Ethereum, bu yıl önemli bir engeli aşarak büyük bir beklentiyle beklenen Shapella güncellemesini başarıyla tamamladı. Shanghai’nin ağ çalıştırma katmanı ve Capella’nın uzlaşma mekanizmasından ismini alan güncelleme, özellikle son zamanlarda Ethereum (ETH) için önemli fiyat dalgalanmalarına neden oldu.

Shapella güncellemesi ile stake edilen ETH’ler için iki çekme seçeneği sunuldu: kısmi ve tam. Kısmi çekme işlemleri, ETH’yi otomatik olarak doğrulayıcılara aktararak bakiyelerinin gereken 32 ETH’de kalmasını sağlar, ancak tam çekmeler doğrulayıcının kapatılmasını ve tüm yatırılan paranın çıkarılmasını içerir.

Güncelleme yaklaşırken, piyasa oynaklığı ve Ethereum fiyatında artışlar görüldü. Bunun üzerine ETH token’ı en çok işlem gören kripto paraların zirvesine çıktı ancak bir süre sonra satış baskısı karşısında direnemeyip az da olsa bir geri çekilme yaşadı.

77.000’den Fazla ETH Çekildi

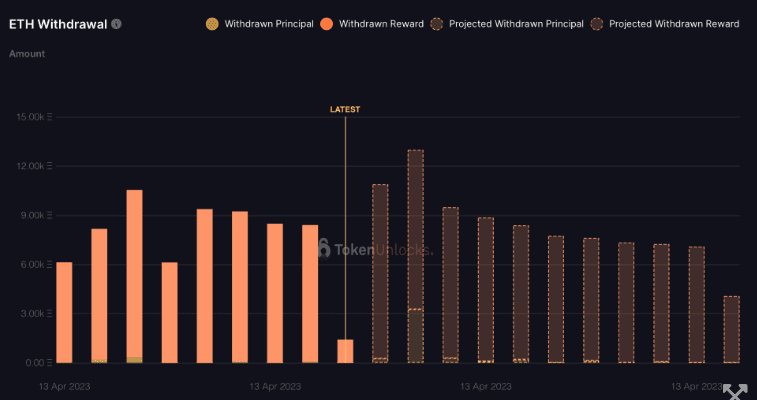

Ethereum güncellemesinin ardından 77.000’den fazla ETH çekildi, bu durum stake edilen ETH miktarının 18 milyonun altına düşmesine ve doğrulayıcı sayısının 562.497’ye düşmesine neden oldu. Shapella güncellemesinden sonra yaklaşık 1,34 milyar dolarlık ETH’nin çekilmesi planlanıyor ve şu anda 695.750’si çekilmeyi bekliyor.

Önümüzdeki 10 saat içinde 99.000’den fazla Ethereum’un (190 milyon dolar değerinde) çekilmesi bekleniyor ve bu, Shapella yükseltmesinden bu yana toplamda 380 milyon dolarlık Ethereum çekiminin gerçekleşmiş olması demek.

Yükseltme, ana ağda 6209536 blok yüksekliğinde yayınlandı.

Shapella’nın Ethereum için EIP-1559 ve The Merge’in devreye alınmasının ardından gelen önemli bir dönüm noktası olduğu aşikar. Çekimler etkinleştirildi ve ağ tamamen proof-of-stake (hisse kanıtı) uzlaşı sürecine geçti.

Şu anda ETH fiyatı 1.950 dolar civarında seyrediyor ve henüz Shapella hard fork’tan etkilendiği üzerine bir kanıt yok. Tahmin edildiği gibi önemli oranda bir satış baskısı da olmadı ve fiyat eğiliminin şu anda yukarı yönlü olduğu görülüyor.