Bugün, ABD’de bölgesel bankaların hisselerinde büyük düşüşler yaşandı.

Özellikle PacWest Bank ($PACW) ve Western Alliance Bank ($WAL) büyük düşüşler gerçekleştirerek dikkatleri üzerine çekti.

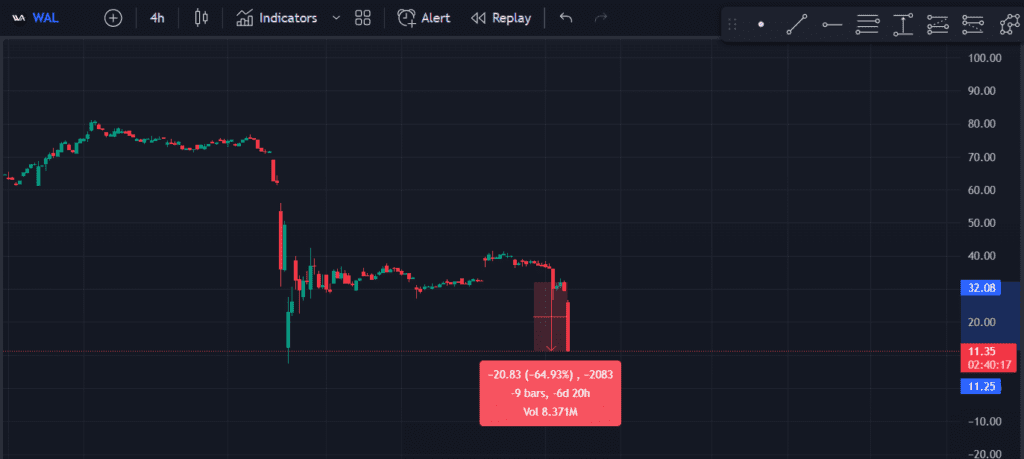

Son 24 saat içinde Western Alliance Bank ($WAL) hisselerinde yaklaşık olarak %65’lik bir düşüş gerçekleşti.

Western Alliance Bank ($WAL) hisse alım satım işlemleri düşüşün ardından 20 dakika içinde 4 kez durduruldu.

Ardından PacWest Bank ($PACW) hisselerinde de %62 oranında düşüş yaşandı.

PacWest Bank ($PACW) hisse alım satım işlemleri de benzer şekilde, yaşanan düşüşün ardından 8 kez durduruldu.

PacWest Bank ve Western Alliance Bank alıcı bulmak için çabalıyor!

Bu olay, diğer bölgesel bankaların da potansiyel satış veya birleşme arayışına girmesiyle birlikte, panik ortamını daha da arttırdı ve hisse fiyatları tüm bankalarda durmaksızın düşmeye devam ediyor. PacWest Bank ($PACW) ve Western Alliance Bank ($WAL) da benzer şekilde, alıcı bulmak için araştırmalarını yürüttüklerini açıkladılar.

Financial Times’a göre, Western Alliance Bank ($WAL)’in potansiyel bir satış için danışmanlar tuttuğunu bildirdi. Örneğin Western Alliance Bank, yılın başlarında 10 milyar dolar değerindeyken, şu anda sadece 1.7 milyar dolar değerinde.

Bu durum, ABD’deki bankacılık sektöründe yaşanan krizin büyüklüğünü gözler önüne seriyor.

Birçok ABD bölgesel banka hissesi bugün neredeyse %50 düştü. First Horizon Bank ($FHN), TD Bank ile birleşmeyi “düzenleyici kurumların yarattığı faktörler” nedeniyle iptal ettiğini açıkladı. Bu da diğer bankaların benzer bir kaderi yaşayabileceği korkusunu arttırdı.

Bu olaylar, ABD bankacılık sektöründe derin bir endişe yarattı. ABD’NİN düzenleyici kurumlarından bu duruma nasıl müdahale edileceği henüz belirsizliğini koruyor.

Uzmanlar, düzenleyici kurumların, bu duruma müdahale etmek için acil bir plan hazırlamaları gerektiğini ve bankaların mali sağlığı konusunda açık ve şeffaf bir şekilde bilgi vermeli gerektiğinin belirtiyor.

Tüm bu yaşanan olayların Altın ve Bitcoin tarafında olumlu etkileri olup olmayacağı yatırımcılar tarafından merak konusu olmaya devam ediyor.