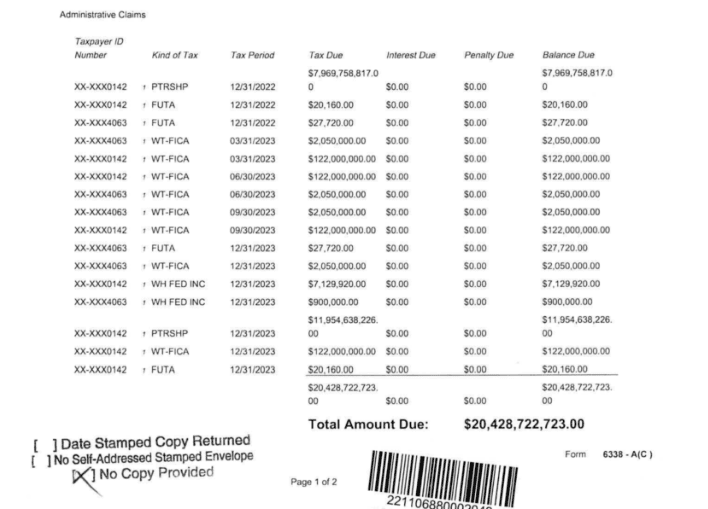

Son finansal haberlere göre, Amerika Birleşik Devletleri İç Gelir Servisi (IRS), iflas etmiş olan kripto para borsası FTX ve onunla ilişkili şirketlere karşı devasa bir 44 milyar dolarlık vergi talebinde bulundu. Son başvurularda açıklanan bu talep, FTX’ye yakından bağlı olan işlem firması Alameda Research’a yönelik 38 milyar dolarlık ciddi bir kısmı da içeriyor.

Cointelegraph’ın haberine göre, IRS, Alameda Research LLC’ye özellikle karşı olmak üzere ödenmemiş ortaklık ve maaş vergilerini 20.4 milyar dolar olarak değerlendirdi. Alameda’nın merkezinin Hong Kong’da olduğunu ve Hong Kong’un sermaye kazançları üzerinden vergi almadığını belirtmek gerek. Ancak, ABD vatandaşları olan Alameda’nın kurucuları ve ana yöneticileri, ABD’deki oturma durumlarına veya ABD’de geçirdikleri süreye bakılmaksızın, vatandaşlık temelli benzersiz ABD vergilendirme sistemine göre küresel gelirlerinden vergi ödemekle yükümlüdür.

IRS’in ortaklık vergilerini değerlendirmesi, Alameda Research’ın bir ortaklık temelinde faaliyet gösterdiği görüşünü ima ediyor; burada kârlar, kurum düzeyinde vergilendirilmez ancak ortaklara aktarılır ve bireysel düzeyde vergilendirilir. Eğer IRS, taleplerinde başarılı olursa, bu durum, dahil olan alacaklılar için olumsuz sonuçlar doğurabilir. IRS’nin 44 milyar dolarlık ödenmemiş vergi talepleri, iflas sürecinde FTX’in bir milyon kullanıcısı da dahil olmak üzere güvencesiz alacaklılarınkine öncelik kazandıracak. İflas mütevellileri ve hukuk firmalarının çabalarına rağmen, şu ana kadar FTX ve ilişkili kuruluşlardan sadece 7.3 milyar dolarlık varlık bulabildi.

Bu son finansal olayda, IRS, FTX ve Alameda Research’a sert bir şekilde karşı çıkarak, ödenmemiş vergilerde önemli bir miktar olan 44 milyar doları talep etti. Bu büyük talep, özellikle Alameda Research’ı 38 milyar dolarlık bir fatura ile hedef alarak, kripto para ticaretinin finansal manzarasını potansiyel olarak değiştirebilir. Bu talep, bir emsal teşkil edebilir ve IRS’nin, geleneksel olarak gevşek vergilendirme kurallarıyla bilinen yargı bölgelerinde faaliyet gösteren kripto varlıklarını bile hesaba katmaya istekli olduğunu gösterebilir.

Ancak, güvencesiz alacaklar, FTX’in bir milyon kullanıcısı da dahil olmak üzere, potansiyel olarak bu olaydan zararlı çıkacak gibi görünüyor. IRS’nin taleplerinin öncelik kazanması, bu alacaklılar için devam eden iflas sürecinde önemli kayıplara yol açabilir. Mütevelliler ve hukuk firmalarının geniş çaplı çabalarına rağmen, şimdiye kadar bulunan 7.3 milyar dolarlık varlık, IRS’nin toplam taleplerinden oldukça uzak görünüyor.