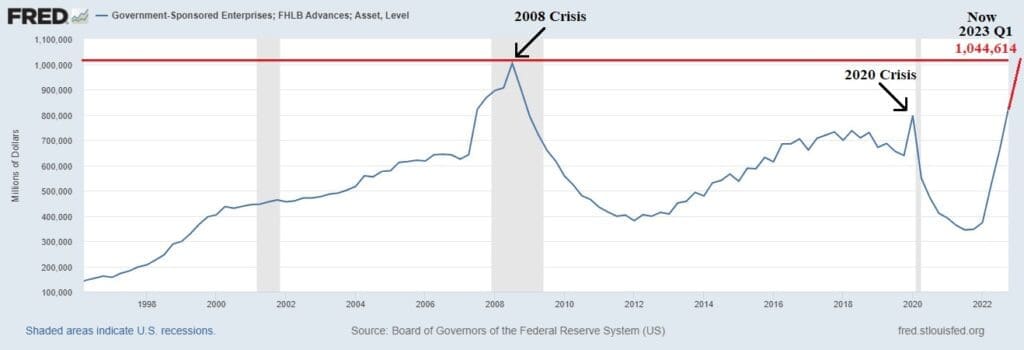

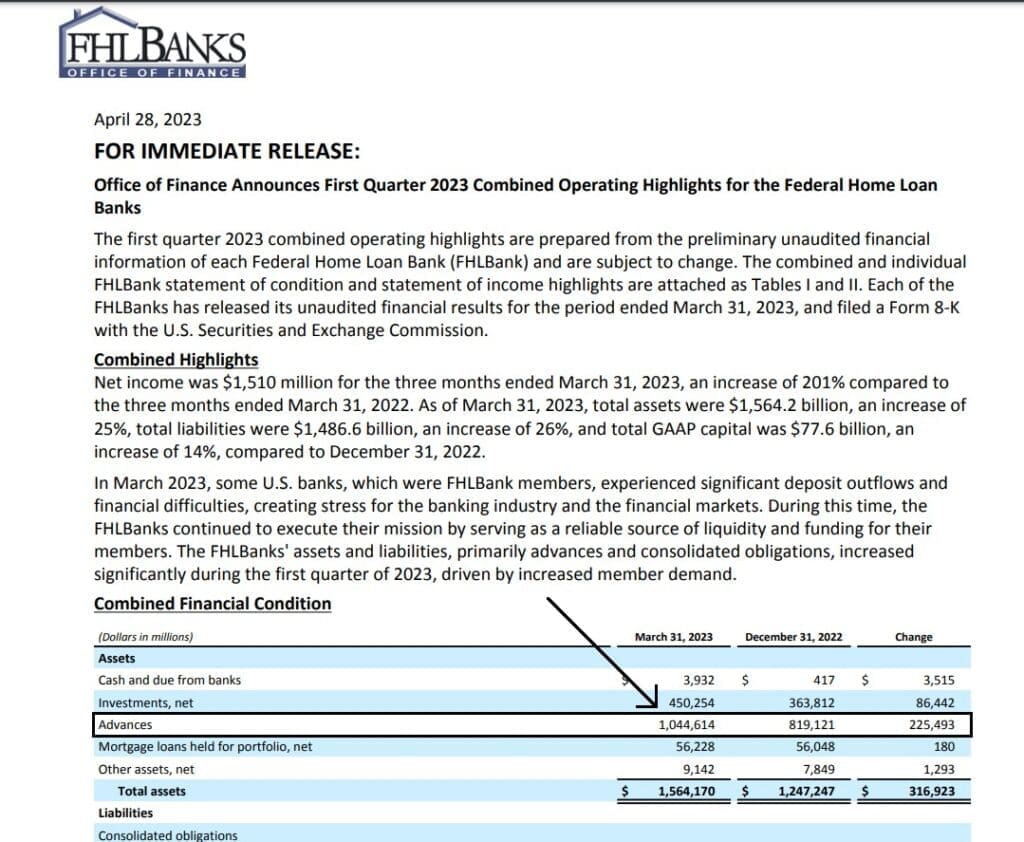

Dünya genelinde enflasyonun artmasıyla 2022 yılında Amerika Merkez Bankası FED, enflasyonu düşürmek için bazı önlemler aldı. Bugünkü tarihte bu alınan önlemler Amerika genelinde birçok kurum ve kuruluşa sorunlar yarattı. Bankalar kredi almak zorunda kaldılar ve alınan kredileri ödeyemeyen bankaların battığına şahit olduk. Daha önce bu bankalara batmadan önce verilen kredilerde büyük bir sıçrama olduğunu görmüştük. FED, bu sıçramayı paylaştığı verilerde göstermese de kredinin verildiği sistemin yönetici kurumu FHLB, paylaştığı belgelerde bunu açıkça dile getiriyor.

Federal Home Loan Banks (FHLB), 2023 1.çeyrek belgelerinde küçük ölçekli bankalara verilen kredi değerlerinin 1Trilyon doları aştığını gösterdi. Ayrıca bu bize FED’in paylaştığı belgelerde çok da şeffaf olmadığını göstermiş oldu.

Belge ve grafiği buradan inceleyebilirsiniz.

Devletler Ne Yapıyorlar?

