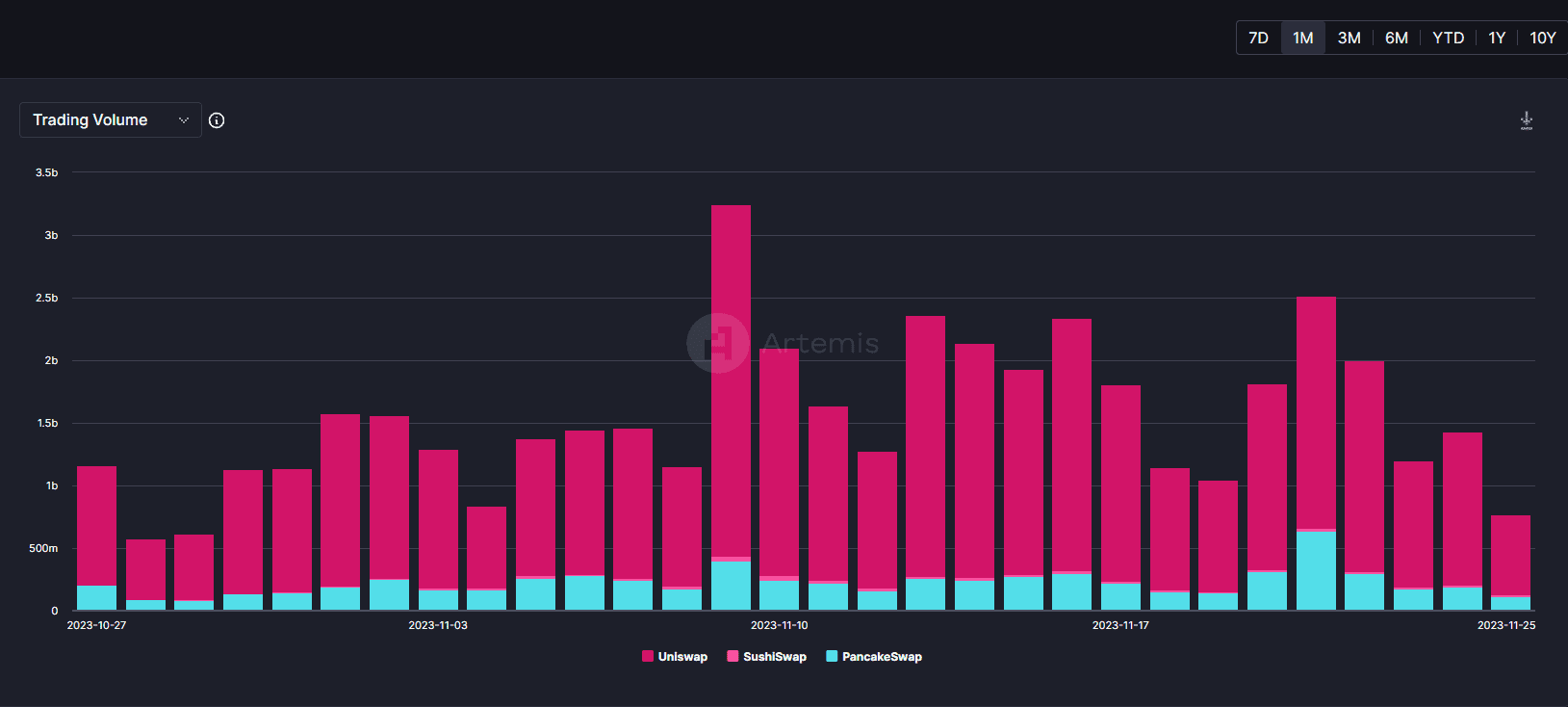

Merkezi borsalarda ki negatif gelişmelerden dolayı, DEX (Merkeziyetsiz Borsa) tarafına hacimin kaydığını söyleyebiliriz. Özellikle geçtiğimiz hafta içi DEX coinlerinde yaklaşık %30 luk yükselişler gördük. Yükselişlerine devam edecekler mi sorusuna gelirsek, hafta başı hacimleri tekrardan kontrol etmekte fayda var her hangi bir işlem almadan önce. Negatif haber akışının şimdilik durulduğunu düşünürsek, takip etmemiz gereken en önemli paritenin hacim olduğunu düşünüyorum.

