DXY’nin ve markette dolar paritelerinin dip/tepe yaptıkları dönemlerde yavaş yavaş diğer paritelere yönelmek mantıklı mı?

DXY (Dolar İndeksi) dip yaptığı şu günlerde hem kripto hem global marketlerde dolar paritelerinde güçlü yükselişlere şahit olduk. Yükselişi yakalayan traderlar kadar, bu ralliden faydalanamayan traderlar başka paritelere yönelmeye başladı bile. Bunlardan biri de $AUDCAD.

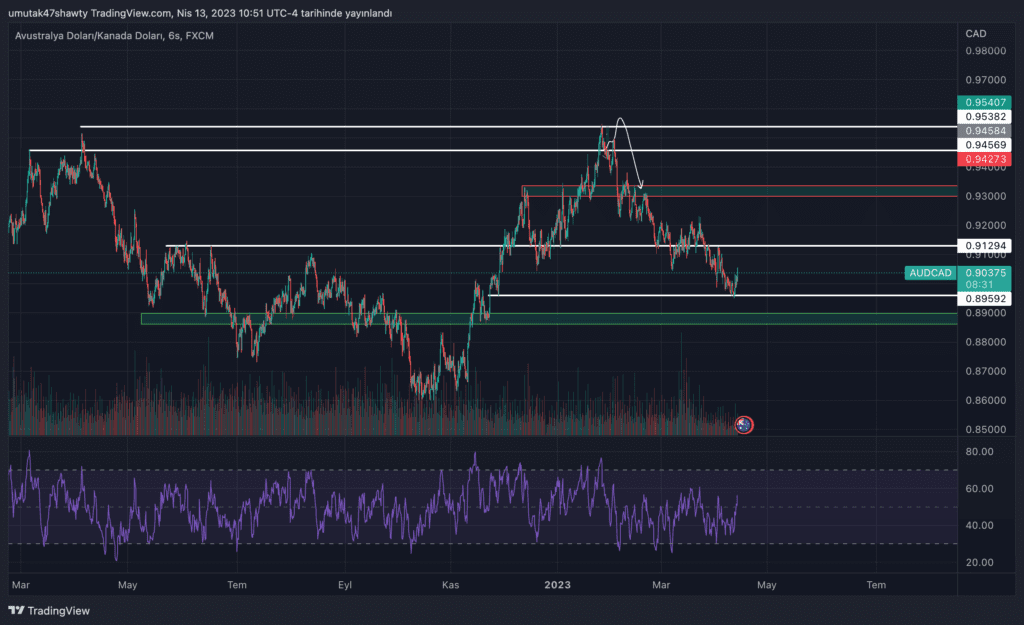

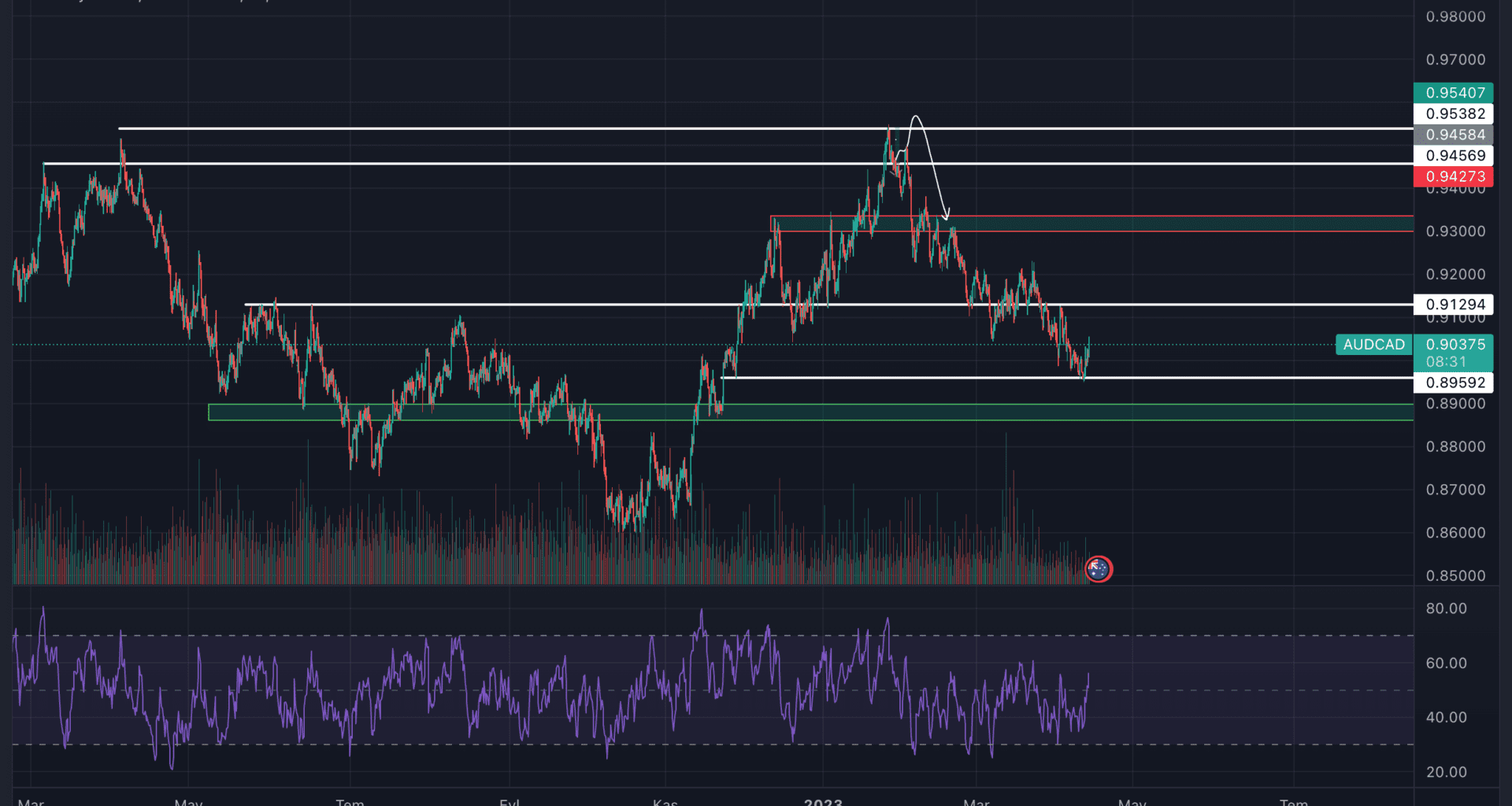

Avustralya Doları; Kanada Doları paritesinde 6 saatlik grafiğe baktığımızda nizami bir range yapısı görmekteyim. Fiyatı ciddi anlamda satışla karşılayabilecek ilk direnç noktası $0.904 bölgesi olduğunu düşünüyorum. Bu bölgeyi aynı zamanda key level olarak da nitelendirebiliriz.

Olası bir geri çekilme durumunda ilk gelmesi muhtemel beklentim olan destek bölgesi $0.895 bölgesi olacaktır. Fiyatın bu bölgeye uğraması durumunda bu alandan yakın stoplu ve düşük riskli $AUDCAD scalp long işlem almayı düşünüyorum.

Eğer düşüş derinleşirse yeşil kutu olarak belirlediğim alana (güvenli alım bölgesi) uğraması durumunda risk iştahım artacaktır. Yeşil kutuya uğraması durumunda bu alanı risk alma bölgesi olarak nitelendirip, %0.3 stop mesafeli olmak kaydı ile swing long pozisyon almayı planlıyorum.

FX işlemlerimizi PrimeXBT borsası üzerinden gerçekleştiriyoruz.