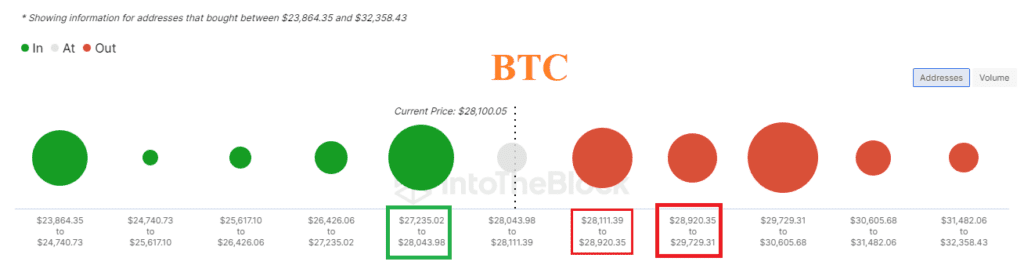

Onchain üzerinde $28920-30600 aralığından bitcoin alan kullanıcılar yüksek zararda görünüyor. $27235-$28045 aralığından bitcoin alan kullanıcıların kar durumları ise oldukça iyi durumda. Kırmızı küreler ne kadar büyük , yeşil küreler ne kadar küçük ise yükseliş ihtimali o kadar yükselir. Yeşil küreler ne kadar büyük, kırmızılar küreler ne kadar küçük ise düşüş ihtimali o kadar yükselir. Kürelerin bulunduğu seviye aralıkları güçlü destek ya da güçlü direnç olarak çalışabilir. Şu anki aşamada bitcoin karar vermeye çalışıyor gibi görünüyor.