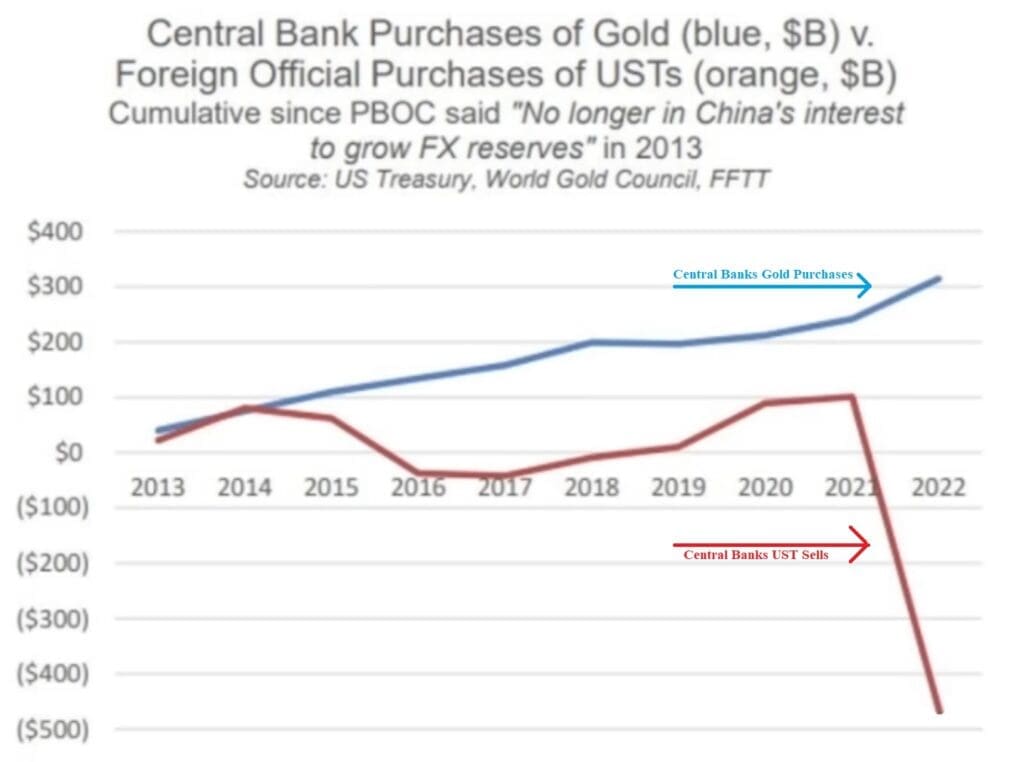

Financial Times’ın 23 Nisan 2023’de yayınlamış olduğu bir makalede ülkelerin merkez bankalarının yıllara göre altınla ilgili neler yaptığını görebiliyoruz. 1971 Büyük krizinden önce devletlerin yüksek değerlerde altın aldıklarını, daha sonrasında 1971 ABD başkanı Richard Nixon’ın altının ABD doları ile ilişkisini kesmesi ile birlikte yüksek değerlerde sürekli altın sattıklarını anlıyoruz. 2000’li yıllarda da aynı durum söz konusu ve daha büyük hacimlerde alım ile sonuçlanıyor. Bu durumun nedeni, sınırsız basılan doların değerini kaybetmesi ve ABD yönetimi tarafından enflasyona karşı alınan önlemlerin işe yaramaması diyebiliriz. Devletler sınırsız basılan dolara karşılık, sınırlı sayıda olan altına yöneldiler. Buradan yola çıkarak devletlerin sınırlı sayıda olan varlıklara önem verdiğini anlayabiliyoruz.

Altını en çok seven devletlerin başında tabi ki Çin geliyor. Çin, ABD dolarının bütün dünyada kabul görmesi ve ticarette çok fazla yerinin olmasından hoşlanmıyor. Bu yüzden kendisi ile yapılan anlaşmalarda ve ticarette kullanılan para birimini Altın ya da Yuan olarak değiştirmeye başladı.

Yukarıdaki haberde Arjantin’in, Çin’den ithal ettiği ürünler için artık dolar yerine yuan ödeyeceği açıklanmış. Çin’in bu anlaşmaları yaparken amacı, doların üstünlüğünü ve ticarette bu kadar çok kullanılmasını azaltmak istemesi.

Küçük Yatırımcı Ne Yapıyor?

Amerika’da yapılan bir incelemede google arama motorunda “Nasıl” başlığı ile başlayan 2.en çok arama altın alımı (“Nasıl Altın Alınır?”) ile alakalı.

Yapılan araştırma ile ilgili habere buradan ulaşabilirsiniz.

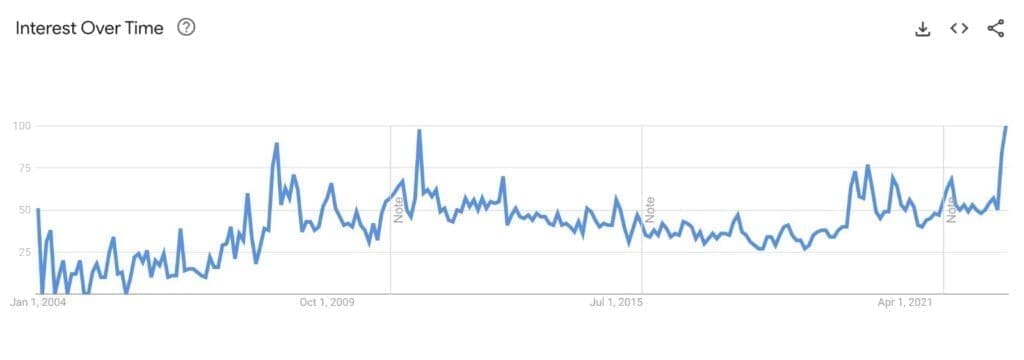

Aşağıdaki görselde son 20 yılda “Nasıl Altın alınır?” aramasına olan ilgiyi görebilirsiniz.

Küçük yatırımcıların altına olan ilgisinin arttığını görebiliyoruz. Devletlerin merkez bankaları altın almaya devam ederken, küçük yatırımcı da altın almaya özen gösteriyor.