Uzun zamandır beklenilen Curve Finance’in stablecoin’i $crvUSD bu çarşamba ana ağda başlatıldı.

Teknik analize geçmeden önce sizlere biraz stablecoin ile alakalı bir kaç bilgi paylaşmak istiyorum.

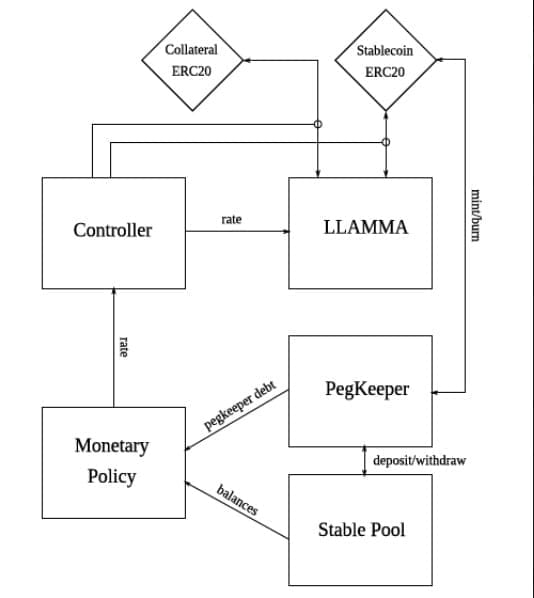

Bu yeni stablecoin ile birlikte, ödünç verme-likidasyon otomatik piyasa yapıcı algoritması(LLAMMA), PegKeeper ve Parasal Politikalar whitepaper’da bahsediliyor.

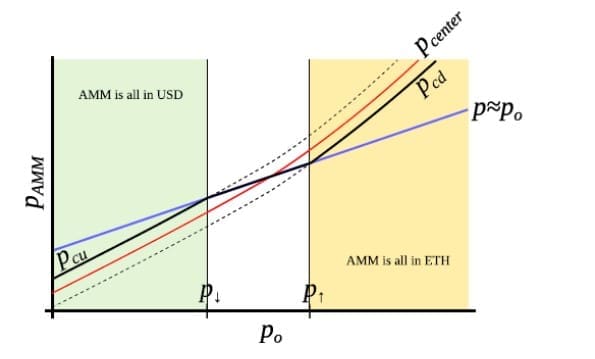

LLAMMA nedir? Basitçe söylemek gerekirse, $crvUSD’nin teminatını oluşturan varlık fiyatına bağlı olarak otomatik olarak teminat ile stablecoin arasında takas yapar.

LLAMMA, takasın ne zaman gerçekleşeceğine karar vermek için teminatın fiyat aralığına sahiptir. Bir harici fiyat oracle’ı, teminatın fiyatını belirlemek için kullanılır.

PegKeeper olarak bilinen kontrat, teminatsız olarak #crvUSD üretir ve sadece tek taraflı bir stablecoin havuzuna yatırabilir. PegKeeper ayrıca, üretilen jetonu asimetrik olarak geri çekebilir ve yok edebilir

Eğer fiyat>1 ise, sözleşme havuzlara token basacaktır (fiyatı düşürmek için). Eğer fiyat<1 ise, kontrat havuzlardan token yakacaktır.

CrvUSD mekanizmasının hedefleri, piyasada bulunan bazı stablecoin’lere kıyasla büyük miktarda Peg Stability Module / Vault tutmaksızın sabitlenmiş olmasına izin vermektedir.

Curve, $DAI, $USDT, $FRAX, $USDC gibi birçok stablecoin ile ortaklık kurmuştur. Curve, büyük stablecoin oyuncularıyla zaten birçok sinerjiye sahip, $crvUSD’nin piyasaya sürülmesi genel olarak stablecoin ekosistemine fayda sağlayacaktır.

Stablecoin’in launch edilmesinin ardından kısa süre içerisinde %10 luk bir yükseliş sergiledi. Gördüğümüz üzere dirençten tekrar red yedi. Fiyatın bir range içinde sıkışmış durumda olduğunu görebiliyoruz. Fiyatın önünde ki en yakın direnç seviyesi 0.980$ civarı. Bu direncin aşılıp üstünde 4 saatlik ya da günlük kapanış yapması durumunda 1.040$ seviyelerini test etmek isteyebilir. Destek olarak belirlediğim seviye ise 0.881$ seviyeleridir. Bu destek eğer kaybedilirse, bir sonra ki destek olarak belirlediğim bölge 0.840$ seviyesidir.

Global tarafta bankalara olan güvenin azalması, gözleri DeFi ürünlerine çevirebilir. Bu dönemde DeFi projelerinin yakından takip edilmesi gerektiğini düşünüyorum. Eğer market bir düşüş yaşamaz ve yükselişine devam ederse DeFi ürünlerinde bir hareketlilik görmemiz mümkün.

Burada paylaşılan analizler yatırım tavsiyesi olmamakla beraber, piyasada kısa-orta vade işlem fırsatı verebileceğini düşünülen destek direnç seviyeleridir. İşlem alma ve risk yönetimi sorumluluğu kullanıcının kendisine aittir. Paylaşılan işlemlerde stop loss kullanmanız şiddetle tavsiye edilir.