Bono ve Tahviller Nasıl Çalışır?

Yaşanan sorunların neden oluştuğunu anlamak için öncelikle bono ve tahvil nasıl çalışır onu anlamalıyız.

Bono ve tahvillerin kendilerine ait değerleri vardır. Bu değerler, kişinin ilgili tahvil ya da bonoyu elinde tutmaya söz verdiği belirli bir vade için hesaplanır. Tahvil ve bonolar, kendilerinden daha değerli yeni bir bono/tahvil çıktığında değerlerini kaybederler. Ancak elinde tutan yatırımcı, söz verdiği vade kadar tutmaya devam ederse vade sonunda bankanın ona söz verdiği değerlemeyi alacaktır. Tutulan bono ya da tahvil erken satılmak istenirse, uğradığı değer kaybı hesaba katılarak yeni değerinden satılabilir. Vade sonuna kadar bekleme sistemine ise “held to maturity” deniyor.

İşte geçtiğimiz aylarda yaşanılan bankacılık krizinin temelinde yatan problem tam olarak buydu. Amerika Merkez Bankası FED’in yapmış olduğu inanılmaz faiz artışlarından sonra dolar değer kazanırken onun karşısındaki alternatif yatırım araçları bono ve tahviller değer kaybına uğradılar. İnsanlar tuttukları inanılmaz değer kaybeden bono ve tahvilleri vadelerini beklemeden satmak istedikleri için, bankalar geri ödemekte büyük sorunlar yaşadılar.

Bu bankalar arasında Amerika tarafındaki Silvergate, Sillicon Valley, Signature, First Republic ve Avrupa tarafındaki Credit Suisse ödeme yapamayan ve batan bankalardı. Aralarındaki en büyük banka olan Credit Suisse, 2022 yılı sonunda elinde 1.4 Trilyon dolarlık varlık bulunduruyordu. Credit Suisse yaşanan bu sorunlar, emeklilik fonlarını çok büyük tehlikeye atmıştı. Bu sorunlardan sonra Credit Suisse’in, sermaye artırmak için büyük yatırımcılarla görüştüğü haberi yayılmaya başladı. Bankanın amacı sermaye artırıp, elindeki varlıkların çoğunu satarak Amerika pazarından çıkmak istemesiydi.

Ancak gereken sermayeyi bulamayan 167 yıllık geçmişe sahip Credit Suisse 19 martta iflas ettiğini açıkladı ve UBS’e satıldı.

Aynı sorunları yaşayan Charles Schwab bankası ise 7.13 Trilyon dolar varlık yönetmekte. Bünyesinde 33.8 milyon aktif yatırım hesabı, 2.4 milyon emeklilik hesabı, 1.7 milyon bankacılık hesabı barındıran banka, Amerikanın en büyük 10.bankası ünvanını taşıyor.

Bankanın CEO’su Walt Bettinger 15 martta verdiği bir röportajda sermaye arayışında olmadıklarını açıklamıştı ancak yayılan haberler doğrultusunda 19 mayısta bankanın 2.5 milyar dolar borçlanmayı düşündüğü paylaşıldı. Bu borçlanmayı ise kendisine ait bir bono çıkarıp satarak sağlamayı düşündüğü belirtildi.

Charles Schwab’ın kendi açıkladığı raporda açıkladığına göre, yukarıda bahsettiğimiz “held to maturity” yani vade sonuna kadar tutma sözünü verdiği varlık miktarı 2021 sonunda “0” iken, 2022 aralık ayında 173.1 milyar dolara yükseldi. Bu bankanın elinde varlık olsun ya da olmasın vermesi gereken nakit para miktarını ifade ediyor.

Aynı raporda, bankanın “Anında satılabilir varlıkları” olarak açıklanan değer ise, 2021 sonunda 390.1 milyar dolar iken, 2022 aralık ayında 147.9 milyar dolara düşmüş durumda. Özet olarak, ödemesi gereken para miktarı artarken, ödemelerin sağlanacağı nakit miktarı ciddi oranda düşüş yaşıyor. Charles Schwab, bu dengeyi sağlayamaz ya da pozitif şekilde tersine çeviremezse, ileriki dönemde iflas ile karşı karşıya kalmaması olanaksız olacak gibi görünüyor.