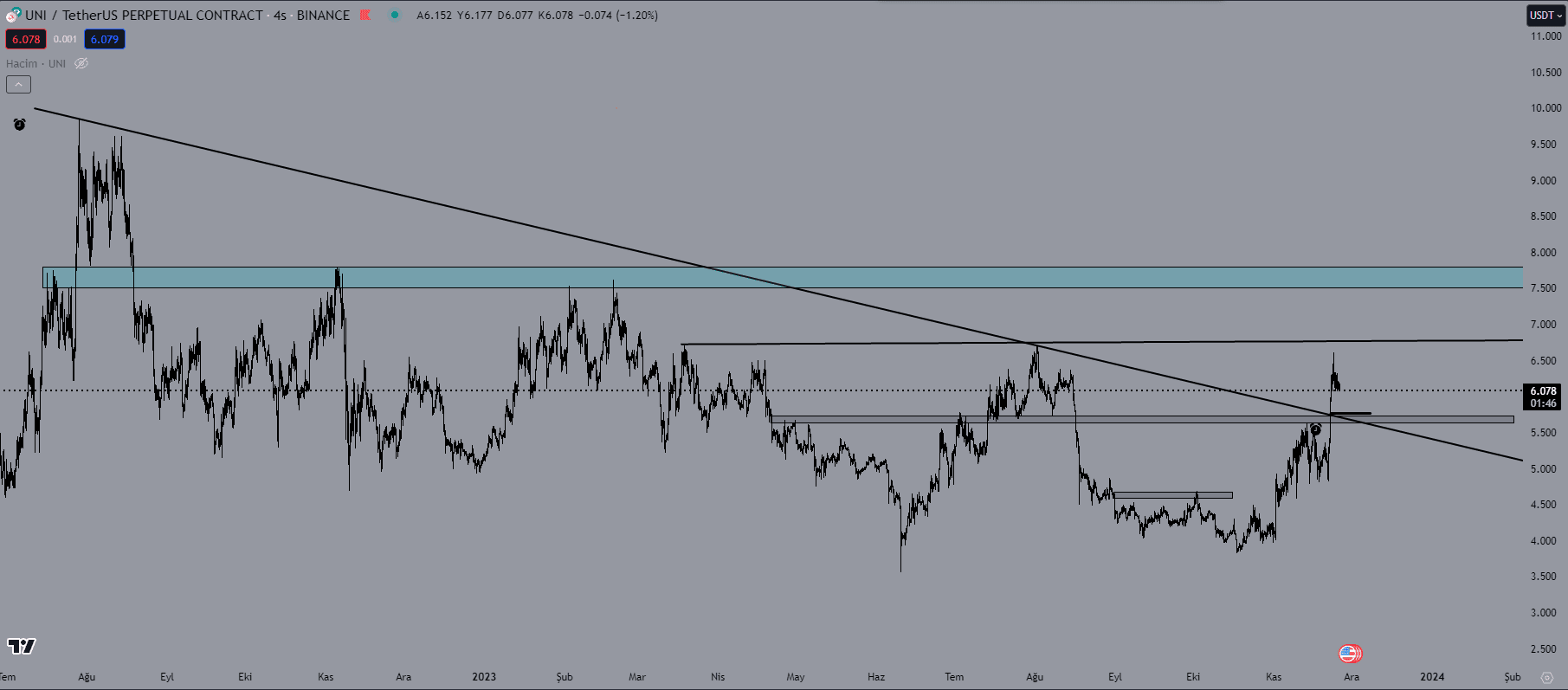

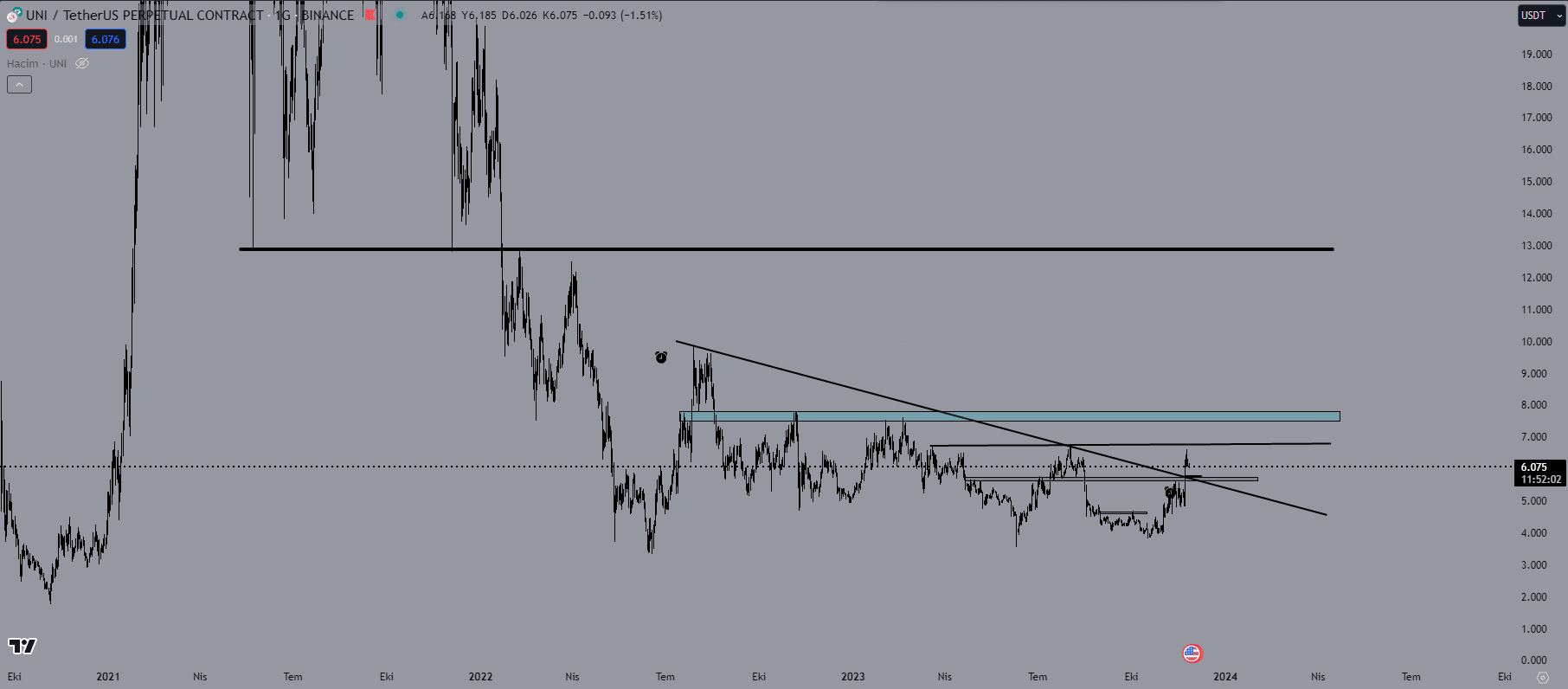

UNI

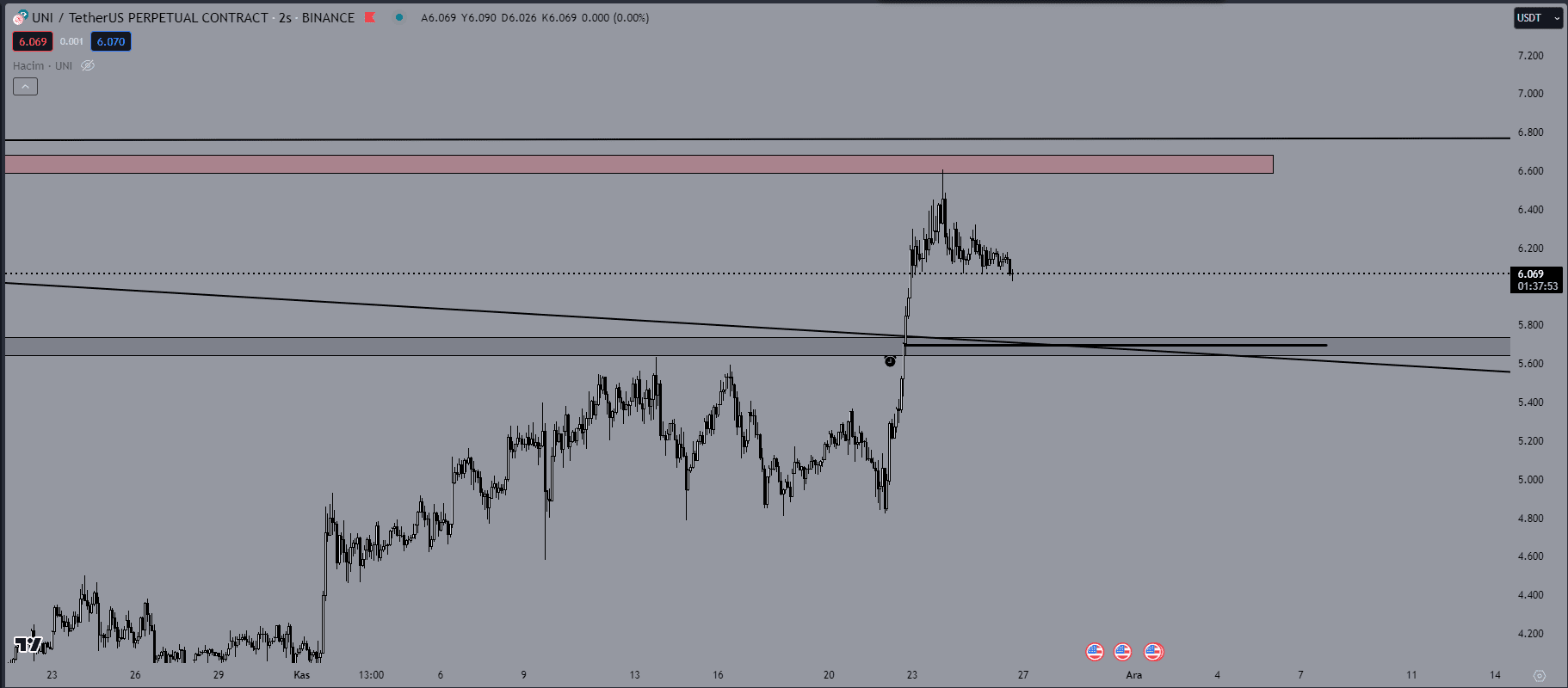

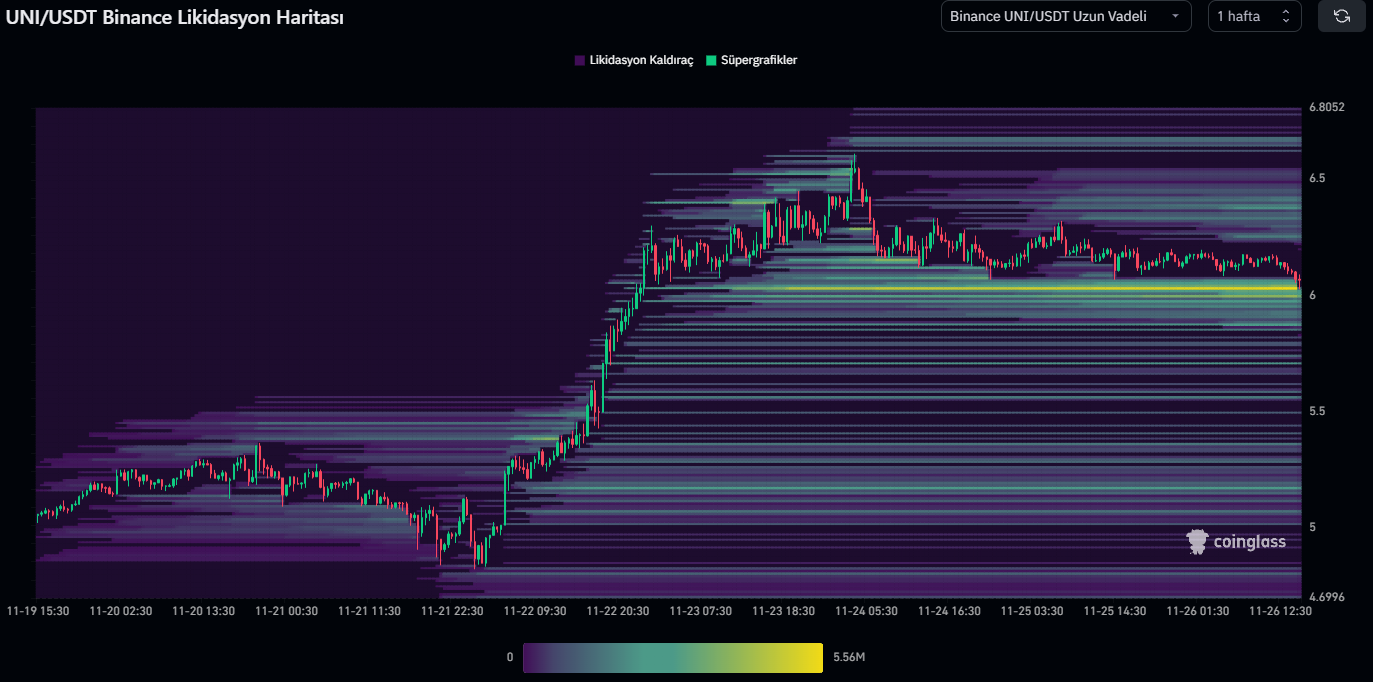

Teknik olarak incelediğimiz de düşen trend kırılımı gerçekleştiğinde düşük zaman diliminde retest verdiği seviyeden dahil olup UNI longlamıştık ninja discordda. Fiyatın 6.750$ seviyesini test etmesini bekliyordum fakat o seviyeye kadar yükseliş gerçekleştiremedi. 1Inch Investment Fund grubunun ellerinde bulunan $UNI coinleri 6.29$ seviyesinden satmalarının fiyat üzerinde ki momentumun kaybolmasına sebep olduğunu düşünüyorum.

Fiyat tekrardan 5.730$-5.6$ aralığına gelir ise düşük zaman diliminde onay aldıktan sonra long yönlü işleme dahil olmak istiyorum. Hedeflediğim seviyeler ilk önce 6.750$ seviyesi daha sonra ise bu seviyeyi kazanması durumunda 7.5$ seviyesine kadar yükselebileceğini düşünüyorum. Önümüzde ki hafta içi merkezi borsalara (CEX) negatif haber akışı gelmesi, bu fiyat hareketini destekleyecektir.