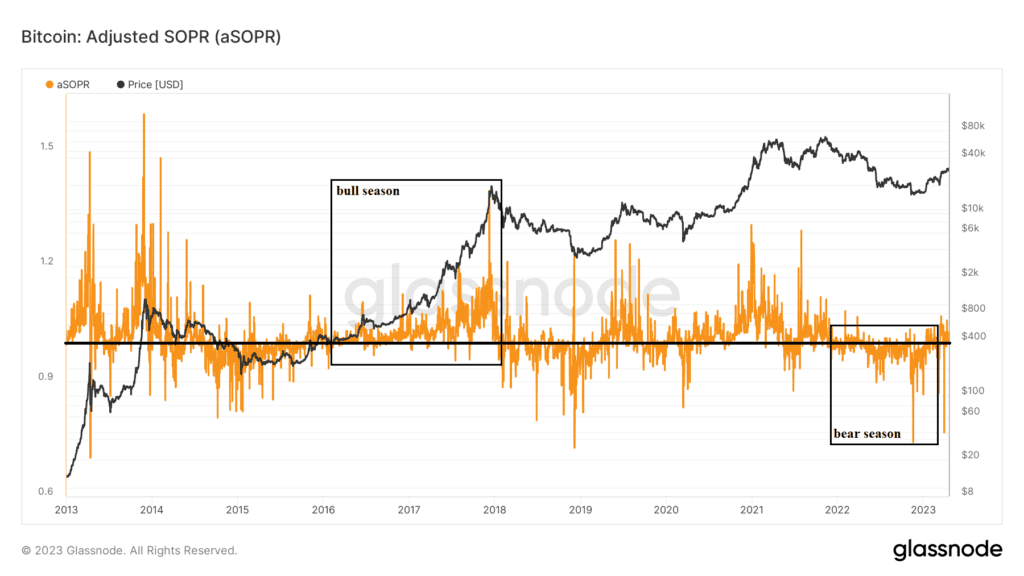

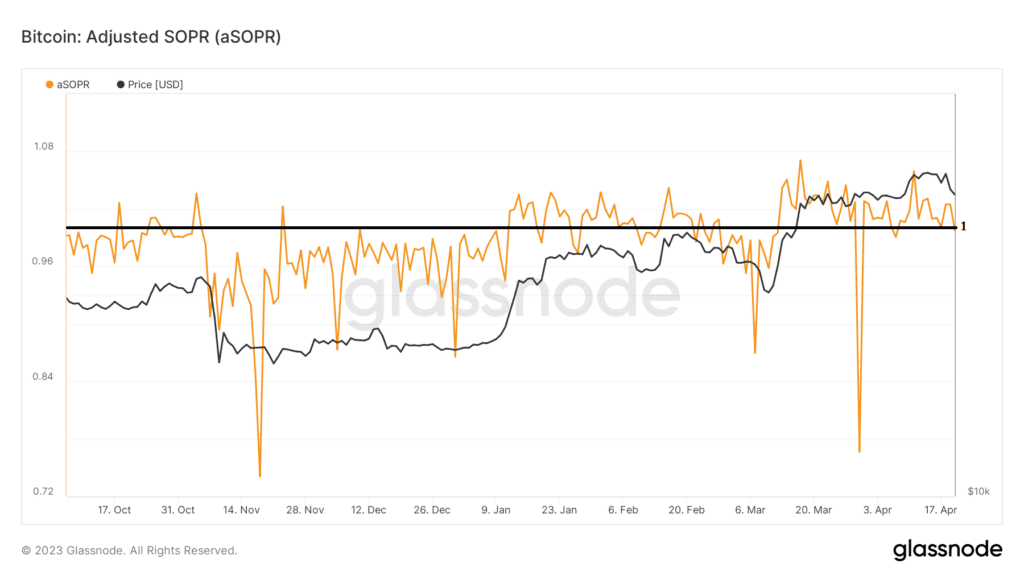

ASOPR verisi boğa sezonlarında çoğunlukla 1 seviyesi ve üzerinde, ayı sezonunda 1 seviyesi ve altında performans göstermiş. Bitcoin boğa sezonunda ise bu verinin 1 seviyesinden yukarıda tutunması gerekir.

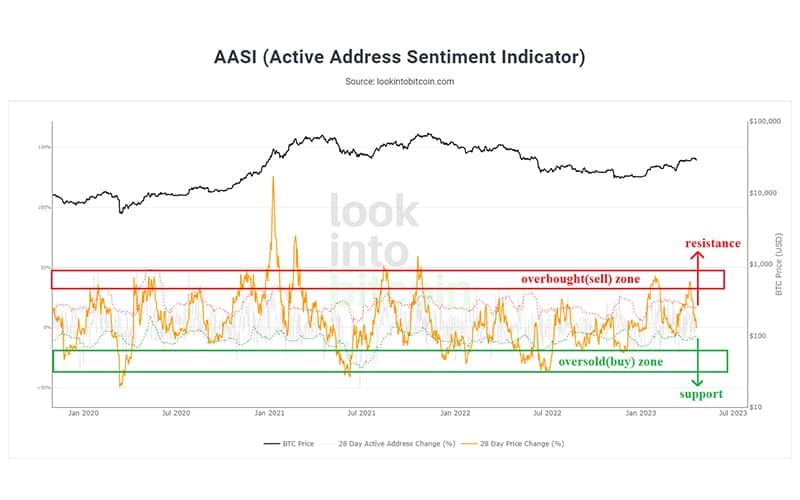

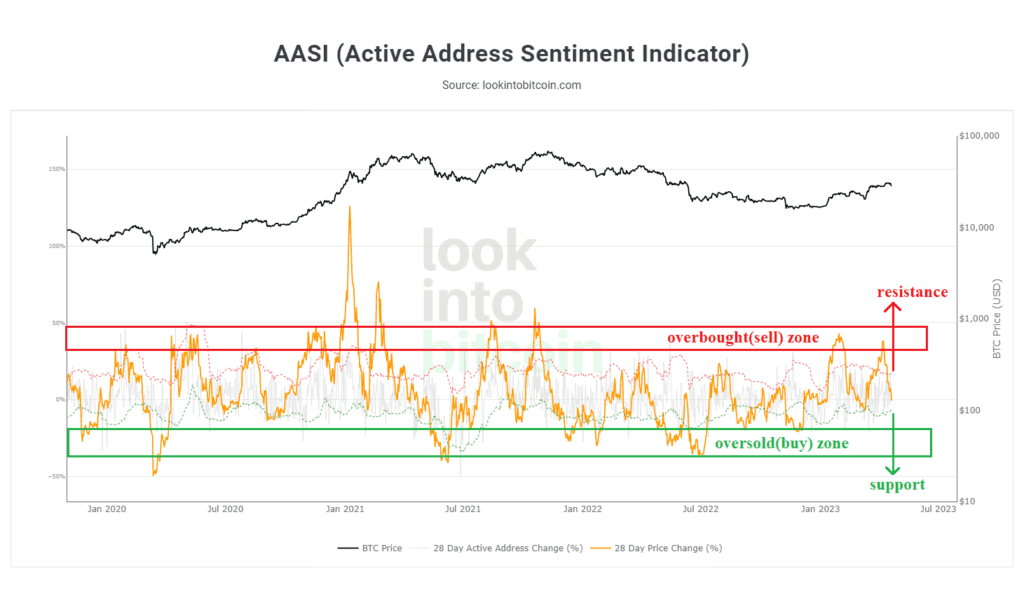

The Active Address Sentiment Indicator verisi dün belirttiğimiz seviyeden daha da aşağıya gerilemiş görünüyor ancak hala ana destek bandından ve ana destek bölgesinden uzakta. Düşüşün devam etmesi durumunda o bölgeye gelmesini bekleyebiliriz.