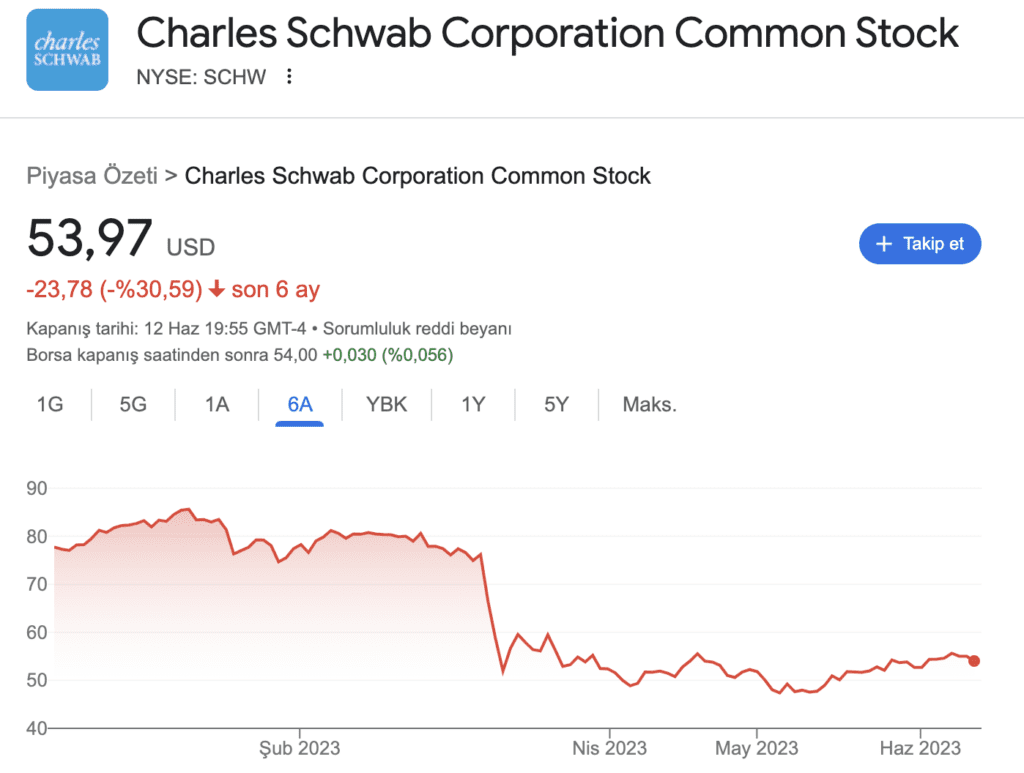

Bahsettiğimiz haberleri, açıklamaları ve raporları okuyan Charles Schwab yatırımcıların ise yatırımlarını azalttığını görebiliyoruz. Korku ve paniğe kapılan yatırımcıların satış yapması ile son aylarda Charles Schwab hissesi sert düşüşler yaşamış durumda.

Charles Schwab’ın yaşadığı bu zorlukları yaşayan başka bankalar olduğu söylentileri de etrafta dolaşmaya başlamış durumda. Aynı sorunlarla mücadele eden bankalar arasında;

PacWest, Western Allience, Bank Of Hawaii, BPPR, US Bank Corp gibi bankalar yer almakta.

Oluşan bu karamsar ve tehlikeli ortam yatırımcıları korkutmaya devam etmekte. Yatırımcılar bankaların yaşadığı bu sorunların bir domino etkisi yapıp yapmayacağı konusunda soru işaretlerine sahipler. Ancak uzmanlar ise, önümüzdeki günlerde bu olanları takip edip dikkatli olmakta fayda olacağı konusunda hemfikirler.