SUSHI

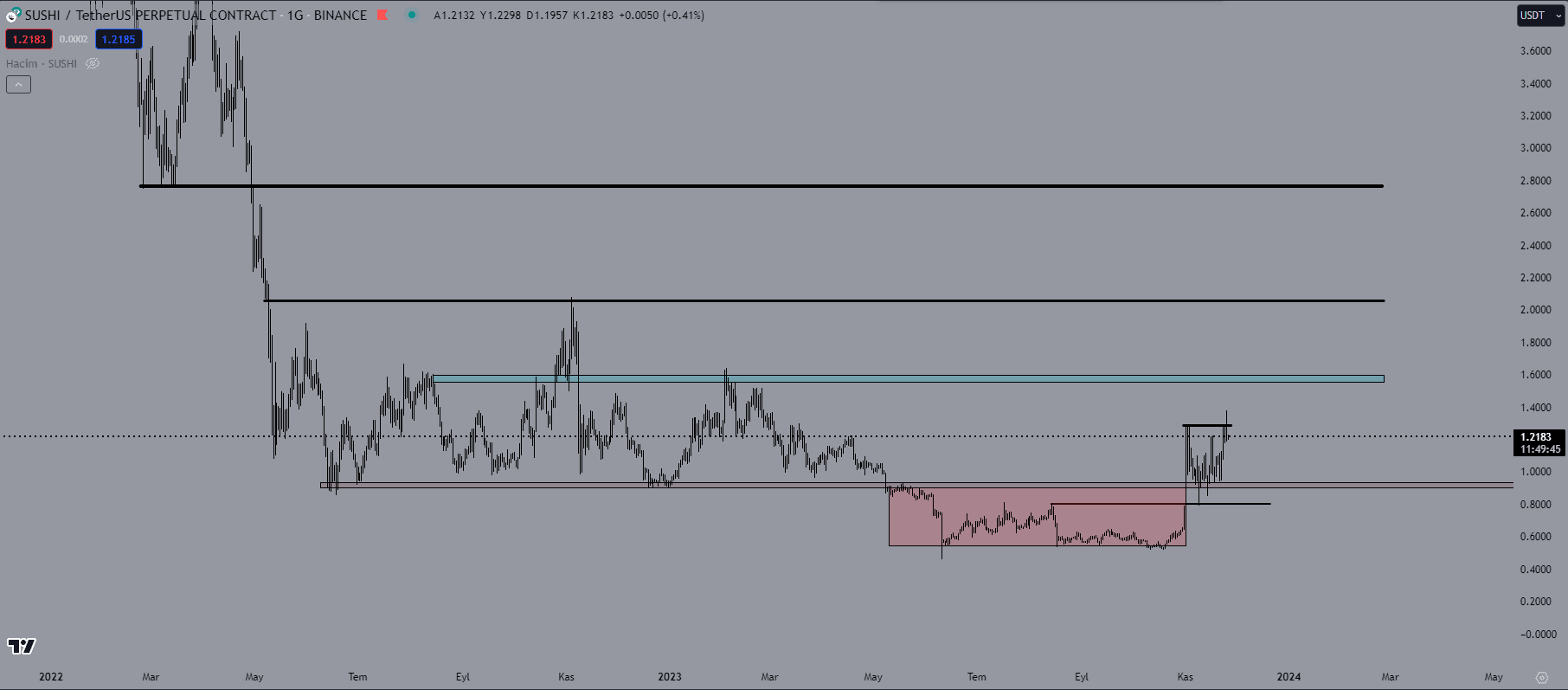

Geniş pencereden baktığım zaman grafiği çok hoşuma gidiyor. Marketin geri çekilme vermemesi durumunda, fiyatın ilk olarak 1.55$ seviyelerini test edebileceğini düşünüyorum. Bir sonra ki takip ettiğim direnç ise 2.06$ ardından 2.75$ seviyesi. En güçlü destek seviyesinin 0.93$-0.91$ seviyesinin olduğunu düşünüyorum.

