Bitcoin’in sert yükselmeye başladığı ve altcoinlerin düşmeye başladığı dönemde gözler her zaman bitcoin dominance grafiğine çevrilir, bunun sebebi bu grafik altcoinlerdeki paranın bitcoin’e yada altcoinlere geçiş yaptığını gösteren bir göstergedir.

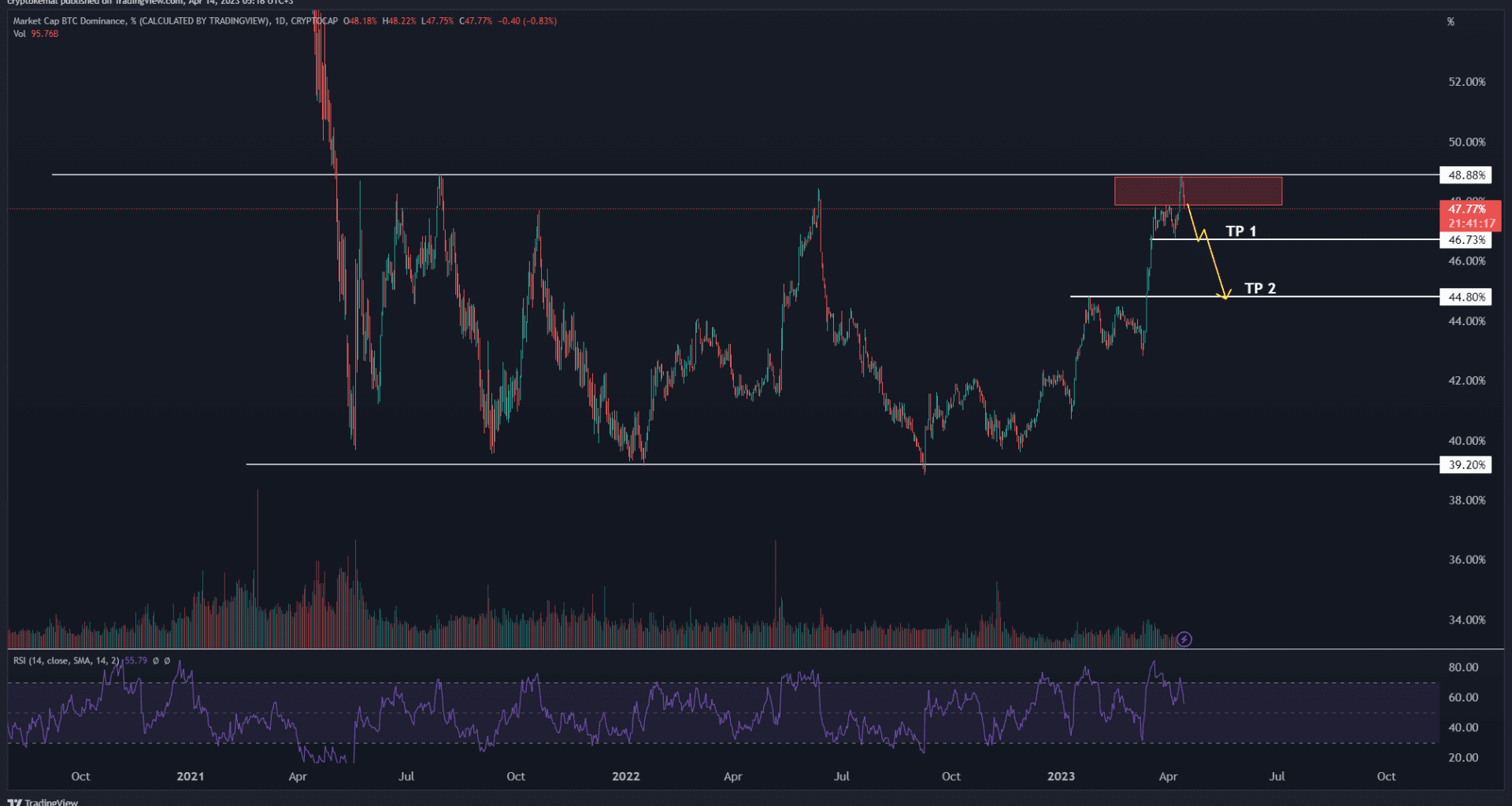

Bu grafiğe göre çok güçlü bir dirence geldik ve genel kanı bu direncin kırılması durumunda altcoinlerde düşüşün devam edebileceği yönündeydi. Bu gece dominance grafiğinin dirençten red yemesi ile birlikte altcoinlere bir para girişi oldu.

Bu noktada bitcoin hakimiyetini takip ederek işlem yapan kullanıcıların mevcut altcoin pozisyonları var ise kar alma noktaları için 46.7 birinci kar alma seviyesi ve 44.8 ikinci kar alma seviyesi olabilir.

Özellikle bitcoin rallilerinde dominance düzeltmeleri altcoinler için güzel işlem fırsatı vermektedir o sebeple ben altcoin işlemlerimde dominance grafiği desteğe geldiği taktirde altcoin pozisyonlarımı azaltıp yeni giriş seviyeleri izleyeceğim.

Dominance grafiğinin yanı sıra güncel bitcoin analizini takip edenler için ise mevcut fiyat yapısına bakarak $29800 altına inmediğimiz sürece yükselişe istekli bir grafik görüyorum. Önümüzde satış baskısı ile karşılaşacağımız direnç seviyesi $31600-$32300 aralığında. O seviyelere gelmemiz durumunda yine markette yukarı yönlü pozisyonlarımda ciddi azaltmaya gitmeyi planlıyorum.

Bitcoin ve altcoinlerin yükselişinin nereye kadar gideceğini tahmin etmek güç, uzun süredir ayı piyasası içerisindeyiz ve net bir boğa rallisi yaşadığımızı söyleyemiyorum. Ancak yeni kullanıcılardan sektöre ciddi bir giriş olur ise bu hareketler yerini ralliye bırakabilir.

O sebeple markete bir tepe noktası belirleyip short kovalamak, veya düşüş beklentisinde ısrarcı olmayı doğru bulmuyorum.

Önemli direnç seviyelerinde riski azaltıp, destek seviyelerinde makul riskler alarak yükselişin gittiği yere kadar (sert ve hacimli bir düşüş mumu yaşanana kadar) yukarı yönlü bakmaya devam edeceğim.

Piyasa son günlerde ciddi yükseliş gösterdi o sebeple her an gelebilecek düzeltme ihtimalini göz önünde bulundurarak mevcut pozisyon boyutunuzu yüklü tutmamanızı öneriyorum.