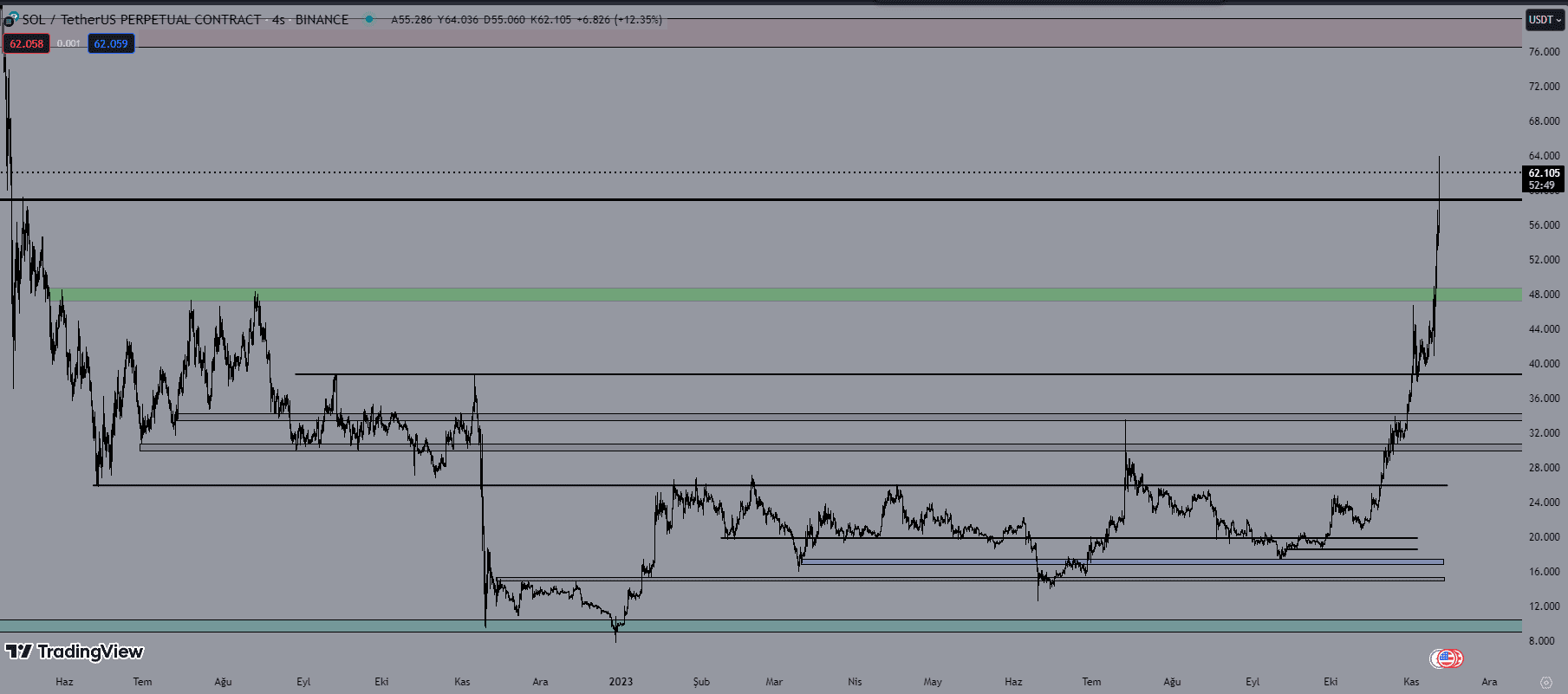

SOL

Geçtiğimiz günlerde FTX borsasının tekrar açılma konusu gündeme geldikten sonra marketinde yükselmesiyle beraber piyasada en çok yükselen coinlerden biri Solana oldu. Yükselişin devam etmesi muhtemel ama önceki Solana analizimizden işlem alan olduysa kar alarak pozisyonlarını taşımalarını tavsiye ederim.

Teknik olarak bakacak olursak, 58$-59$ aralığı ilk destek seviyesi. Buraya yüksek zaman diliminde retest vermesi durumunda bir üst direnç hedefli long pozisyonlar inşa edilebilir. Bu seviyenin tutmaması durumunda takip ettiğim ikinci destek seviyesi 49$ seviyesi. Direnç olarak ise takip ettiğim ilk seviye 75$-76$ seviyesi.

AVAX

Genelde markette Solana yürüdükten sonra Avax’ın eşlik etmesi beklenilir. Düşen trend kırılımı gerçekleşti. Dün gece saatlerinde retestini verdi. Takip ettiğim ilk direnç seviyesi 16$ seviyesi. Bu bölgenin kazanılmasıyla beraber fiyatın 21$ seviyesini test etmesini beklerim. Markette Avax’a eş projelere baktığımda Avax’ın fiyat olarak çok geride kaldığını düşünüyorum. Destek olarak takip ettiğim seviye ise trend retesti aynı zamanda yatay desteği olan 13.80$-13.90$ aralığıdır.

Burada paylaşılan analizler yatırım tavsiyesi olmamakla beraber, piyasada kısa-orta vade işlem fırsatı verebileceğini düşünülen destek direnç seviyeleridir. İşlem alma ve risk yönetimi sorumluluğu kullanıcının kendisine aittir. Paylaşılan işlemlerde stop loss kullanmanız şiddetle tavsiye edilir.