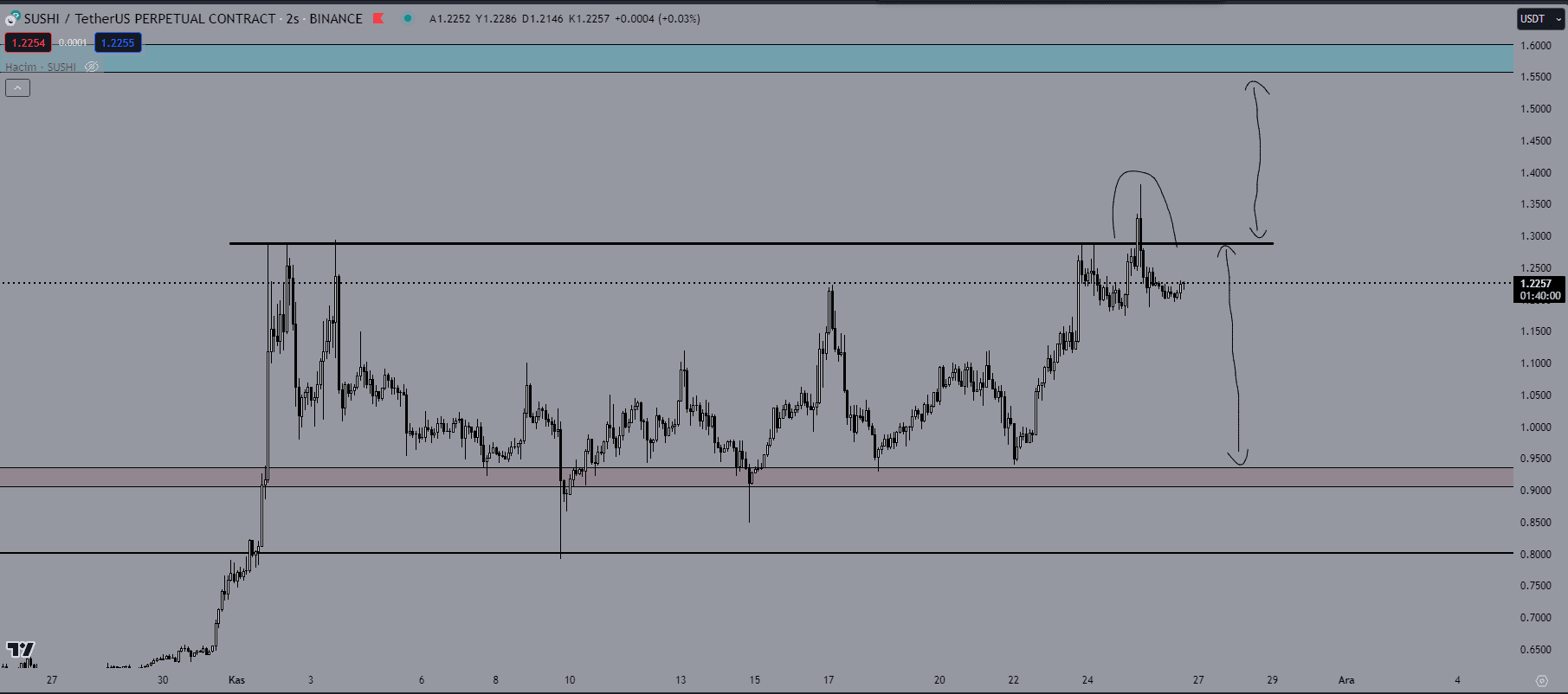

Düşük zaman diliminde ise görüntü çok hoş değil. Takip ettiğim range aralıklarını grafik üzerinde işaretledim. Fiyat bulunduğu ara bölgede ilgimi çekmiyor.

Burada paylaşılan analizler yatırım tavsiyesi olmamakla beraber, piyasada kısa-orta vade işlem fırsatı verebileceğini düşünülen destek direnç seviyeleridir. İşlem alma ve risk yönetimi sorumluluğu kullanıcının kendisine aittir. Paylaşılan işlemlerde stop loss kullanmanız şiddetle tavsiye edilir.