Kripto dünyasının en büyük stablecoin ihraççılarından biri olarak bilinen Tether’in son dönemdeki kredilendirme politikaları, hem yatırımcılar hem de sektör takipçileri tarafından yakından izleniyor. 2022’de kredileri sıfırlama kararını duyuran Tether, 2023’te bu kararından bir ölçüde sapma gösterdi.

2022’deki Açıklamalar Aksini Söylüyordu

Tether, geçtiğimiz yıl sonunda yaptığı açıklamayla stablecoin kredilerini sıfıra indireceğini belirtmişti. Ancak 2023 verilerine bakıldığında, şirketin bu tür kredilere yönelik talebi tamamen reddetmediği gözlemleniyor. Özellikle uzun vadeli müşterileri, USDT stablecoin için kredilendirme talebinde bulundular.

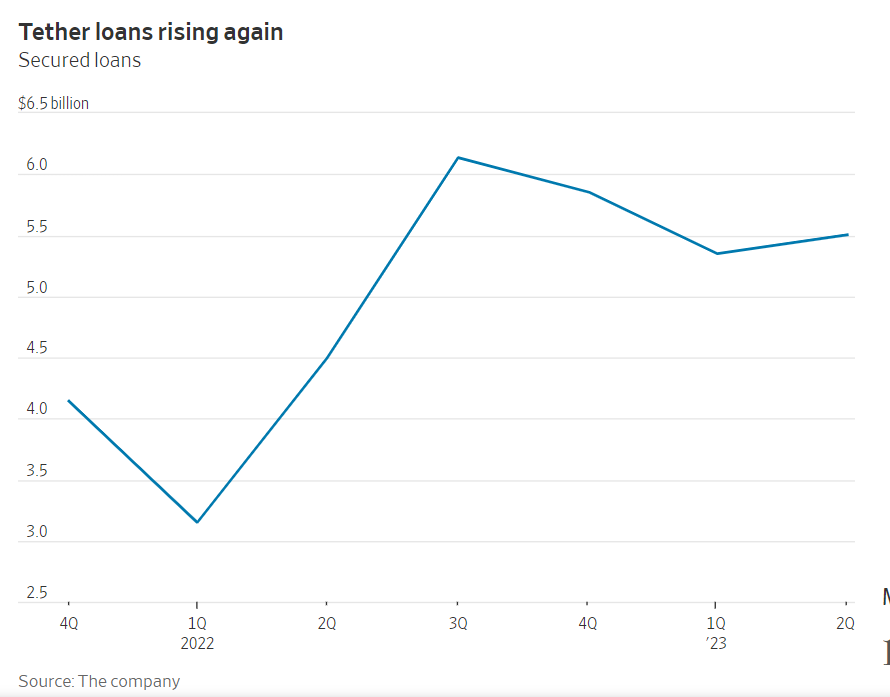

Son üç aylık raporda Tether’in varlıklarının önemli bir kısmının kredilendirme faaliyetlerinden geldiği görülüyor. Önceki çeyrekte 5,3 milyar dolar olan bu değer, 30 Haziran itibarıyla 5,5 milyar dolara yükseldi.

Tether yetkilileri, bu artışın nedenini “uzun süredir devam eden ilişkiler” ile geliştirdikleri müşterilerin kısa vadeli kredi taleplerine bağlıyorlar. Şirket sözcüsü, 2024 yılına kadar bu tür kredileri sıfıra indirme kararlarının hâlâ geçerli olduğunu vurguladı.

Ancak Aralık 2022’de Wall Street Journal tarafından yayımlanan bir rapor, Tether’ın kredi politikaları hakkında bazı endişeleri gündeme getirmişti. Bu raporda, Tether’ın kredilerinin tam olarak teminatlandırılmadığına dair iddialar bulunuyor ve bu durumun, özellikle kriz dönemlerinde, Tether’ın ödeme yeteneğini zora sokabileceği belirtiliyor.

Kaynak: WSJ