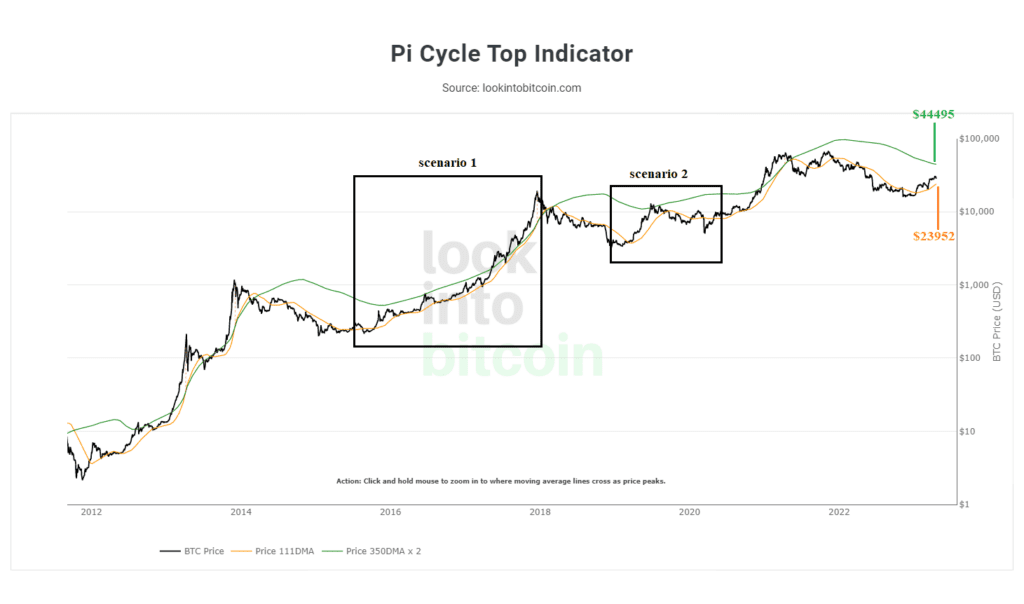

Bitcoin, geçmişte turuncu bant altındaki fiyat hareketinden sonra kendini turuncu bandın üstüne atarak yükseliş yaşamış. 2016-2018 yıllarında yeşil bant ve turuncu bant paralel olarak birlikte yükselmiş ve boğa sezonu yaşanmış. Ancak 2019-2020 yılları arasında Yeşil bant güçlü bir direnç olmuş ve ayı sezonu yaşanmış. Şu anki grafiğe göre turuncu bant desteği 23952$, yeşil bant direnci 44495$. Grafikteki bantlarla ilgili senaryolardan hangisinin gerçekleşeceğini izliyor olacağız.

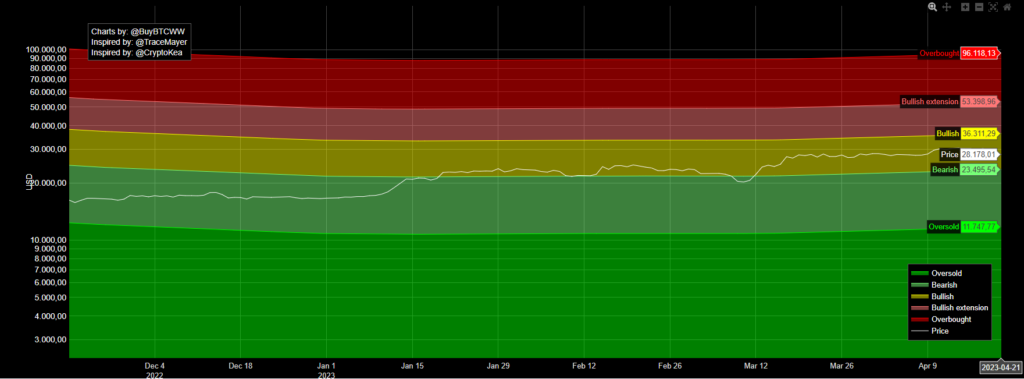

Bitcoinin bullish yapısını koruması için tutunması gereken seviye 23495$. Daha da sert yükselişler yapabilmesi için 36311$ seviyesini aşması beklenir. Tekrar derin bir ayı sezonu yaşanması durumunda izleyeceğimiz destek seviyesi $11747.

Onchain verileri ve açıklamalarına göz atabilirsiniz.

Onchain analiz, blockchain piyasalarından elde edilen verilerden oluşur ve sadece borsalara giriş ve çıkışları yansıtır. Bu veriler olumlu veya olumsuz şekilde yorumlanabilir, ancak boğa veya ayı piyasasıyla ilgili kesin bir öngörü içermez. Yukarıda paylaşılan tüm analizler eğitim amaçlıdır, bu gönderi herhangi bir finansal tavsiye içermez.