcha adlı bir ön yüz uygulaması geliştirdi, bu varlıkların bazıları kaldıraçlı tokenlardı ve yine uygun bir şekilde kayıtlı değildi.

CFTC’nin Opyn, ZeroEx ve Deridex’a karşı eylemleri, düzenleyici organların filizlenmekte olan DeFi sektörüne nasıl yaklaşacakları konusunda bir örnek olabilir. Bu eylem, bu tür platformların mevcut yasalara uyum sağlamalarının gerekliliğini sadece vurgulamakla kalmıyor, aynı zamanda DeFi endüstrisinin düzenleyici kısıtlamalara takılmadan nasıl ilerleyebileceği konusunda soruları da gündeme getiriyor.