Bir ay önce, Amerika Birleşik Devletleri Menkul Kıymetler ve Borsa Komisyonu (SEC), Amerika merkezli dünyanın en büyük merkeziyetsiz kripto para borsalarından biri olan Coinbase’e bir uyarı mektubu göndermişti. Bu mektubun ardından iki taraf arasında uzun soluklu bir gerilim başladı.

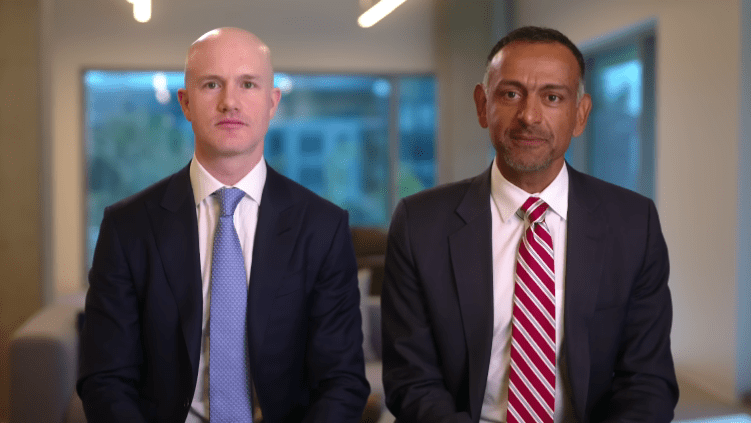

Perşembe günü, Coinbase CEO’su Brian Armstrong ve Baş Hukuk Müşaviri Paul Grewal, YouTube kanallarında yayınladıkları bir video mesajında SEC’ten aldıkları “Wells Bildirimi”ni konuştular.

Aynı gün Coinbase, Wells Bildirimine yanıt olarak SEC’e gönderdikleri bir mektubu da paylaştı. Mektupta, Coinbase, SEC personelinin şirketin en azından 2018’den beri yasadışı faaliyet gösterdiğini iddia ettiğini belirtiyor. Ancak Coinbase, personelin hukuki teorilerinin “kusurlu ve denenmemiş” olduğunu savunuyor.

Brian Armstrong, videoya Coinbase’in kuruluş hikayesini anlatarak başladı. Ona göre, “Kripto, küresel finans sistemini güncellemek için önemli bir teknolojidir,”

Armstrong’ın başlangıçtaki amacı, Coinbase’i Amerika Birleşik Devletleri’nde kurmaktı, ancak bunun tahmin edilenden daha zor olduğunu ortaya çıktı. Videodaki mesajında, bu zorlukların nedenlerini açıklamaya devam etti.

“Gerçekten ne yapmamız gerektiği açık değildi çünkü bu yeni bir sektördü. Açıklık olmamasına rağmen doğru şeyi yapmaya çalıştık, ancak amacımız düzenleyici açıklığın olmamasına rağmen güvenli ve düşünceli olmaktı.”

Coinbase’in CEO’su Brian Armstrong.

Komisyon üyelerine ve SEC’e bir mesaj bırakmak istediğini belirterek şöyle devam etti: “Düzenleyici çerçeve içinde çalışmaya kararlıyız. Kripto menkul kıymetlerin ticareti için açık bir piyasa yapısı görmek istiyoruz. Bu endüstriyi daha güvenilir hale getirmek için birden fazla düzenleyiciyle çalışacağız,”

Armstrong, “Wells Bildirimi” ile ilgili endişelerini dile getirerek, bu aşamada bunun açık olmadığını ve Amerika Birleşik Devletleri için faydalı olmadığını belirtti. Coinbase’in mahkemede duruşunu savunmaya hazır olduğunu vurgulasa da, bunun olmamasını umuyor. Armstrong ayrıca şirketin, tüm sektör için uygun ve çalışabilir bir yol bulmada işbirliği yaparak açık iletişimi sürdürmeye hazır olduğunu da ekledi.

“Mahkemede bu durumu savunmaya hazırız. Ancak bunun olması gerekmez. Sektörümüz için uygulanabilir bir yol hakkında gerçek bir diyalogu memnuniyetle karşılarız.”

Brian Armstrong.

Endişelerini dile getiren Armstrong, konuşmayı bir süre sonra Paul Grewal’a devretti. Grewal, daha önce SEC’e işlemlerine rehberlik etmesi için düzenleyici bir çerçeve talep eden mektuplar gönderdiklerini belirterek başladı. Ancak, SEC’ten herhangi bir yanıt almadıklarını da ekledi.

“Çok açık olmak istiyorum. Coinbase, menkul kıymetler listelememektedir. Menkul kıymet listelememek için SEC yönlendirmelerine dayalı sağlam bir süreç kullanıyoruz. İncelediğimiz varlıkların %90’ını reddediyoruz.”

Coinbase Baş Hukuk Müşaviri Paul Grewal.

Hem Armstrong hem de Grewal, dava yoluna başvurmanın gerekli olmadığına ve sonunda yatırımcılara zarar vereceğine inanıyorlar. Düzenleme yapma konusundaki istekliliklerini vurgulayarak, kripto para sektöründeki yatırımcıların çıkarlarını korumak için SEC ile işbirliği yapma arzularını dile getiriyorlar.

Sonuç olarak, Coinbase liderliği, SEC’in Wells Bildirimine yönelik olarak proaktif bir yaklaşım benimseyerek, dava yoluna gitme yerine işbirliği ve açık diyalogun önemini vurguluyor. Kripto para sektörü gelişmeye devam ettikçe, Coinbase gibi şirketler ve düzenleyiciler için, yeniliği teşvik ederken yatırımcıların çıkarlarını koruyan açık kurallar belirlemek çok önemlidir.

İki taraf arasındaki gerilim uzun bir süre daha devam edecek gibi görünüyor. Gelişmeleri aktarmaya devam edeceğiz.