Ethereum’un Shanghai hard fork’u veya “Shapella” şu anda tamamlanmış olup, blockchain işlemlerini güvence altına alan ve doğrulayan kullanıcılar için staked ether (ETH) çekimlerine izin vermektedir. Ethereum’un son Shapella yükseltmesinin, ağın bekleyen çekimlerine ve ether fiyatına olumlu bir etkisi olduğu görülmektedir.

Yatırımcıların Güncellemeden Beklentisi Neydi?

Shapella’nın ana özelliği, stake edenlerin ETH’lerini çekmelerine izin veren, para yatırma sözleşmelerinden Ethereum’un “staking” işleminin etkinleştirilmesiydi. Fakat buna ek olarak, Ethereum yazılımına yapılan birkaç küçük değişikliği de içeriyor.

Belirli aktiviteler için işlem maliyetlerini azaltmayı da hedefleyen bu güncellemeyle, gaz ücretlerinin maliyeti de azalabilir. Güncellemenin aktifleştirilmesiyle, Ethereum staking’in 2020’de başlamasından bu yana ilk kez, yatırımcıların stake mevduatlarını geri almalarına izin verildi.

Piyasalarda, bu kullanıcıların Ethereum’larının kilitlerini açarak satmaları da beklentiler arasındaydı. Kullanıcıların ethereum maliyetleri, stake öncesi günümüz fiyatlarının altında olan kişilerin sayısı, daha yüksekten maliyetlenenlerden daha fazla. Bu da, insanların global piyasalardaki olumlu havaların aksine, Ethereum’larını satıp kar alabilme düşüncelerini arttırıyordu. Ethereum’dan yüksek miktarda çekim işlemi yapılsa da, fiyat beklenenin tersine yukarı yönlü hareket ediyor.

3,10 Milyar Dolar Değerinde Ether Çekilmeyi Bekliyor

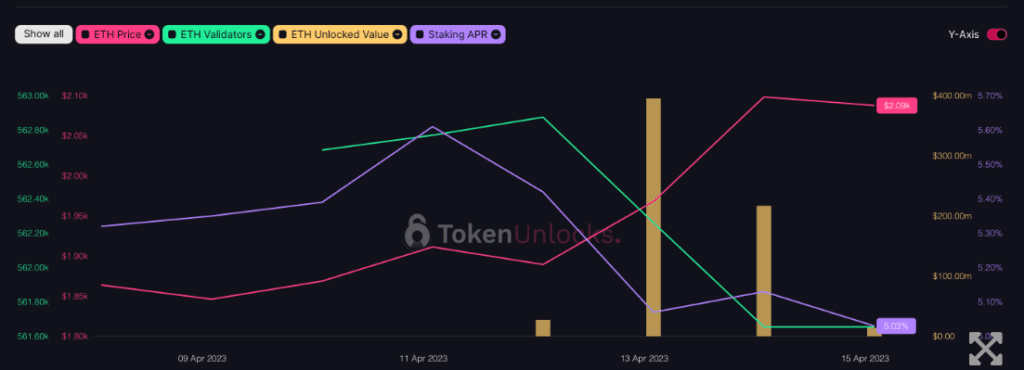

Token.unlocks verilerine göre, şu anda 3,10 milyar dolar değerinde ether çekilmeyi bekliyor ve kullanıcılar için günlük tahmini 1,07 milyar dolar değerinde ether mevcut durumda. Ayrıca, önümüzdeki 11 saat içinde 257.340 ether’in (536,95 milyon dolar) çekilmesi bekleniyor.

Yükseltmeyi takiben ether fiyatının düşmesini bekleyen bazı analistler ve hızlı satıcılar olmasına rağmen, fiyat yükseldi ve şu anda 2100 dolar civarında hafifçe işlem görüyor. Ağın önümüzdeki haftalar ve aylarda nasıl performans gösterdiği ve artan çekimler ve maliyetlerin sürekli olup olmadığı gözlemlenecek.

Ayrıca, merkezi bir borsa olan Kraken, şu anda 551.000’den fazla ETH’ye (1 milyar doların üzerinde değere sahip) ulaşan en büyük staked ether çekimiyle lider durumda görünüyor.

Staking Durum Güncellemesi: Ethereum’un Shanghai Yükseltmesinden Sonra Ne Kadar Ether Stake Ediliyor?

Ödüller dışında, toplam arzın %15,34’üne karşılık gelen 17,23 milyon ether (35,95 milyar dolar) stake edilmeye devam ediyor. Dünün net staking dengesi, 201.840 ether çekilirken ve 98.240 ether yatırılırken, yaklaşık -103.600 ETH (-204,04 milyon dolar) idi.

Shanghai hard fork’u sonrası net staking dengesi, 325.900 coin çekilirken ve 213.790 coin yatırılırken, -112.110 ETH (-228,72 milyon dolar) oldu.

Grayscale’in Matt Maximo ve Michael Zhao’ya göre, Staked ether çekiminin bu kadar gecikmesi beklenmiyordu.

“Çekimler kısa vadede artmaya devam etse bile, çekimler mutlak satışa işaret etmiyor, çünkü kullanıcılar doğrulayıcıları değiştirebilir veya daha yüksek getiri sunan staking sağlayıcılarına geçebilir.”

Matt Maximo ve Michael Zhao Analizinden.

Vitalik Buterin, Ethereum’un Bir Sonraki Zor Sınavını Açıklıyor: Ölçeklendirme

Daha önceki bir canlı yayında, Ethereum’un kurucusu Vitalik Buterin, Ethereum’un protokol değişiminin en zor ve zaman alıcı kısımlarının neredeyse tamamlandığını belirtti. Ona göre, önemli görevler kalsa da, bunlar daha makul bir hızda tamamlanabilir.

“Artık Ethereum protokolünün en zor ve hızlı geçiş aşamalarına neredeyse tamamlandığı noktaya geldik. Yapılması gereken önemli görevler hala var, ancak bunlar daha yavaş bir tempoda güvenli bir şekilde yapılabilir.”

Vitalik Buterin, Rus-Kanadalı bilgisayar programcısı ve Ethereum’un kurucusu.

Buterin, Shanghai hard fork’u takip eden Ethereum’un bir sonraki zorluğunun ölçeklendirme – işlem hızını artırma ve maliyetleri düşürme olduğunu vurguladı. Ölçeklenebilirlik, bir sonraki boğa koşulundan önce ele alınmazsa müşterilerin işlem başına 500 dolar ödemek zorunda kalabileceği konusunda uyardı. Buna karşılık, Verkle Trees’ın bir sonraki boğa koşulundan önce dağıtılmaması daha az önemli bir sorun olacağını, bunun da önceliğin Ethereum’un ölçeklenebilirliğini artırmak olması gerektiğini söylüyor.

Özetle, Ethereum’un son dönemdeki oynaklığı ve piyasaya etkisi apaçık belli oluyor. Vitalik’in, önemli ilerlemeler kaydedildiğini ve Ethereum cephesinde birçok yenilik beklentisine karşılık verileceği haber vermesi piyasa için sevindirici. Bu sebeplerden, piyasa aktivitesinin artması ve Ethereum’un 2.000 doları aşmasıyla birçok insan bunun “boğa sinyali” olduğuna inanıyor.